Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

The term "PA form" can have various meanings depending on the context. Here are a few possible interpretations:

1. Personal Assistant Form: In some organizations, a PA form refers to a document that outlines the responsibilities, tasks, and obligations of a personal assistant or a support staff member.

2. Power of Attorney Form: PA form is an abbreviation for Power of Attorney form. It is a legal document that authorizes someone to act on behalf of another person in financial, legal, or health-related matters.

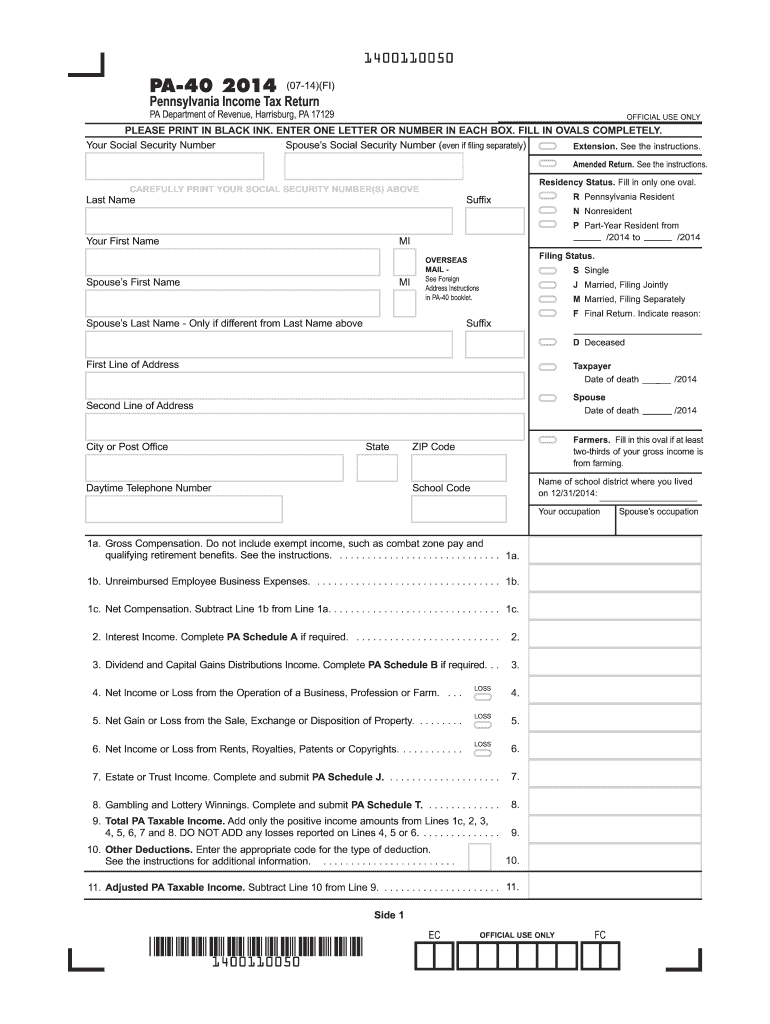

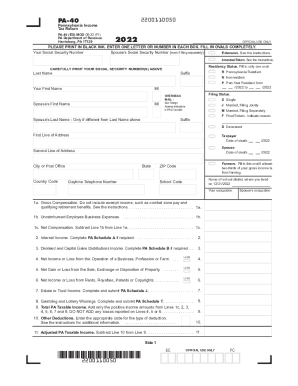

3. Pennsylvania (PA) Tax Forms: PA form can also refer to the various tax forms used in the state of Pennsylvania for filing income taxes or other tax-related documents.

Without further context, it is difficult to determine the specific meaning of "PA form".

Who is required to file pa form?

PA form refers to Pennsylvania state tax forms. In general, individuals who are residents of Pennsylvania or have earned income in Pennsylvania are required to file a PA state tax return. Additionally, non-residents who earned income in Pennsylvania may also be required to file a PA state tax return. It is important to consult the Pennsylvania Department of Revenue or a tax professional to determine if you are required to file a PA form specific to your circumstances.

To fill out a PA (Pennsylvania) form, you will need to follow these general steps:

1. Obtain the correct form: Determine the specific PA form that you need to fill out. This may include tax forms, registration forms, or other government-related documents.

2. Read the instructions: Carefully review the instructions provided with the form. These instructions will guide you through the process and help you understand what information is required.

3. Gather the necessary information: Collect any relevant documents, records, or details that are needed to complete the form. This may include personal information, income statements, financial data, or identification documents.

4. Start the form: Begin filling out the form by entering your personal information, such as your name, address, and Social Security Number (or other identifying numbers).

5. Provide requested information: Proceed to provide all the requested information on the form. Make sure to enter the data accurately and clearly, paying attention to details such as dates, amounts, and addresses.

6. Follow any specific instructions: If there are specific instructions related to certain sections or entries, make sure to adhere to them. For example, some forms might require you to attach supporting documents or notarize certain sections.

7. Double-check for accuracy: Before submitting the form, carefully review all the information you have provided to ensure accuracy and completeness. Mistakes or omissions could lead to delays or complications.

8. Sign and date: If required, sign and date the form in the designated area. This signifies that you have completed the form truthfully and are responsible for its contents.

9. Make copies: It is always a good idea to make copies of the filled-out form for your records before submitting it. This will help you keep a record of the information you provided.

10. Submit the form: Determine the appropriate method for submitting the form. This may include mailing it to the appropriate address, submitting it online, or delivering it in person. Follow the instructions provided on the form or on the respective government website.

It's important to note that specific instructions for each form may vary, so always consult the provided instructions for the particular PA form you are filling out.

What is the purpose of pa form?

The purpose of a PA (Power of Attorney) form is to legally authorize someone, known as the agent or attorney-in-fact, to make decisions and act on behalf of another person, known as the principal, in various matters. This legal document can be used for various purposes, including financial matters, healthcare decisions, legal proceedings, or general representation. It allows the agent to handle specific responsibilities and make decisions on behalf of the principal, who may be unable or prefer not to handle these matters themselves. The PA form provides a clear and legally binding way to delegate authority and ensure someone can act on behalf of another person in specific situations.

What information must be reported on pa form?

The information that must be reported on the PA form (presumably referring to Pennsylvania state tax forms) can vary depending on the specific form being referenced. However, generally, the following information is commonly required on Pennsylvania state tax forms:

1. Personal information: This includes your full name, Social Security number, mailing address, and contact information.

2. Filing status: You will need to indicate whether you are filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

3. Income: Report all types of income earned during the tax year, such as wages, salaries, tips, interest, dividends, rental income, self-employment income, retirement income, unemployment compensation, and any other sources of income.

4. Deductions: Report any deductions you are eligible for, which may include state and local taxes paid, mortgage interest, property taxes, student loan interest, charitable contributions, medical expenses, and other deductions.

5. Tax credits: Report any tax credits you may be eligible for, such as the Earned Income Tax Credit (EITC), Child Tax Credit, Pennsylvania Property Tax/Rent Rebate Program, etc.

6. Tax payments and withholdings: Report any tax payments already made through employer withholdings, estimated tax payments, or any other tax credits that have been applied.

7. Pennsylvania-specific information: Some Pennsylvania state tax forms may require additional information specific to the state, such as reporting property ownership, use tax, contributions to Pennsylvania 529 plans, etc.

Remember, the specific information required may vary depending on the form being used, and it is always recommended to carefully review the instructions provided with the form or consult a tax professional for accurate guidance.

What is the penalty for the late filing of pa form?

The penalty for the late filing of a PA form (presumably referring to the state of Pennsylvania) varies depending on the specific form and the extent of the delay. Generally, penalties for late filing may include the following:

1. Late filing fee: This is a fixed penalty imposed for filing a form after the due date. The amount of the late filing fee depends on the specific form and can range from a few dollars to several hundred dollars.

2. Interest charges: If you file your PA form late, you may also be liable for interest charges on any late payments owed. The interest rate is typically calculated based on the underpayment rate set by the Pennsylvania Department of Revenue.

3. Increased tax liability: Filing a PA form late may also result in an increased tax liability if the late filing results in additional taxes owed. This could be due to missed deductions, allowances, or credits that would have otherwise been available had the form been filed on time.

It is important to note that the penalties and consequences for late filing can vary depending on the specific form and circumstances. It is advisable to consult the instructions provided with each PA form or contact the Pennsylvania Department of Revenue for accurate and up-to-date information.

How do I make changes in 2014 pa form?

With pdfFiller, the editing process is straightforward. Open your 2014 pa form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit 2014 pa form in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 2014 pa form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit 2014 pa form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 2014 pa form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.