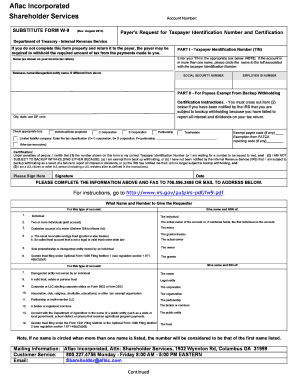

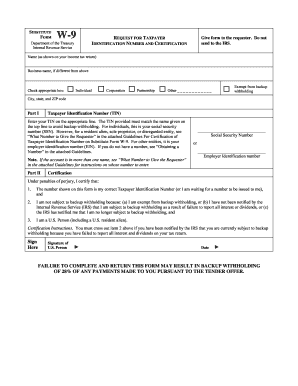

What is substitute w9 form?

When organization or institution is required to file information returns with the IRS and therefore must obtain the taxpayer’s identification number (TIN) to fulfill our reporting requirement. The Substitute W-9 is used by a U.S. person (including a resident alien), to provide their correct TIN. The form also serves to:

-

Certify that the TIN you are providing is correct (or in case the applicant is waiting for a number to be issued),

-

Certify that you are not subject to backup withholding, or

-

Claim exemption from backup withholding if you are a U.S. exempt payee.

Is substitute w9 form Accompanied by Other Documents?

If you are exempt from backup withholding, enter your name as described above and check the appropriate box for your status, then write “Exempt” on the line provided, sign and date the form. An electronic signature must match the person whose name is on the Legal Name line when an SSN is provided. In the case of an EIN, the signature does not need to match the legal name. An electronic signature must identify the person or entity submitting the electronic form and must authenticate and verify the submission.

What Information do I Provide in substitute w9 form?

Legal Name can be Individual (if you are a Sole Proprietor enter your individual name as shown on your federal income tax return on the Legal Name line). In case the applicant is “Partnership, C Corporation, or S Corporation” enter the entity's name on the Legal Name line. Disregarded entity Single-Member LLC — enter the owner's name on the Legal Name line. Address is entered in full. In the “Ownership Status” check appropriate box of person/entity whose name is on the Legal Name line. If you are providing Health Care or Legal services please check the appropriate box. Tax ID Number (TIN).