UMB i000734 2014-2025 free printable template

Show details

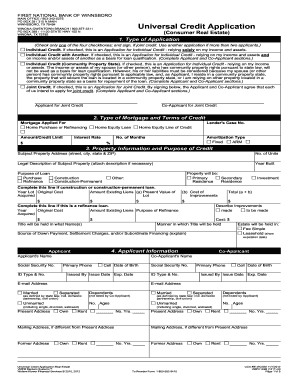

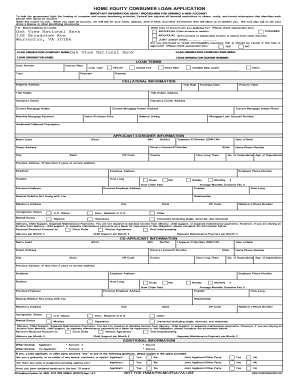

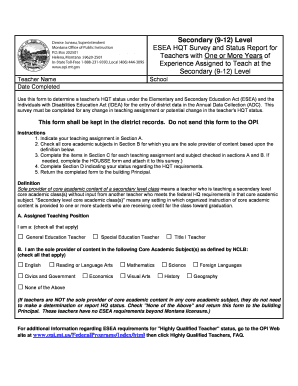

(R 05/11) Branch Name/No. Closing Location Mortgage Loan Originator #: Interviewer: Rate Quoted Source Code Priority Home Equity LOC Application (over $100K) Our bank complies with Section 326 of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 2014 umb home equity loan form

Edit your heloc application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your heloc application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit umb equity loan get online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit i000734 equity loan online form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out equity loan form

How to fill out UMB i000734

01

Obtain the UMB i000734 form from the official website or your local branch.

02

Fill in the required personal information at the top of the form, including your name, address, and contact details.

03

Provide any necessary identification or account numbers as requested in the designated fields.

04

Follow the instructions for each section carefully, ensuring all relevant information is accurately filled out.

05

Review the completed form for any errors or missing information.

06

Sign and date the form at the bottom where indicated.

07

Submit the form either electronically or in person to the appropriate department as instructed.

Who needs UMB i000734?

01

Individuals applying for specific banking services or products offered by UMB.

02

Customers needing to update their account information with UMB.

03

Anyone required to file documentation related to UMB banking policies.

Fill

i000734 home loan application form

: Try Risk Free

People Also Ask about home equity loan application form pdf

Is it a good idea to take equity out of your house?

Taking out a home equity loan can help you fund life expenses such as home renovations, higher education costs or unexpected emergencies. Home equity loans tend to have lower interest rates than other types of debt, which is a significant benefit in today's rising interest rate environment.

How long does it take to get a home equity loan approved?

The truth is that home equity loan approval can take anywhere from a week—or two up to months in some cases. Most lenders will tell you that the average window of time it takes to get a home equity loan is between two and six weeks, with most closings happening within a month.

Does everyone get approved for a home equity loan?

Lenders prefer borrowers with good credit scores and low debt-to-income (DTI) ratios. You generally need at least 20% equity in your home to be approved for a home equity loan. You usually cannot tap 100% of your equity.

When can I borrow against the equity in my home?

How Soon Can You Get A HELOC After Purchasing A Home? A HELOC can be obtained 30-45 days after the purchase of a home. However, borrowers will need to meet all of the necessary lender requirements, including 15-20% equity in home, good repayment history, and more.

How do I borrow money from my home equity?

Home equity loans, home equity lines of credit (HELOCs), and cash-out refinancing are the main ways to unlock home equity. Tapping your equity allows you to access needed funds without having to sell your home or take out a higher-interest personal loan.

What do I need to bring to get a home equity loan?

At least 15 percent to 20 percent equity in your home. Equity is the difference between how much you owe on your mortgage and the home's market value. A credit score in the mid-600s. A DTI ratio of no more than 43 percent. An adequate income. A reliable payment history.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit home loan application online?

With pdfFiller, the editing process is straightforward. Open your equity loan application form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the home equity loan agreement template in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your equity bank loan application form in seconds.

Can I create an eSignature for the home equity loan application form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your online loan application right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is UMB i000734?

UMB i000734 is a specific form used for reporting certain financial or operational information by entities as required by regulatory authorities.

Who is required to file UMB i000734?

Entities that meet certain thresholds or criteria set forth by regulatory authorities are required to file UMB i000734.

How to fill out UMB i000734?

To fill out UMB i000734, you need to gather the required information, follow the instructions provided for the form, and ensure all sections are completed accurately before submission.

What is the purpose of UMB i000734?

The purpose of UMB i000734 is to collect data necessary for regulatory compliance, monitoring, or statistical analysis within a specific sector.

What information must be reported on UMB i000734?

The information required on UMB i000734 typically includes financial figures, operational data, and any other relevant metrics as dictated by the form's guidelines.

Fill out your UMB i000734 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Loan Application Online is not the form you're looking for?Search for another form here.

Keywords relevant to online loan application form interface

Related to home equity loan example

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.