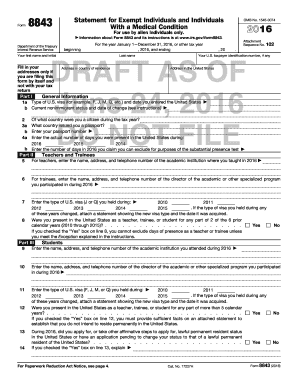

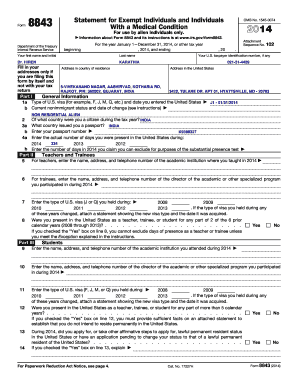

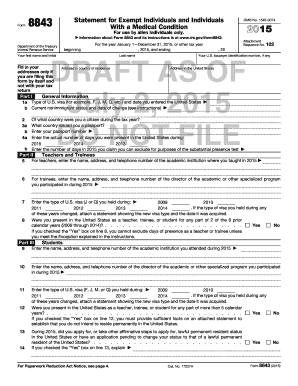

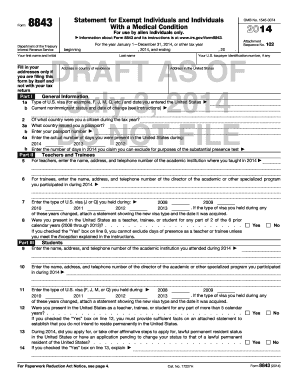

Form 8843 2014

What is form 8843 2014?

Form 8843 2014 is a document used by nonresident aliens in the United States to claim exemption from certain taxes. This form is specifically for individuals who are not U.S. citizens or residents but have been present in the country for a certain period of time.

What are the types of form 8843 2014?

There are two main types of form 8843 2014: the regular form and the simplified form. The regular form is used by most nonresident aliens who need to report their presence in the United States. The simplified form, on the other hand, is available for individuals who meet certain criteria, such as being exempt from income tax or reporting fewer than 10 days of presence in the country.

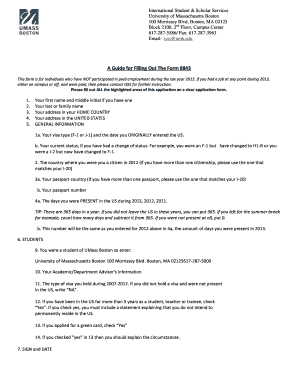

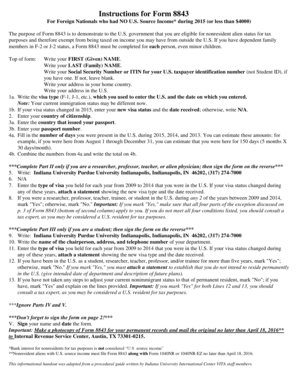

How to complete form 8843 2014

Completing form 8843 2014 is a straightforward process. Here are the steps to follow:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.