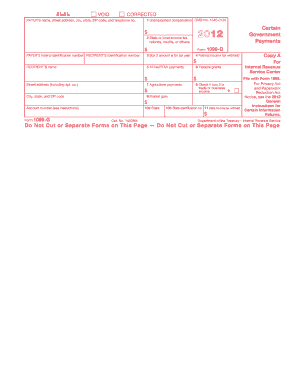

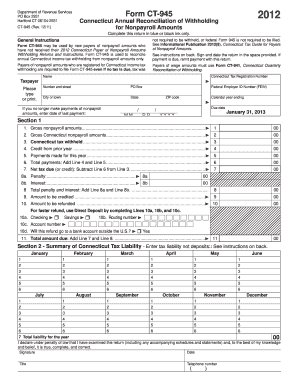

2012 Form 1096

What is 2012 form 1096?

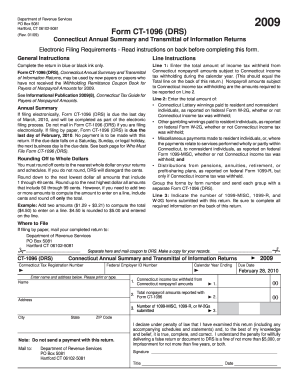

The 2012 form 1096 is an important tax document used by businesses to summarize and transmit various types of information related to the filing of specific tax forms. It is a form that needs to be completed and submitted to the Internal Revenue Service (IRS) along with other necessary tax documents.

What are the types of 2012 form 1096?

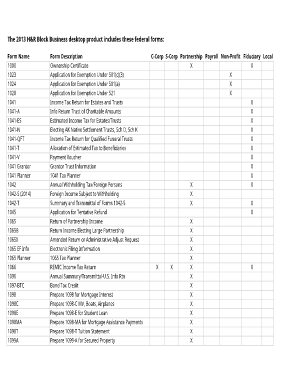

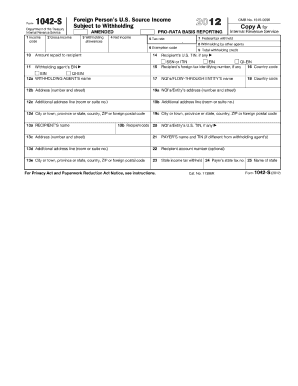

The 2012 form 1096 is used for different types of tax forms, including but not limited to:

Form 1099-MISC: Used to report miscellaneous income paid to non-employees, such as freelancers or independent contractors.

Form 1099-INT: Used to report interest income received throughout the year.

Form 1099-DIV: Used to report dividends and distributions received from investments.

Form 1099-R: Used to report distributions from pensions, annuities, retirement plans, and similar accounts.

Form 1099-B: Used to report proceeds from broker and barter exchange transactions.

Form 1099-S: Used to report proceeds from the sale of real estate.

Form Used to report mortgage interest received throughout the year.

How to complete 2012 form 1096

Completing the 2012 form 1096 is a straightforward process. Here are the steps to follow:

01

Fill in the taxpayer information, including your name, address, and identification number.

02

Enter the total number of forms being transmitted with this 1096 form.

03

Provide information about your business or organization, including the name and address.

04

Specify the type of filer you are, whether an individual, corporation, partnership, or government entity.

05

Fill in the monetary details, such as the total amount reported on the attached forms.

06

Make sure to sign and date the form before submitting it to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2012 form 1096

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the deadline for 1096 forms to be mailed 2022?

The filing deadline for Form 1096 depends on the filing deadline of the form it accompanies. The filing deadline is the same whether you file by mail or online. For tax year 2022, With Forms 1099-NEC, file by January 31, 2023.

Can I print my own 1096 forms?

The official printed version of this IRS form is scannable, but a copy, printed from this website, is not. Do not print and file a Form 1096 downloaded from this website. a penalty may be imposed for filing with the IRS information return forms that can't be scanned.

Do you have to file a 1096 if you file electronically?

Keep in mind IRS Form 1096 is only necessary for the mail transmittal of U.S. information returns. if you plan to go the e-file route and file your information returns electronically, you don't need to worry about attaching Form 1096.

Will IRS accept printed 1096?

The official printed version of this IRS form is scannable, but a copy, printed from this website, is not. Do not print and file a Form 1096 downloaded from this website. a penalty may be imposed for filing with the IRS information return forms that can't be scanned.

How do I fill out 1096?

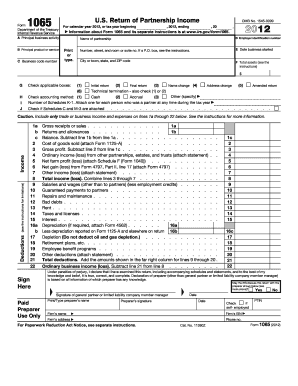

Form 1096 instructions Step 1: Complete your business's information returns. Step 2: Fill in the basic information at the top of IRS Form 1096. Step 3: Complete box 1 or 2, plus box 3. Step 4: Complete box 4 and 5. Step 5: Complete box 6 and 7. Step 6: Review Form 1096 and file with the IRS. File electronically.

Can I fill out 1099 1096 by hand?

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, “Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.

Related templates