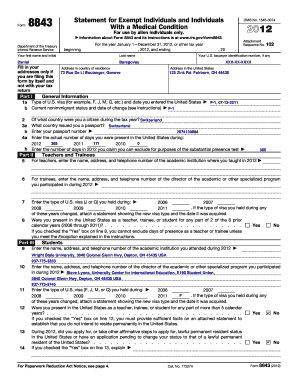

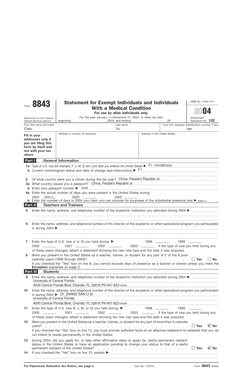

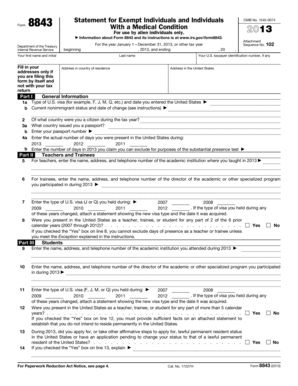

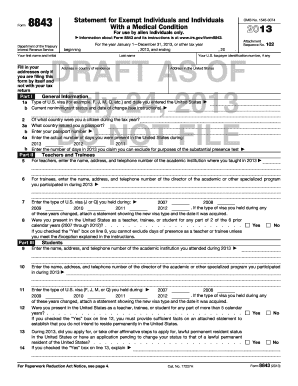

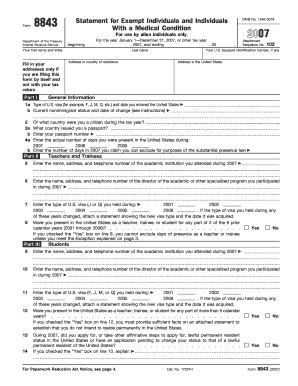

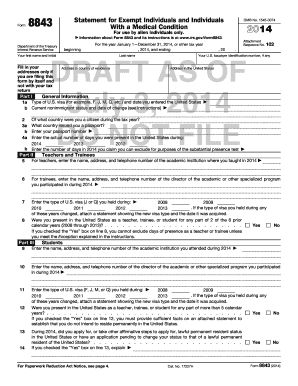

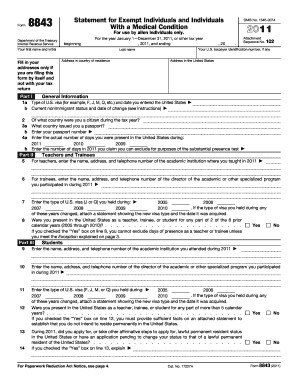

2012 8843 Form

What is 2012 8843 Form?

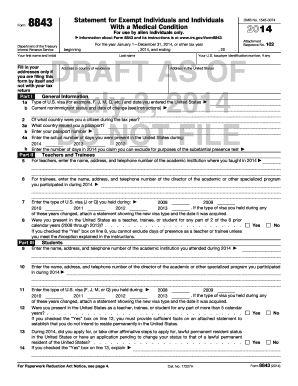

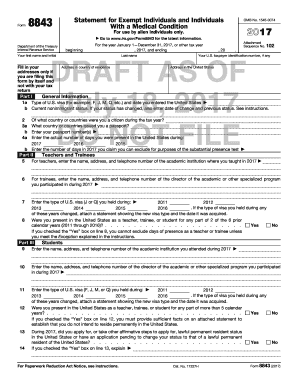

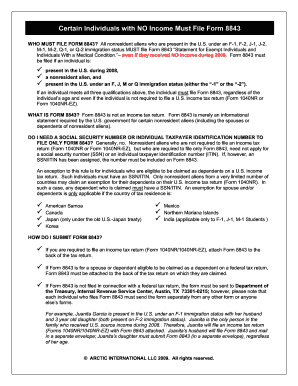

The 2012 8843 Form is a document issued by the Internal Revenue Service (IRS) in the United States. It is used by nonresident aliens who were present in the country during the previous calendar year and need to report their days of presence for tax purposes. This form helps nonresident aliens who are exempt from income tax filing requirements to comply with the substantial presence test and maintain their exempt status.

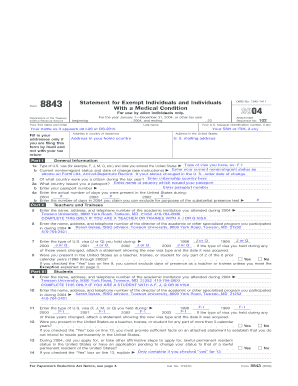

What are the types of 2012 8843 Form?

There are no specific types of the 2012 8843 Form. The form is used by nonresident aliens regardless of their individual circumstances. However, it is important to fill out the form accurately and provide all the required information, such as name, address, passport number, and days of presence in the United States.

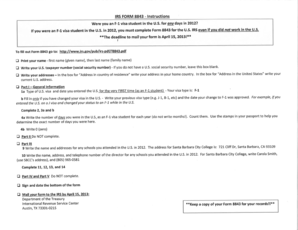

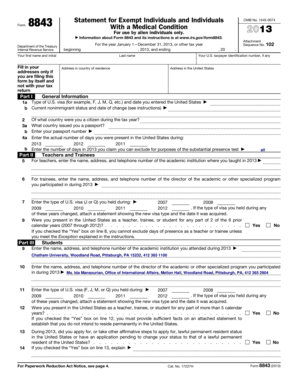

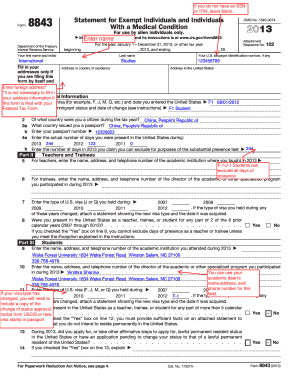

How to complete 2012 8843 Form

Completing the 2012 8843 Form is a straightforward process. Follow these steps:

pdfFiller is an excellent tool that empowers users to create, edit, and share documents online, including the 2012 8843 Form. With its unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you'll need to efficiently complete your documents.