Irs Tax Calculator

What is irs tax calculator?

An IRS tax calculator is a tool that allows individuals to estimate their tax liability or refund by inputting their income, deductions, and other relevant information. It takes into account the current tax laws and calculations to provide users with an estimate of their tax obligations.

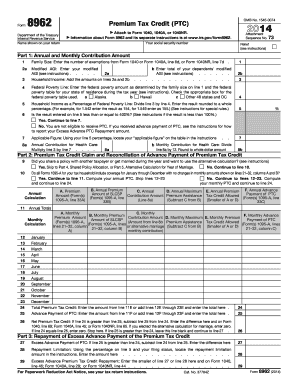

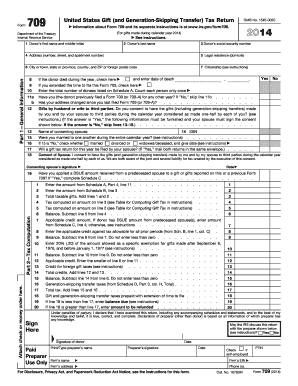

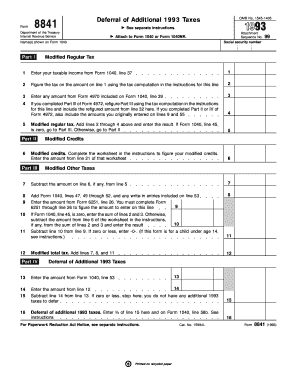

What are the types of irs tax calculator?

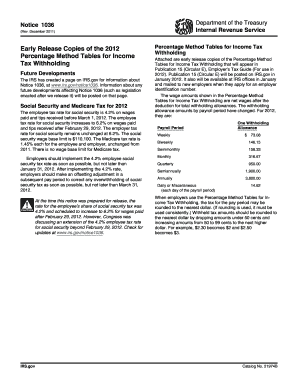

There are several types of IRS tax calculators available to taxpayers. These include: 1. Income Tax Calculator: This type of calculator helps individuals estimate their income tax liability based on their income, filing status, deductions, and credits. 2. Refund Calculator: This calculator helps taxpayers determine the amount of refund they may be eligible for based on their income, deductions, and credits. 3. Withholding Calculator: This type of calculator assists individuals in determining the appropriate amount of tax to withhold from their paychecks to avoid owing taxes or receiving a large refund at year-end.

How to complete irs tax calculator

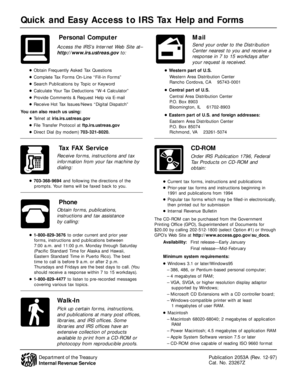

Completing an IRS tax calculator is a straightforward process. Follow these steps: 1. Gather your financial information: This includes your income statements, deduction details, and any other relevant financial documentation. 2. Open the IRS tax calculator: You can find various IRS tax calculators online or on the IRS website. 3. Enter your information: Input your income, deductions, filing status, and any other required details into the calculator. 4. Review the results: The calculator will provide you with an estimate of your tax liability or refund. 5. Make adjustments if necessary: If the results are not as expected, you can make adjustments to your inputs and recalculate. 6. Consult a tax professional if needed: If you have complex tax situations or questions, it's always a good idea to consult a tax professional for guidance.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.