Mark Form W-8BEN For Free

Users trust to manage documents on pdfFiller platform

Watch a quick video tutorial on how to Mark Form W-8BEN

pdfFiller scores top ratings in multiple categories on G2

Mark Form W-8BEN in minutes

pdfFiller enables you to Mark Form W-8BEN in no time. The editor's hassle-free drag and drop interface ensures quick and intuitive signing on any device.

Signing PDFs electronically is a quick and secure way to verify documents anytime and anywhere, even while on the go.

See the step-by-step guide on how to Mark Form W-8BEN electronically with pdfFiller:

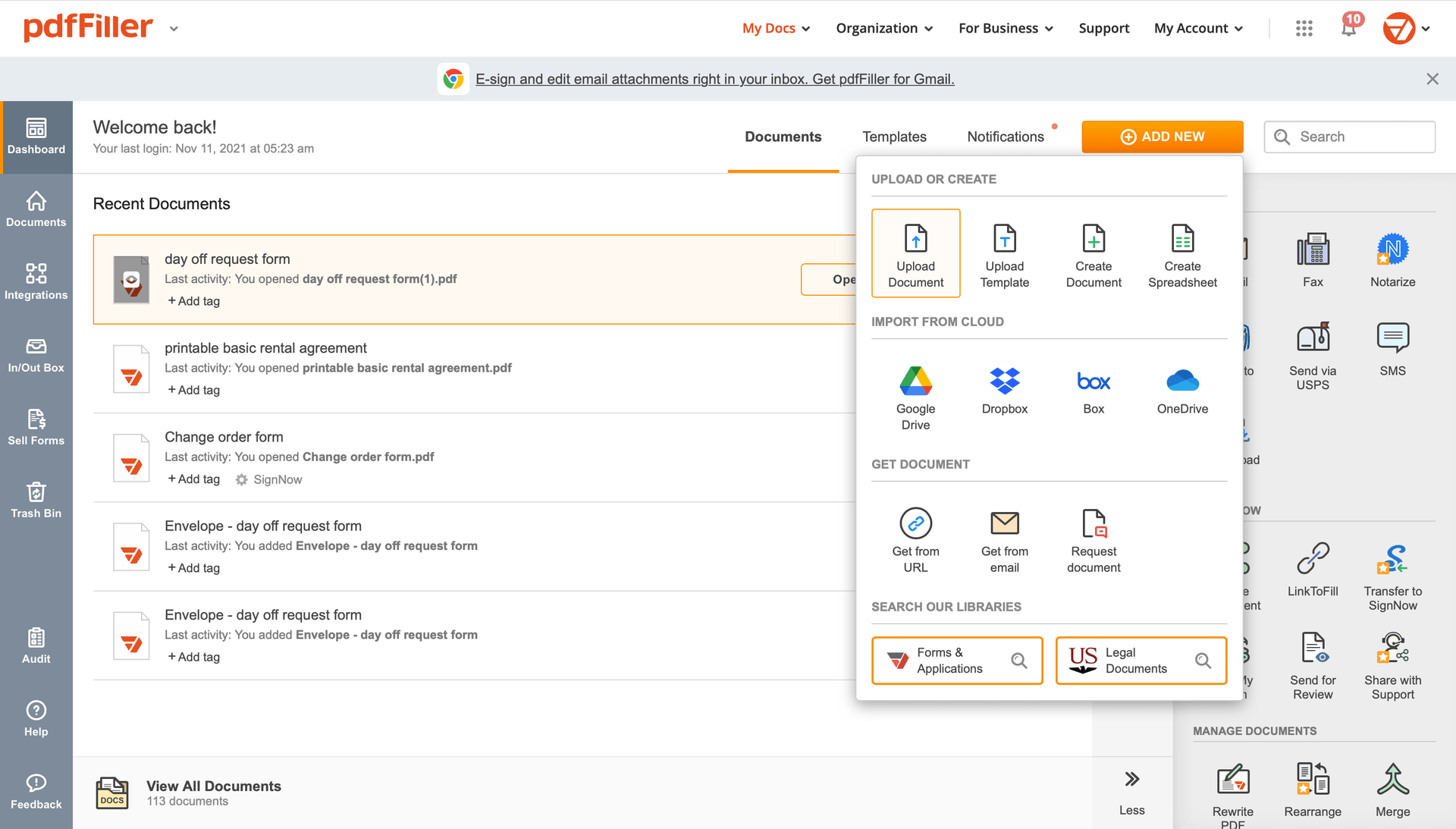

Upload the document you need to sign to pdfFiller from your device or cloud storage.

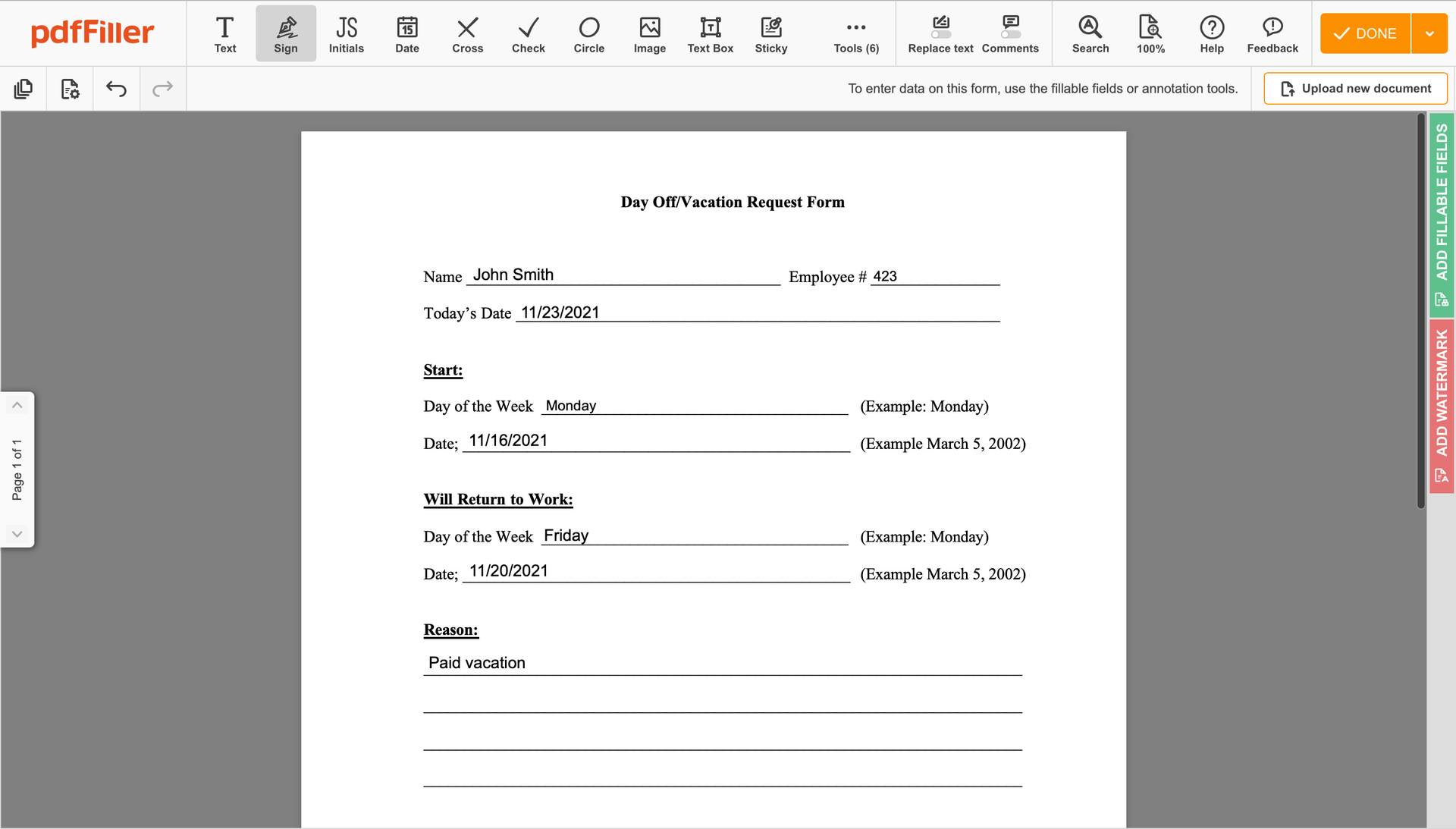

As soon as the file opens in the editor, hit Sign in the top toolbar.

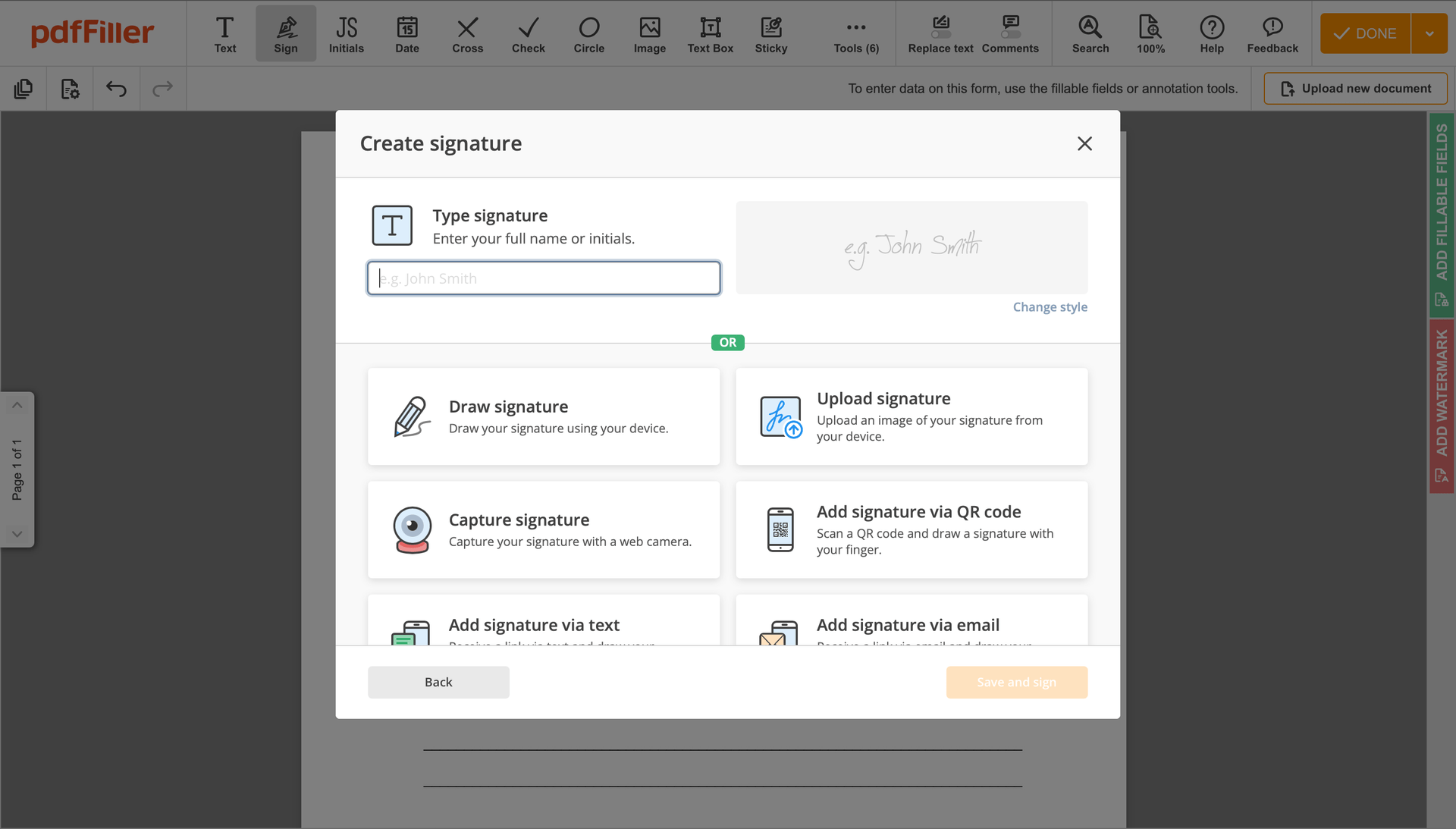

Generate your electronic signature by typing, drawing, or adding your handwritten signature's photo from your laptop. Then, hit Save and sign.

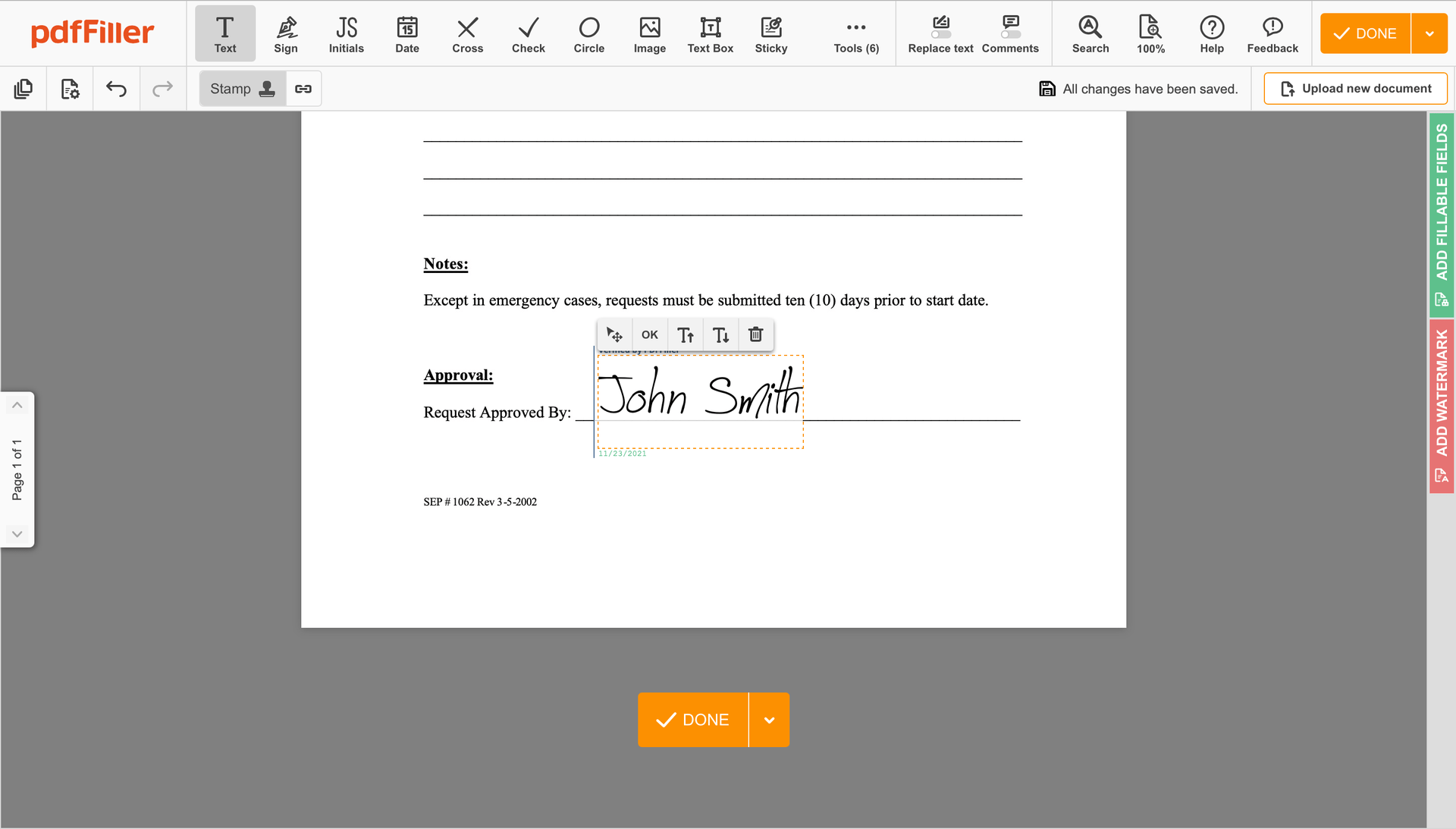

Click anywhere on a form to Mark Form W-8BEN. You can drag it around or resize it utilizing the controls in the hovering panel. To apply your signature, click OK.

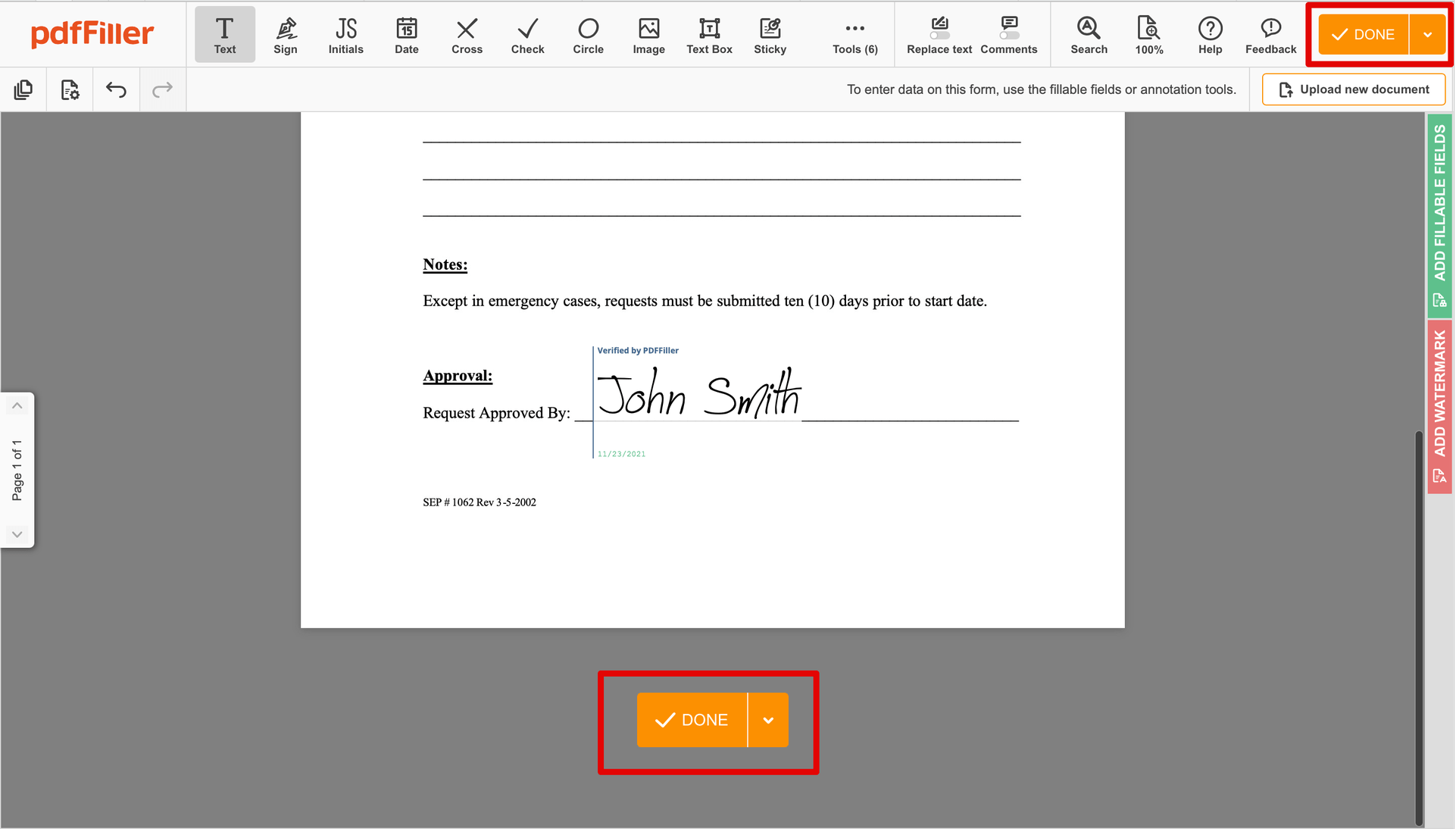

Complete the signing session by clicking DONE below your document or in the top right corner.

After that, you'll return to the pdfFiller dashboard. From there, you can get a signed copy, print the document, or send it to other parties for review or approval.

Still using different applications to manage your documents? Try this all-in-one solution instead. Use our document management tool for the fast and efficient process. Create fillable forms, contracts, make templates, integrate cloud services and utilize other features within one browser tab. Plus, you can use Mark Form W-8BEN and add high-quality features like signing orders, alerts, attachment and payment requests, easier than ever. Have the value of full featured program, for the cost of a lightweight basic app.

How to edit a PDF document using the pdfFiller editor:

How to Send a PDF for eSignature

How to Use the Mark Form W-8BEN Feature in pdfFiller

The Mark Form W-8BEN feature in pdfFiller allows you to easily complete and submit the W-8BEN form, which is used by non-U.S. individuals to claim tax treaty benefits. Follow these steps to use this feature:

By following these steps, you can easily use the Mark Form W-8BEN feature in pdfFiller to complete and submit the W-8BEN form accurately and efficiently.

What our customers say about pdfFiller

Easy to use, anyone who I've sent a file has had no issues receiving and downloading. Some of them have told me they've gone on to use the product regularly themselves.

What do you dislike?

Nothing to do with pdffiller, but I sometimes forget to set up the files I'm uploading in the right folders. That's on me.

What problems are you solving with the product? What benefits have you realized?

Under the 'documents' tab, the 2 columns on the right could be made more distinctly different from each other to denote they are in fact different. They are just two shades of gray and not that different in tone.

I like the fact that PDF filler is very user friendly. I use it often in my insurance business

What do you dislike?

Not always easy to find specific forms for my business

What problems are you solving with the product? What benefits have you realized?

It has made the use of filling out pre-set forms much more convenient.