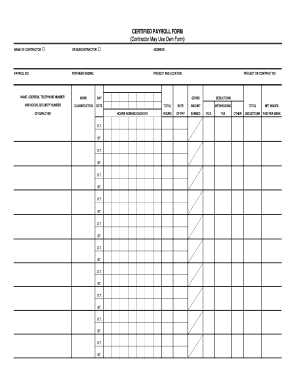

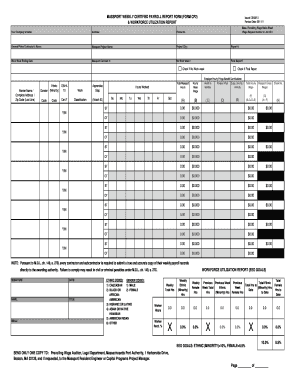

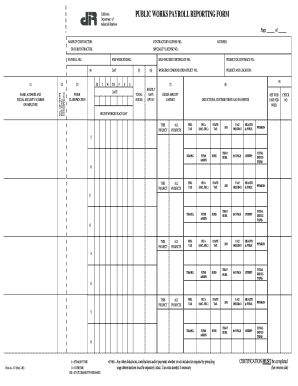

General Certified Payroll Form

What is General Certified Payroll Form?

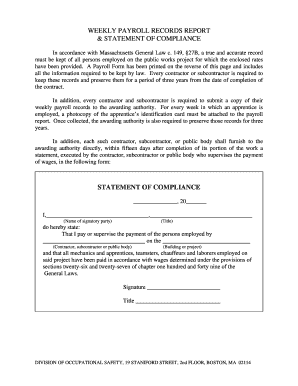

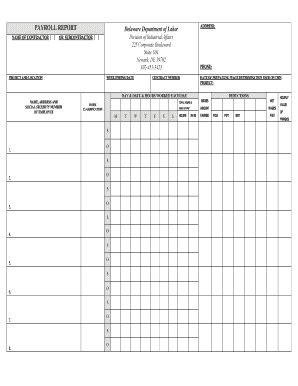

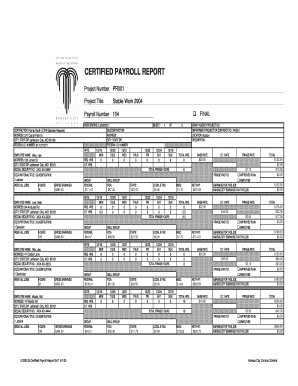

A General Certified Payroll Form is a document used by contractors and sub-contractors in the construction industry to keep track of wages paid to workers on public works projects. It is a standardized form that provides detailed information about the hours worked, pay rates, deductions, and other relevant information for each worker.

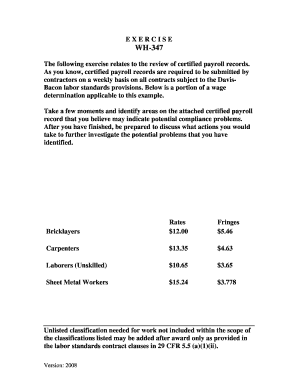

What are the types of General Certified Payroll Form?

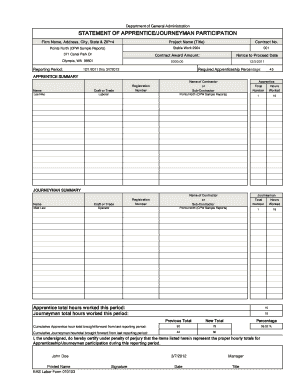

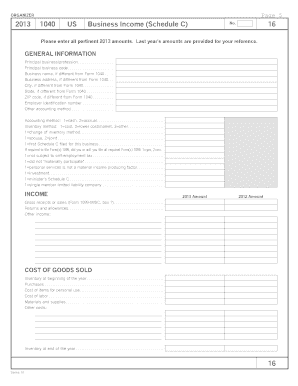

There are various types of General Certified Payroll Forms, depending on the specific project and requirements. Some common types include:

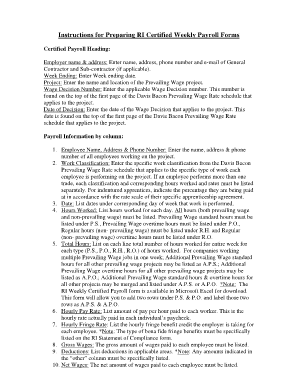

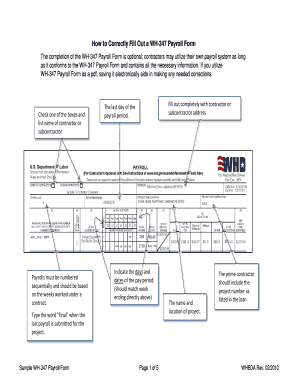

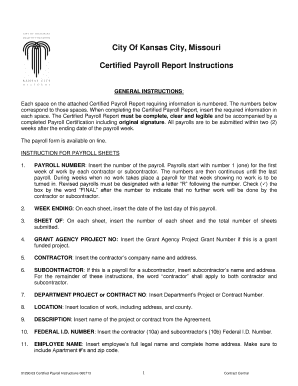

How to complete General Certified Payroll Form

Completing a General Certified Payroll Form requires attention to detail and accurate information. Here are the steps to complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.