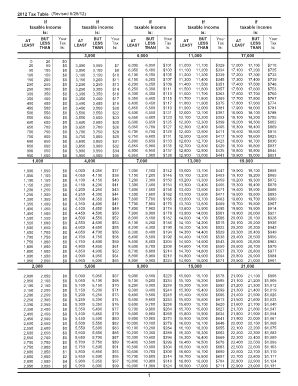

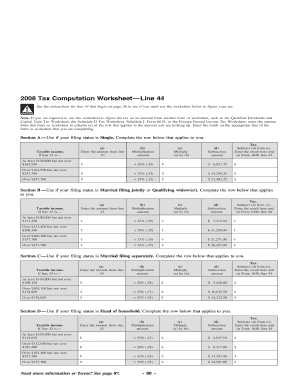

2012 Tax Tables

What is 2012 tax tables?

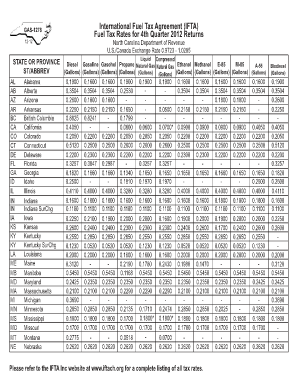

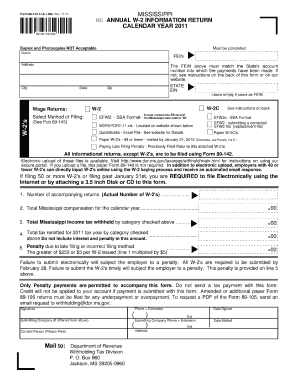

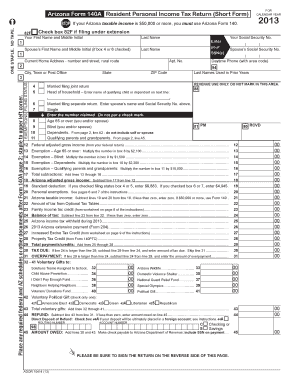

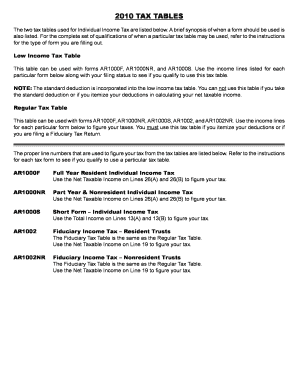

The 2012 tax tables are a set of documents that provide information on the income tax rates and brackets for individuals, families, and businesses for the year 2012. These tables help taxpayers calculate the amount of tax they owe based on their income and filing status. By referring to the appropriate tax table, individuals can determine their tax liability and ensure they are paying the correct amount to the government.

What are the types of 2012 tax tables?

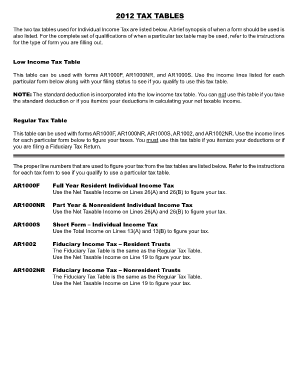

There are several types of 2012 tax tables, each designed for specific types of taxpayers. These include: 1. Individual tax tables: These tables are used by individuals filing under various statuses such as single, married filing jointly, married filing separately, and head of household. 2. Corporate tax tables: These tables are used by businesses to calculate their income tax liability based on their taxable income. 3. Estate and trust tax tables: These tables are used by estates and trusts to determine the income tax owed on their taxable income. 4. Alternative Minimum Tax (AMT) tables: These tables are used by taxpayers subject to the AMT to calculate their alternative minimum tax liability. By using the appropriate type of tax table, taxpayers can accurately calculate their tax liability and meet their tax obligations.

How to complete 2012 tax tables

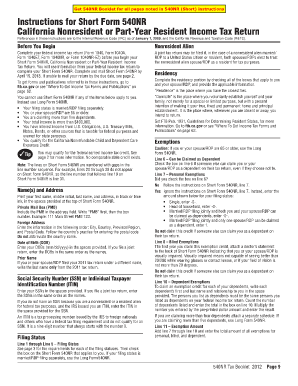

Completing the 2012 tax tables may seem daunting, but with careful attention to detail and the right tools, it can be a smooth process. Here are some steps to guide you through: 1. Gather all the necessary documents: Make sure you have all the required information, including W-2 forms, 1099 forms, and any other relevant documents that show your income and deductions. 2. Determine your filing status: Understand the different filing statuses (e.g., single, married filing jointly, etc.) and choose the one that best applies to your situation. 3. Calculate your income: Add up your total income, including wages, self-employment income, and any other sources of income. 4. Determine your deductions: Identify any eligible deductions and credits that can reduce your taxable income. These may include mortgage interest, student loan interest, and charitable contributions. 5. Use the appropriate tax table: Refer to the specific tax table that corresponds to your filing status and taxable income. 6. Fill in the required fields: Enter your income, deductions, and other necessary information accurately into the tax table. 7. Calculate your tax liability: Follow the instructions provided with the tax table to determine your final tax liability. 8. Review and submit: Double-check all the information you have entered to ensure accuracy. Once you are confident, submit your completed tax table to the relevant tax authority. By following these steps, you can confidently complete the 2012 tax tables and fulfill your tax obligations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.