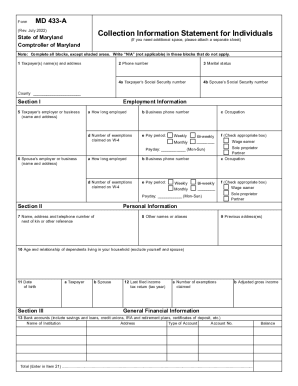

MD Comptroller 433-A 2000 free printable template

Get, Create, Make and Sign

Editing md 433 a online

MD Comptroller 433-A Form Versions

How to fill out md 433 a 2000

How to fill out md 433 a:

Who needs md 433 a:

Video instructions and help with filling out and completing md 433 a

Instructions and Help about state government form

Hello everyone this is Heidi Duran enrolled agent and founder of achievable dream tax resolution today I'm going to show you how to complete before 33 an is the IRS is financial form it's called the collection information statement for wage earners and self-employed individuals if the IRS has asked you to complete this form that means that you or they or those are looking for some sort of resolution now this form does two things it shows your ability or inability to pay it also shows the IRS what they can collect from you reasonably the IRS tends to assume that you have a lot more than you do for this form is very good for both of you actually it's a little of a reality check so as you can see to save time I filled in the obvious information such as your name social and address don't forget your County there I always like to put at least one phone number now if you're working with a representative you're still going to put your number as far as 2 B goes I get a lot of questions about this you're going to list anyone that you pay for so normally that's your children but if you're also taking care of an adult child a dependent adult for example you're going to put that in here as well whether you claim them on your taxes doesn't matter so much in this section you're going to be explaining this section to your revenue officer or your tax representative, but you want to include anyone that you're paying for remember we want to show a reality check of what you can or cannot pay now if you notice that I put simply John a Joe and not his wife the reason I did this is that more often than not I do see a joint return, but sometimes you get a married filing separate and only one of the people owns the tax, so that person is billing out before 33a here's what you do if that's the case if you're a John a Joe and your wife Mary has nothing to do with this tax liability you're going to put in your name your social your job however you're still going to add your spouse's social date of birth and driver's license number you do not however have to fill in his or her job information now for the job you're going to put in the name of whom you work for obviously the address can either be the home office or the physical location where you work they may cross-reference this with your pay stub, so I tend to put the home office you're going to put your work phone number it's going to ask if your employer allows contact at work I always say no you do not want a revenue officer contacting you at work how long you've been there very self-explanatory your job and how many exemptions you claim on you're dead before be very careful of claiming to you don't buy it be like you're filling out this form if for some reason let's say John you take care of these three people here, and you claim 13 I've seen it the IRS is going to scrutinize that once we see this if you have claimed far too much talk to your payroll department immediately about changing your w-4 now moving on to...

Fill tax local state : Try Risk Free

People Also Ask about md 433 a

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your md 433 a 2000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.