Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

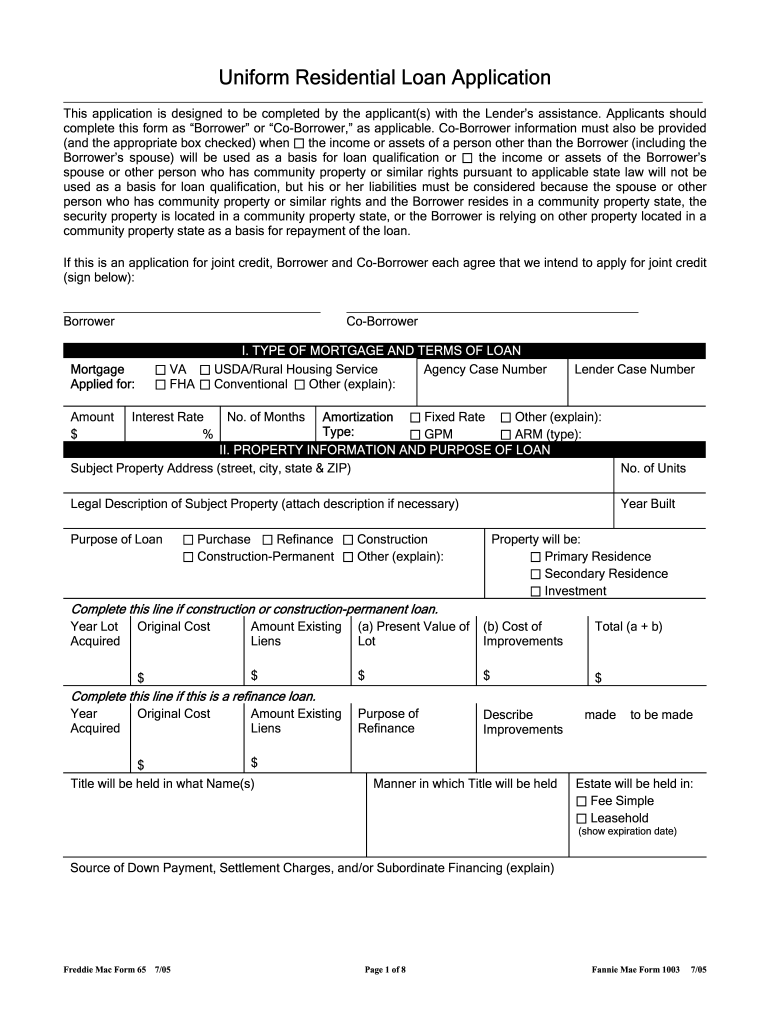

What is freddie form 65 pdf?

Freddie Form 65 is a document used by the Federal Home Loan Mortgage Corporation (Freddie Mac) to evaluate prospective borrowers' creditworthiness. It is used by mortgage lenders to analyze a borrower's ability to repay a mortgage loan. The form includes a credit report, a debt-to-income ratio calculation, and other information about the borrower.

Who is required to file freddie form 65 pdf?

Freddie Form 65 must be completed by any mortgagor who is refinancing a single-family Freddie Mac loan.

What information must be reported on freddie form 65 pdf?

Freddie Form 65 requires information about the borrower's loan terms, including the loan number, loan amount, interest rate, amortization period, loan purpose, loan type, title insurance information, loan-to-value ratio, and occupancy. Additionally, the form requires information about the borrower's financial status, including their income, assets, debts, and credit score. Lastly, it requires information about the property, such as the address, sales price, appraised value, appraisal fee, and estimated market value.

When is the deadline to file freddie form 65 pdf in 2023?

The Freddie Mac Form 65 is only used to apply for multifamily mortgage loan programs and is not required to be filed. Therefore, there is no deadline for filing the form.

What is the penalty for the late filing of freddie form 65 pdf?

The penalty for the late filing of Freddie Form 65 PDF depends on the type of form and the reason for the late filing. Generally, the penalty for late filing is a late fee, which may range from $50 to $500, plus interest.

How to fill out freddie form 65 pdf?

To fill out the Freddie Form 65 PDF, follow these steps:

1. Download the Freddie Form 65 (Uniform Residential Loan Application) in PDF format from the official Freddie Mac website or a trusted source.

2. Open the downloaded PDF file using a PDF reader or editor software (such as Adobe Acrobat Reader).

3. Review the instructions and guidelines provided at the beginning of the form. Familiarize yourself with the sections and requirements.

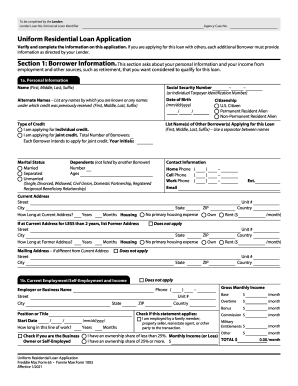

4. Begin filling out the form by entering the necessary information. The form comprises multiple sections such as Personal Information, Employment Information, Income Information, and Asset and Liability Information.

5. Input your personal details, including full name, mailing address, Social Security number, date of birth, and phone number. Ensure accuracy and double-check the information for any mistakes.

6. Proceed to the Employment Information section and provide details about your current employment. Include your employer's name, address, position/title, employment dates, and income information.

7. Fill in the Income Information section by reporting your annual salary, bonuses, commissions, overtime, rental income, and any other sources of income. Provide supporting documents or additional evidence if required.

8. Switch to the Assets and Liability Information section, where you'll enter details about your bank accounts, real estate properties, vehicles, outstanding debts (such as student loans, credit card debt), and other financial obligations.

9. Finally, review the completed form thoroughly to ensure accuracy and completeness. Verify that all required fields are filled, and there are no errors or missing information.

10. Save a copy of the filled form for your records.

11. If necessary, print out the form and sign it manually. Keep in mind that some PDF editors may enable you to add an electronic signature if allowed by the form.

12. Submit the completed Freddie Form 65 as per the instructions provided by the institution or individual requiring the application. This may involve mailing a physical copy, submitting it online, or sending it via email.

Remember, it's crucial to provide accurate and truthful information when filling out any loan application form, as inaccurate or misleading information can have legal consequences.

What is the purpose of freddie form 65 pdf?

Freddie Form 65, officially known as the Uniform Residential Loan Application, is a standard document used by borrowers to apply for a mortgage loan. It is required by the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), the two government-sponsored entities that buy and securitize mortgage loans in the United States.

The purpose of Freddie Form 65 is to collect essential information about the borrower, co-borrower, and property to assess the borrower's creditworthiness and eligibility for a mortgage loan. It includes sections regarding the borrower's personal and financial information, employment history, income, assets, existing debts, and details about the property being purchased or refinanced.

Lenders use this form to evaluate the borrower's ability to repay the loan, determine the loan amount and terms, and comply with regulatory requirements. It helps streamline the mortgage application process and ensures consistency in the information collected from borrowers across different lenders.

Overall, Freddie Form 65 is a standardized document that facilitates the mortgage application process, allows lenders to assess the borrower's eligibility, and helps Fannie Mae and Freddie Mac in evaluating the loans they purchase.

How do I edit freddie form 65 pdf in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing freddie form 65 pdf and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the freddie form 65 pdf electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your freddie form 65 pdf in minutes.

How do I complete freddie form 65 pdf on an Android device?

Use the pdfFiller mobile app to complete your freddie form 65 pdf on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.