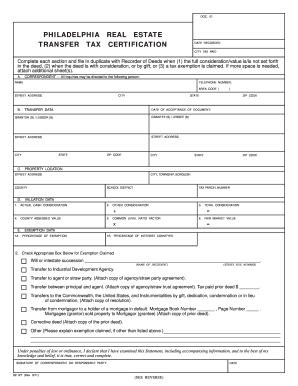

Who needs a Real Estate Transfer Tax Certification?

This certification form is used during the procedure of selling real estate when the owner transfers ownership or title to the buyer. The form should be filed with the Recorder of Deeds if the consideration value is not set forth in the deed; if the deed is with consideration; if the tax exemption is claimed.

What is the purpose of the Real Estate Transfer Tax Certification?

This document certifies the transfer of property rights to a certain individual. The form contains the information about the property location, transfer and exemption data.

What documents must accompany the Real Estate Transfer Tax Certification?

As a rule, the Certification is accompanied by the copy of Property deed transfer form, copy of the Sales and Purchase agreement, and some other supporting documents if required.

When is the Real Estate Transfer Tax Certification due?

The certification is completed and filed when there is a need. Usually, it is required when the tax exemption is claimed. The estimated time for completing the Certification is 10 minutes.

What information should be provided in the Real Estate Transfer Tax Certification?

The document has the following sections for completing:

-

Information about the correspondent (the person who will receive all the inquiries): name, phone number, address.

-

Transfer data: date of acceptance of document, name and address of the granter and the grantee

-

Property location

-

Valuation data: actual cash consideration, other consideration, total consideration, county assessed value, common level ratio factor, fair market value

-

Exemption data: amount of exemption, percentage of interest conveyed

-

Information about the exemption claimed (the filler has to check the appropriate box)

The Certification must be as well signed and dated.

What do I do with the form after its completion?

The completed and signed Certification is filed with the Recorder of Deeds.