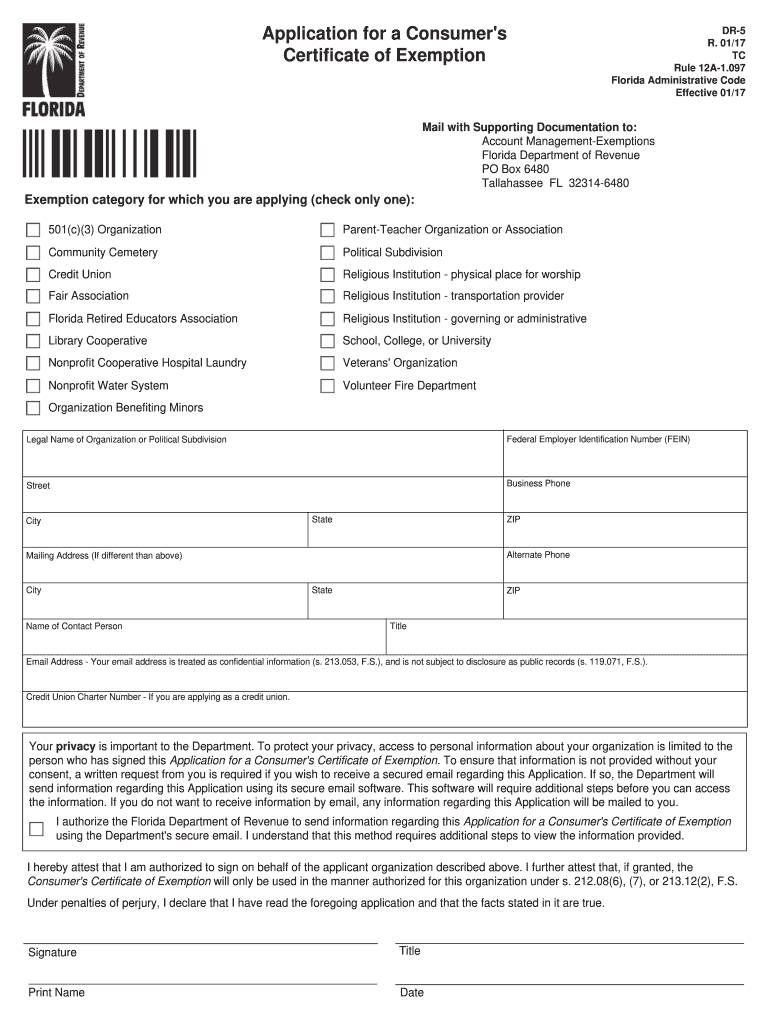

Who needs a DR-5 Form?

This form is important for those who have the right to be exempted from Florida sales and use tax. Some political subdivisions and nonprofit organizations can fill out this form to apply for a Consumer’s Certificate of Exemption. Among these organizations and subdivisions are community cemeteries, credit unions, fair associations, Florida fire and emergency services foundations, Florida retired educators association, library cooperatives, nonprofit cooperative hospital laundries, nonprofit water systems, organizations benefiting minors, parent-teacher organizations or associations, religious institutions, schools, colleges, universities, veteran’s organizations, volunteer fire departments

What is a DR-5 Form for?

The DR-5 form is an application for a consumer’s certificate of exemption. The qualified organizations can apply for a tax exemption to save money for their growth and development.

Is a DR-5 Form accompanied by other forms?

The applicant should provide copies of all required documentation (proofs of qualification), such as an IRS determination letter, law creating the entity, proof of nonprofit organization, articles of incorporation, etc.

When is a DR-5 form due?

Florida sales tax exemption form can be filled out whenever there is a need. The certificate of the tax exemption is valid for 5 years.

How do I fill out form DR-5?

The application consists of one page. You should answer all questions. There are no fees associated with the form. First, you should indicate whether this is a new application or you want to renew the certificate. You should also check the exemption category for which you are applying and provide some information about the organization (name, address, ZIP, VEIN, phone). The applicant should also sign and date the form on behalf of the qualified organization.

Where do I send a DR-5 form?

The application should be sent to Florida Department of Revenue, Account Management, Tallahassee FL.