Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

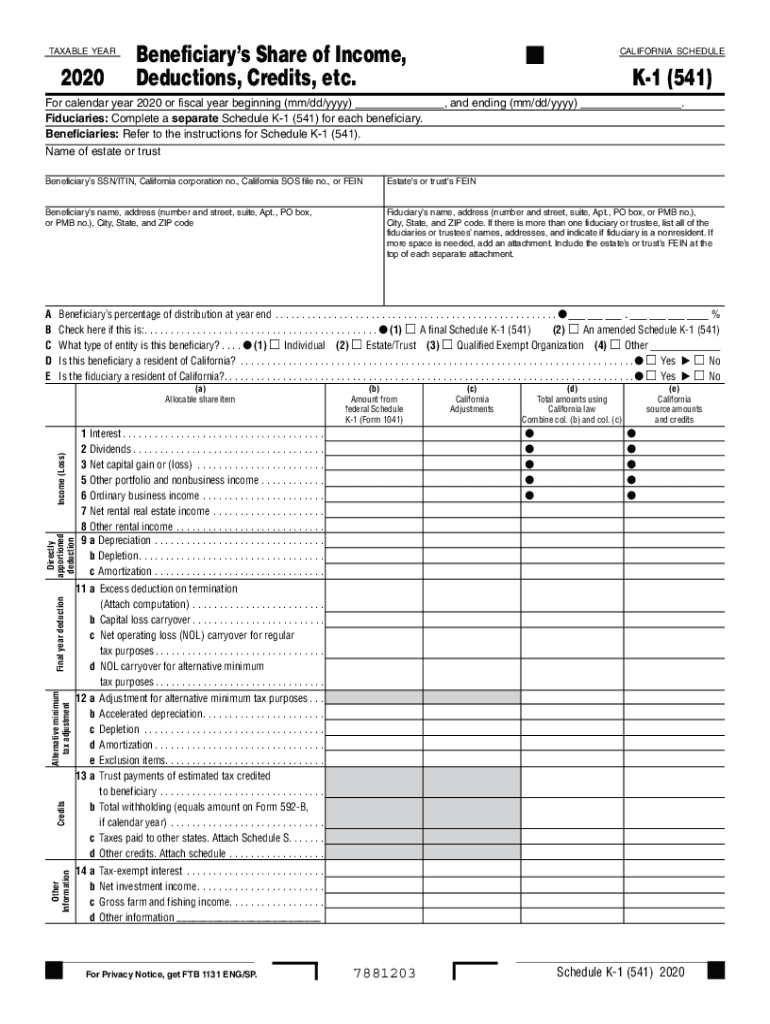

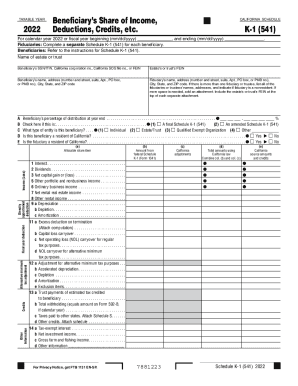

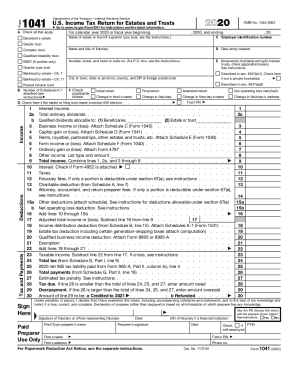

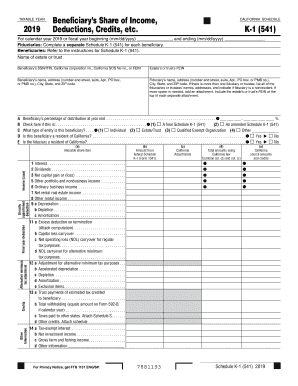

What is state of california form?

The State of California form refers to the various official documents and forms used by the government of California. These forms cover a wide range of purposes and topics, including tax forms, business registration forms, voter registration forms, driver's license applications, healthcare applications, and many others. These forms help individuals and businesses comply with the state's laws, regulations, and requirements. They can typically be obtained online from the official website of the relevant state agency or department, or in-person at government offices and service centers.

Who is required to file state of california form?

The California Form is required to be filed by individuals who are residents of California and have reached the minimum income threshold set by the state. Additionally, non-residents who have earned income from sources within California may also be required to file a California state tax return.

How to fill out state of california form?

To fill out a California state form, follow these steps:

1. Obtain the correct form: Visit the California government website or reach out to the relevant government agency to find and download the specific form you need.

2. Read the form's instructions: Carefully review the instructions provided with the form. It will outline the purpose of the form, explain what information is required, and provide any additional guidance or requirements.

3. Gather necessary information: Collect all the required information that you'll need to complete the form accurately. This may include personal details, identification numbers, financial information, or other specific data.

4. Start filling out the form: Begin by entering your personal information, such as your name, address, and contact details, in the appropriate fields. Make sure to use legible handwriting or type if the form allows for electronic completion.

5. Complete all sections: Work through each section of the form, providing the requested information in the designated spaces. Be sure to follow any formatting instructions, such as using specific date formats or providing responses in specific units or currencies.

6. Check for accuracy and completeness: After completing the form, carefully review it to ensure all required fields have been filled in accurately and completely. Double-check for spelling errors, missing or incorrect information, or any other mistakes.

7. Attach any required documents: If the form requires supporting documents, such as photocopies of identification or additional forms, make sure to include them in the right places. Follow the instructions provided to determine where and how to attach these documents.

8. Sign and date the form: If necessary, sign and date the form in the designated area. Some forms may require a witness or a notary to be present during the signing process. Make sure to follow the specific signing requirements mentioned in the instructions.

9. Make copies for your records: Once you have filled out the form entirely, make copies of the completed form and any accompanying documents for your personal record keeping.

10. Submit the form: Submit the completed form as directed. It may be required to send it by mail, submit it electronically through the state's website, or hand it in person at a specific office or agency. Follow the instructions closely to ensure it reaches the correct destination.

Note: If you're unsure about how to fill out a specific form or require additional assistance, consider reaching out to the responsible agency directly. They can provide guidance and clarify any doubts you may have about completing the form accurately.

What is the purpose of state of california form?

The purpose of California state forms is to collect information and facilitate various administrative processes within the state of California. These forms serve a wide range of purposes, including tax reporting, voter registration, driver's license applications, business filings, healthcare applications, and many other areas of public administration. The specific purpose of each form depends on the agency or department that requires the information.

What information must be reported on state of california form?

The specific information that must be reported on a state of California form can vary depending on the type of form being filed. However, generally, common information required on California forms includes:

1. Personal Information: This includes the name, address, Social Security number, and other contact details of the individual or business entity filing the form.

2. Financial Information: Depending on the form, this may include income, expenses, assets, liabilities, or any other financial details relevant to the purpose of the form.

3. Tax Information: If the form is related to taxes, it may require reporting of income, deductions, credits, exemptions, or any other tax-related information.

4. Legal and Regulatory Details: Some forms may require providing legal or regulatory information such as licenses, permits, registrations, or any other compliance-related data.

It is important to note that the specific information required will vary depending on the purpose and nature of the form, so it is advisable to carefully review the instructions provided with each individual form to ensure accurate reporting.

What is the penalty for the late filing of state of california form?

The penalty for late filing of state of California forms can vary depending on the specific form and the amount of time it is overdue. Generally, the penalty for late filing can range from 5% to 25% of the tax due, and in some cases, there may also be interest charges added to the penalty. It is important to consult the California Franchise Tax Board (FTB) or the specific agency responsible for the form you are filing to get accurate and up-to-date information on penalties for late filing.

How do I make edits in state of california form 541 k 1 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 2020 form k 1, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my how to ca form 541 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your california schedule k 1 541 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out form 541 schedule k 1 on an Android device?

Use the pdfFiller Android app to finish your how to ca 541 form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.