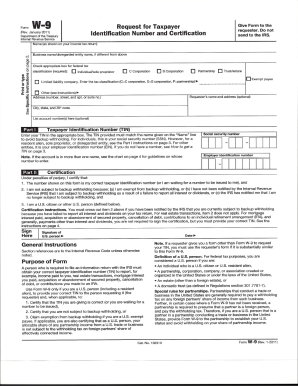

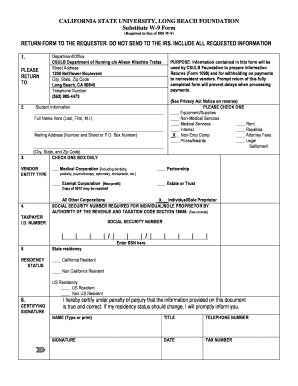

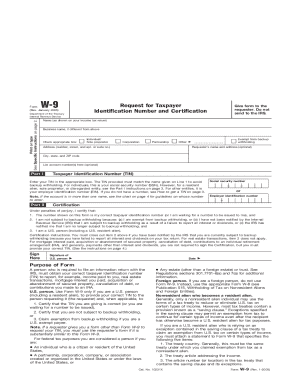

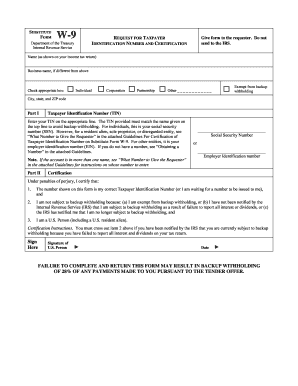

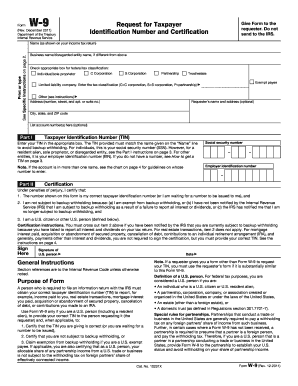

W-9 Form 2021 Pdf

What is W-9 form 2021 pdf?

The W-9 form 2021 pdf is a document used by businesses to collect taxpayer identification information from individuals who provide services as independent contractors. It is essential for reporting income to the IRS.

What are the types of W-9 form 2021 pdf?

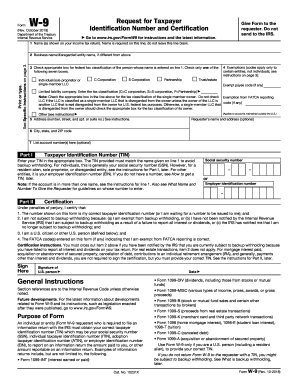

There are two main types of W-9 form 2021 pdf: the printable version that can be filled out manually and the fillable pdf version that can be completed electronically.

Printable W-9 form 2021 pdf

Fillable W-9 form 2021 pdf

How to complete W-9 form 2021 pdf

To complete the W-9 form 2021 pdf, follow these steps:

01

Enter your full name as shown on your tax return

02

Provide your taxpayer identification number

03

Indicate your business structure (e.g., sole proprietor, corporation)

04

Sign and date the form

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I fill out a w9 form in PDF?

0:20 1:35 How to Fill Out a W9 Form Online - YouTube YouTube Start of suggested clip End of suggested clip Use only secure channels to fill out and send your w9. You can either get your copy from the irs.MoreUse only secure channels to fill out and send your w9. You can either get your copy from the irs. Website or go to pdffiller.com.

Can you fill out a W9 electronically?

The IRS accepts electronic signatures The W4 and W9 forms may be completed via e signatures, and the IRS regulations around them are reasonable. Minimize printing, signing, and mailing your IRS documents by signing them electronically.

Is there a 2021 w9 form?

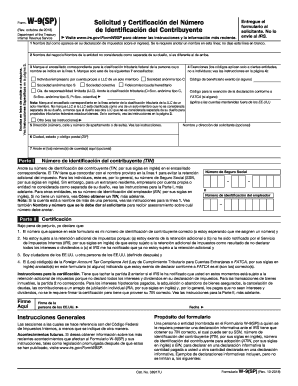

As it was mentioned earlier, you can find the latest W-9 form 2021 fillable on the IRS website. Though, in most cases you'll get the blank from the requester. Note that some states may have form substitutes like the one in NY city. They'll look a bit different comparing to the conventional document.

Where can I get a 2021 W9 form?

▶ Go to www.irs.gov/FormW9 for instructions and the latest information. Give Form to the requester. Do not send to the IRS. Print or type.

Where can I get a 2021 W-9 Form?

▶ Go to www.irs.gov/FormW9 for instructions and the latest information. Give Form to the requester. Do not send to the IRS. Print or type.

Can I print a W-9 form online?

Fill out your Social Security Number or Employer Identification Number. Sign and date the form, click 'Print' or 'Download' to print or save the W-9 to your computer as a PDF.

How do I get w9 form?

Most of the time, a company or financial institution will send you a blank W-9 form to complete before you begin business with them. If you need to issue the form, you can download a W-9 from the IRS website.

Is it safe to fill out a w9 form online?

Don't send your completed W-9 as an unsecured or unencrypted email attachment. Instead use secure methods of transmission, such as hand delivery, mail, or encrypted file attachments to an email to the person who requested it.

How do I create a W-9 Form?

W-9 Form Instructions Line 1 – Name. Line 2 – Business name. Line 3 – Federal tax classification. Line 4 – Exemptions. Lines 5 & 6 – Address, city, state, and ZIP code. Line 7 – Account number(s) Part I – Taxpayer Identification Number (TIN) Part II – Certification.

What is latest w9 form?

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid. Acquisition or abandonment of secured property.

Is there a 2022 w9 form?

Get the free w9 form 2018-2022. If you are providing Form W-9 to an FFI to document a joint account each holder of the account that is a U.S. person must provide a Form W-9. See What is backup withholding later. Form W-9 Rev.

How can I get a free w9 form?

Go to www.irs.gov/Forms to view, download, or print Form W-7 and/or Form SS-4. Or, you can go to www.irs.gov/OrderForms to place an order and have Form W-7 and/or SS-4 mailed to you within 10 business days.

Is there a new W-9 form for 2021?

As it was mentioned earlier, you can find the latest W-9 form 2021 fillable on the IRS website. Though, in most cases you'll get the blank from the requester. Note that some states may have form substitutes like the one in NY city. They'll look a bit different comparing to the conventional document.

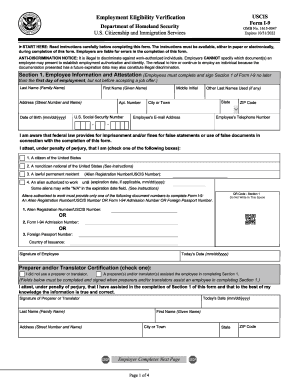

Related templates