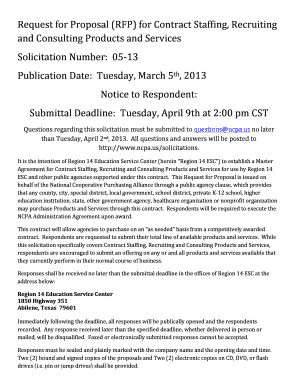

Tin Certificate Download Bd

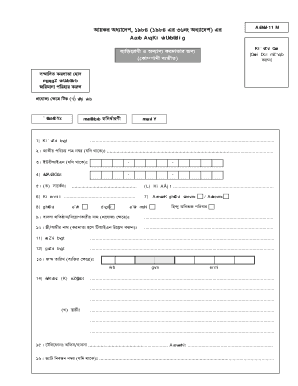

What is Tin certificate download bd?

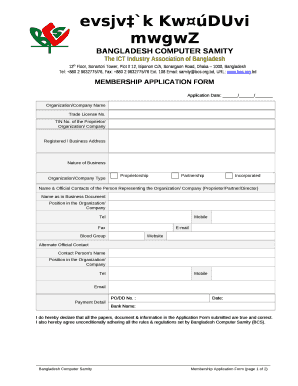

Tin certificate download bd is a process through which individuals or businesses in Bangladesh can obtain their Tax Identification Number certificate online.

What are the types of Tin certificate download bd?

There are two main types of Tin certificate download bd: Individual Tin certificate and Business Tin certificate.

Individual Tin certificate

Business Tin certificate

How to complete Tin certificate download bd?

To complete Tin certificate download bd, follow these steps:

01

Visit the official website of the National Board of Revenue (NBR) in Bangladesh.

02

Click on the Tin certificate download option and select the type of certificate you need (Individual or Business).

03

Fill out the online form with your personal or business information.

04

Submit the form and download your Tin certificate for online verification.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

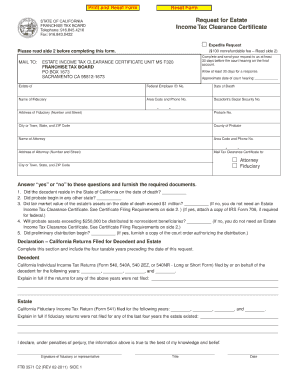

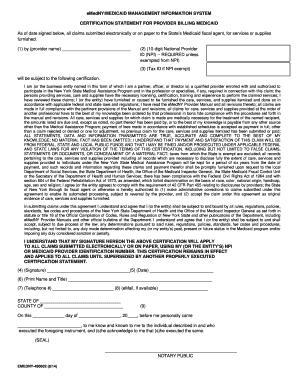

How can I get my TIN number certificate online?

Log-In with User ID/Password. Fill in the TIN Registration form by providing relevant information of the applicant/Company. Preview the submitted application. Obtain E-TIN Certificate.

How do I get an e tin copy?

Log-In with User ID/Password. Fill in the TIN Registration form by providing relevant information of the applicant/Company. Preview the submitted application. Obtain E-TIN Certificate.

How do I print a tin certificate?

Visit the web portal (ura.go.ug) Click on eservices. Go to Print Submitted Form on the right hand side and enter in your Reference Number and the Search Code as they appear on the Acknowledgement Receipt that you received after submitting your application on the URA web portal. Click on the print form button.

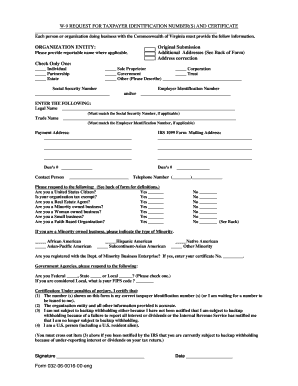

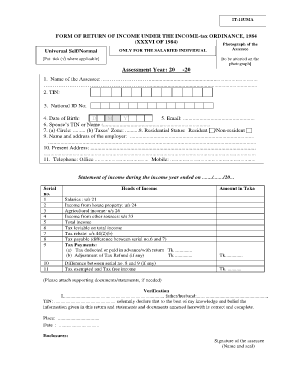

How can I register my personal TIN number?

Follow this step by step guide and you will be issued your tax identification number: Complete the Application form for your TIN. Provide your ID document (It can be your driver's license, ID card, international passport or staff ID). Provide your physical address, phone number, and other information required.

How do I recover my eTIN user ID?

If you forgot your User ID, you can retrieve it by confirming your identity and providing us with the Password associated with your account. Your User ID will be sent to you in an email.

What is e-TIN?

Electronic Taxpayer's Identification Number (e-TIN) is provided by National Board of Revenue (NBR). Each and every entity (Individual or Corporate) must have the Tax Identification Number who is eligible to pay Tax according to the Income Tax Ordinance 1984.

How do I get a TIN certificate?

Log-In with User ID/Password. Fill in the TIN Registration form by providing relevant information of the applicant/Company. Preview the submitted application. Obtain E-TIN Certificate.

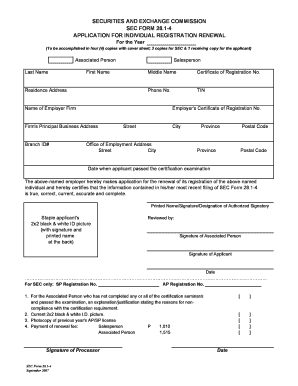

How can I get my TIN certificate online?

TIN Registration Process for Individuals STEP 1: Visit the verification portal – Joint Tax Board. STEP 2: Select your date of birth. STEP 3: Select your preferred search criteria (BVN, NIN or registered number) from the drop-down menu. STEP 4: Enter the digit of the search criteria you selected in the previous step.

Related templates