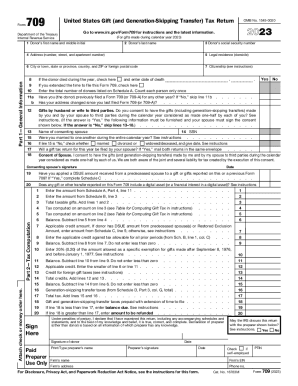

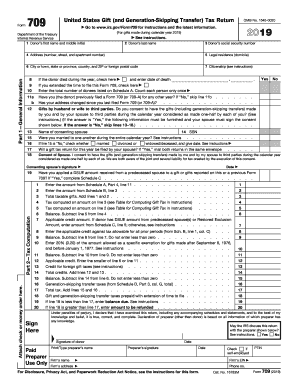

Who needs an IRS 709 form?

The IRS 709 form is used in the following cases:

-

If the individual gave gifts to someone during the tax year totaling more than $14,000.

-

If the individual gave gifts known as future interests of any dollar amount.

-

If the individual is a part of a trust, estate, partnership, or corporation that gave gifts.

Keep in mind that gifts made to political organizations, some educational institutions, and some medical institutions are not subject to gift taxes.

What is the purpose of the IRS 709 form?

IRS form 709 is used to calculate gift taxes and report the IRS about this amount. Some gifts, donations, or transfers are subject to taxes. The form is also used to calculate taxes on generation skipping transfers, or GSTs. The taxpayer that gave the gift is required to pay the tax on it. The receiver of the gift may also be required to pay taxes on it.

What other forms accompany the IRS form 709?

Typically form 709 is sent with a taxpayer’s annual individual tax return. The donor should also attach other supporting documents if required.

When is the IRS form 709 due?

This form should be filed within the period starting from the 1st of January and ending on the 15th of April of the year after the gift was made.

What information should be provided in the IRS form 709?

The filler has to add the information about the donor and fill out all the attached schedules. Follow the instructions in the form to compute the amount of taxes due.

The filler and the donor also must sign and date the form.

What do I do with the form after its completion?

The completed and signed form is forwarded to Department of the Treasury Internal Revenue Service Center Cincinnati, OH 45999.