What is the purpose of 540 Schedule CA?

Purpose. Use Schedule CA (540), California Adjustments – Residents, to make adjustments to your federal adjusted gross income and to your federal itemized deductions using California law.

Is California tax deadline extended?

Extension to file Pay by April 18, 2022 to avoid penalties and interest. We give you an automatic extension to file your return. No application is required. The deadline to pay is April 18, 2022.

What is the difference between a K-1 for a trust and other K 1s?

A Schedule K-1 is the official federal tax form that's used to report earnings and losses when there is an investment in a partnership. In cases of estate planning, Schedule K-1s are used to report earned income from the Trust.

What is the due date for California tax return?

When is the last day to file my taxes? The last day to file your tax return for 2021 is April 18, but you should get ahead of the curve to avoid holdups. The deadline, while typically on the 15th, was moved to the following Monday because Washington, D.C., observes Emancipation Day on April 15 this year.

Is there a tax extension for 2021 California?

File and Pay Extension Taxpayers will have until April 18, 2022 to file and pay income taxes. California grants you an automatic extension to file your state tax return. No form is required. You must file by October 17, 2022.

Who must file a California Nonresident return?

Visit 540NR Booklet for more information. A nonresident return is required when a resident spouse and a nonresident spouse wish to file a joint return.

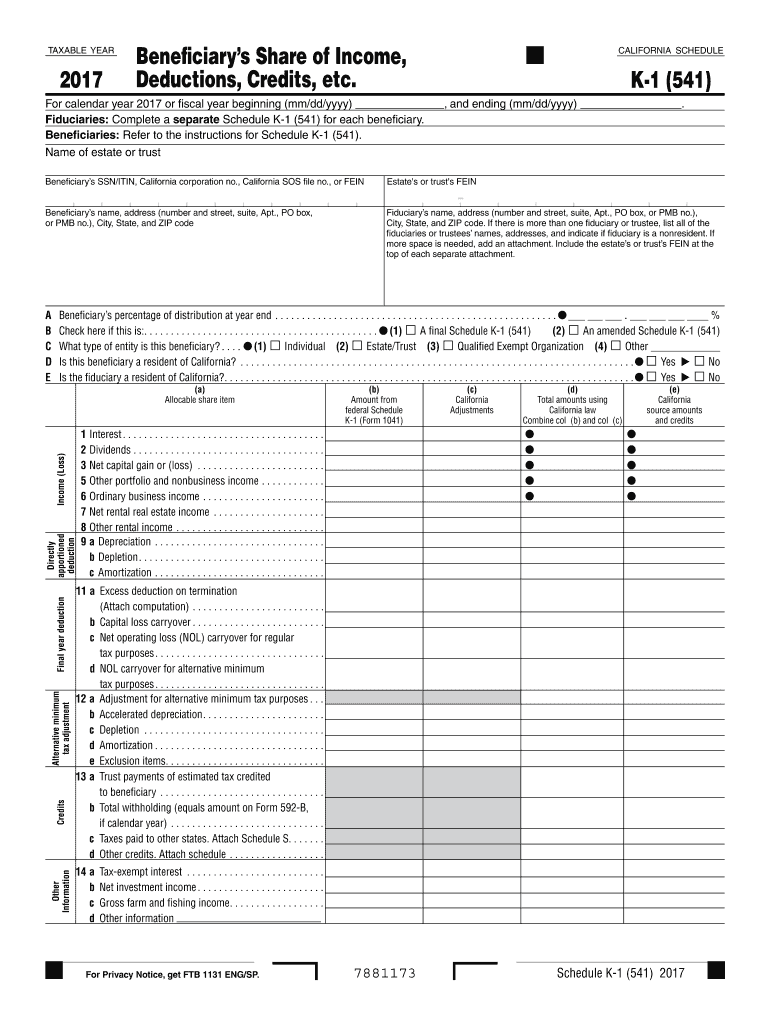

What is California Schedule K-1 541?

The estate or trust uses Schedule K-1 (541) to report your share of the estate's or trust's income, deductions, credits, etc. Your name, address, and tax identification number, as well as the estate's or trust's name, address, and tax identification number, should be entered on the Schedule K-1 (541).

Who must file California Form 541?

The fiduciary (or one of the joint fiduciaries) must file Form 541 and pay an annual tax of $800 for a REMIC that is governed by California law, qualified to do business in California, or has done business in California at any time during the year. A REMIC trust is not subject to any other taxes assessed on this form.

What is Schedule CA used for?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

Who must file California form 541?

The fiduciary (or one of the joint fiduciaries) must file Form 541 and pay an annual tax of $800 for a REMIC that is governed by California law, qualified to do business in California, or has done business in California at any time during the year. A REMIC trust is not subject to any other taxes assessed on this form.

What is California Schedule k1?

Purpose. The partnership uses Schedule K-1 (565), Partner's Share of Income, Deductions, Credits, etc., to report your distributive share of the partnership's income, deductions, credits, etc. Keep the Schedule K-1 (565) for your records.

Does CA use federal extension?

California grants taxpayers an automatic six-month filing extension. You do not need to file any forms to claim this extension, unlike the federal filing extension, which taxpayers apply for using Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return).

Do I need to file Schedule 540 CA?

Common California Income Tax Forms & Instructions The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

Who must file a California partnership tax return?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Who must file Schedule CA 540?

If you have a tax liability for 2021 or owe any of the following taxes for 2021, you must file Form 540. Tax on a lump-sum distribution. Tax on a qualified retirement plan including an Individual Retirement Arrangement (IRA) or an Archer Medical Savings Account (MSA).

What is the extended due date for filing CA fiduciary return?

Fiduciary due dates for fiscal year filers TimeframesTask15th day of the 4th month after the close of the taxable year.Last Day to Transmit Timely-Filed Returns15th day of the 6th month after the original due date of the return.Last Day to Transmit Timely Filed Current Year Returns on Extension5 more rows

What is a Schedule K-1 for a trust?

Schedule K-1 is a tax document that you might receive if you are the beneficiary of a trust or estate. This document reports a beneficiary's share of income, deductions and credits from the trust or estate.

Why do I need to fill out Form 540?

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

Who must file California Franchise Tax?

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California.