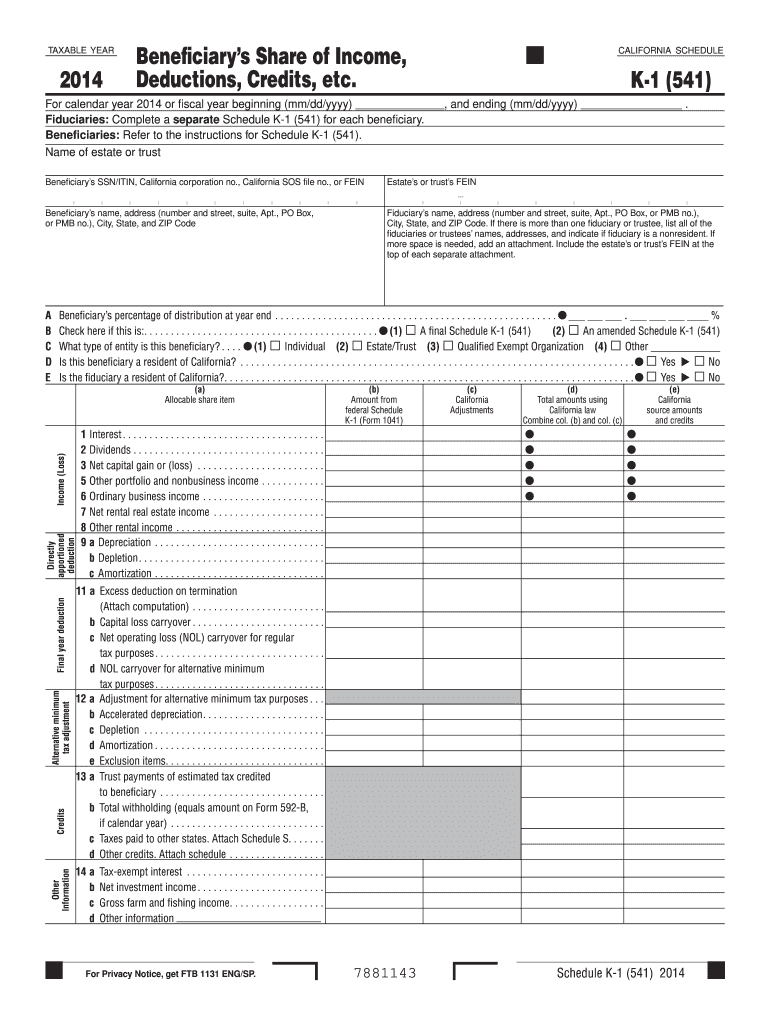

Who needs a Schedule K-1 (541) form?

This form is used by the estates and trusts in the state of California to report to the Franchise Tax Board about the amount of an individual’s (beneficiary’s) share of an estate’s or trust’s income. This form must be filed for each beneficiary. The form is completed by the appropriate organization.

What is the purpose of the Schedule K-1 (541) form?

The given Schedule is essential to report the beneficiary’s share of a certain estate’s or trust’s income to the California Franchise Tax Board. The beneficiary uses the information provided to file his individual tax return. In case the beneficiary didn’t pay tax on their estate’s or trust’s income, they are subject to penalties.

What other documents must accompany the Schedule K-1 (541) form?

The beneficiary uses this form preparing the individual tax return (the type of this form depends on the income and other factors as well). The business entity should attach this schedule to form 541.

When is the Schedule K-1 (541) form due?

This schedule is to be filed by the 18th of April 2016.

What details should be provided in the Schedule K-1 (541) form?

This schedule has the following sections for completion:

- Name of the estate or trust

- SSN/TIN of the Beneficiary

- FINE of the estate or trust

- Beneficiary’s and fiduciary’s name

- Information about the income (loss)

- Directly apportioned deduction

- Final year deduction

- Alternative minimum tax adjustment

- Credits

- Other information

What do I do with the Schedule K-1 after its completion?

The completed Schedule is forwarded to the California Franchise Tax Board. One copy is sent to the beneficiary for personal records.