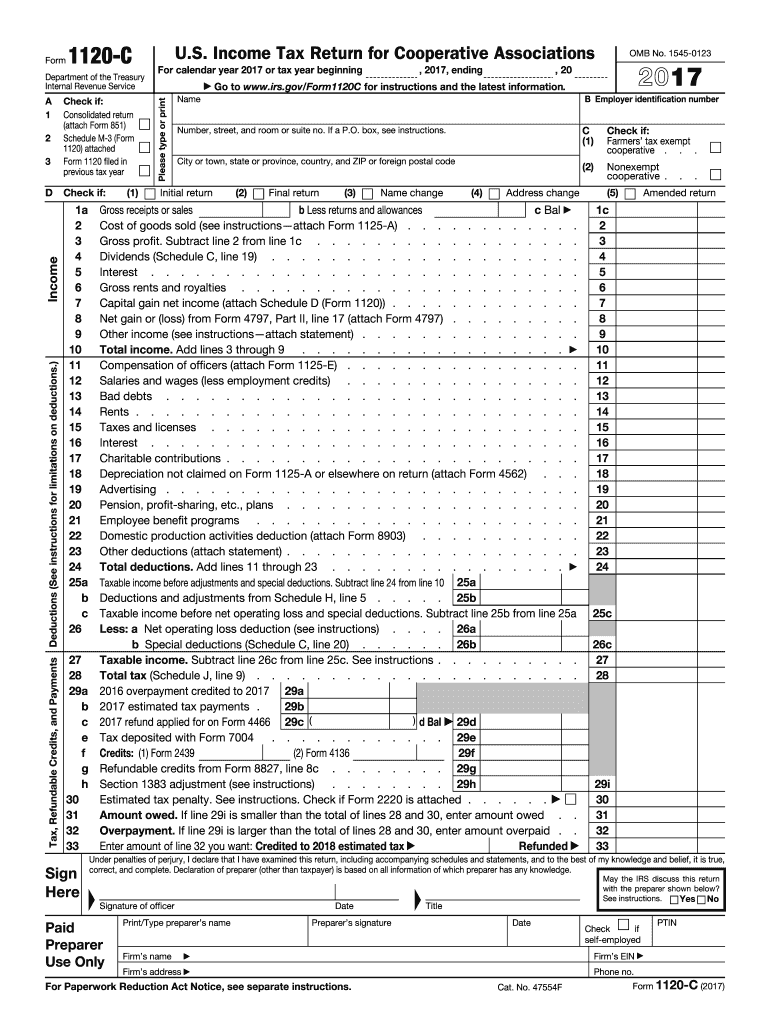

What is form 1120-C?

Corporations operating on a cooperative basis file tax returns using form 1120-C to report their income, gains, losses, deductions, and credits. It is also used to determine their income tax liability.

Who should file form 1120-C 2017?

Corporations that meet the following criteria must file this tax return:

- Operate on a cooperative basis under section 1381

- Allocate amounts to patrons based on business done with or for such patrons (including farmers' cooperatives under section 521 whether or not it has a taxable income).

What information do you need when you file 1120-C?

To properly fill out form 1120-C, you will need the following information:

- Name and address

- Income details

- Deductions

- Tax, refundable credits, and payments

Here are the different sections to take notice of:

- Schedule C is for reporting dividends, inclusions, and special deductions.

- Schedule G is for the allocation of patronage and nonpatronage income and deductions.

- Deductions and adjustments under section 1382 are reported in Schedule H.

- Schedule J is for tax computation.

- Schedule K includes other information, including accounting methods, etc.

- Schedule L is dedicated to balance sheets per books.

- Schedule M-1 is for reconciliation of income (loss) per books with income per return.

- Schedule M-2 includes analysis of unappropriated retained earnings per books.

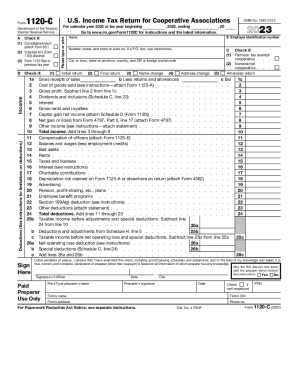

How do I fill out form 1120-C in 2018?

You can print and complete the 1120-C tax form or fill it out online with pdfFiller and send it via USPS. Here’s how:

- Click Get Form at the top of this page

- Fill out all required fields in the form

- Add your signature

- Click Done to complete editing

- Select the form and click Send via USPS

- Provide the addresses and select delivery terms

- Click Send

pdfFiller will print and deliver the form to the post office.

When is form 1120-C due?

The due date for filing 1120-C for cooperative associations described in section 6072(d) is the 15th day of the 9th month after its tax year ends.

Cooperative associations not described in section 6072(d) must file their tax returns by the 15th day of the 4th month after the tax year ends. A cooperative with a fiscal tax year ending June 30 must file the tax return by the 15th day of the 3rd month after the end of the tax year. The same applies to a cooperative with a short tax year ending in June.

Where do I send form 1120-C?

Choose the appropriate address depending on whether the cooperative’s principal business, office, or agency is located in the U.S. or not.