IRS 709 1989 free printable template

Instructions and Help about IRS 709

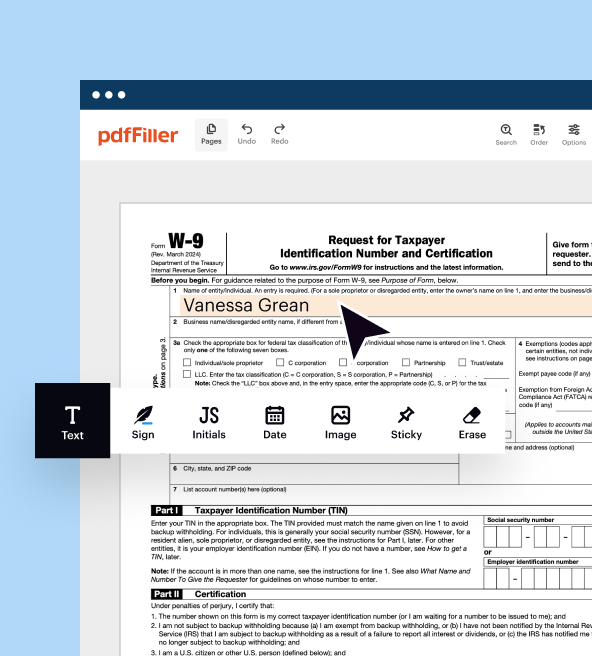

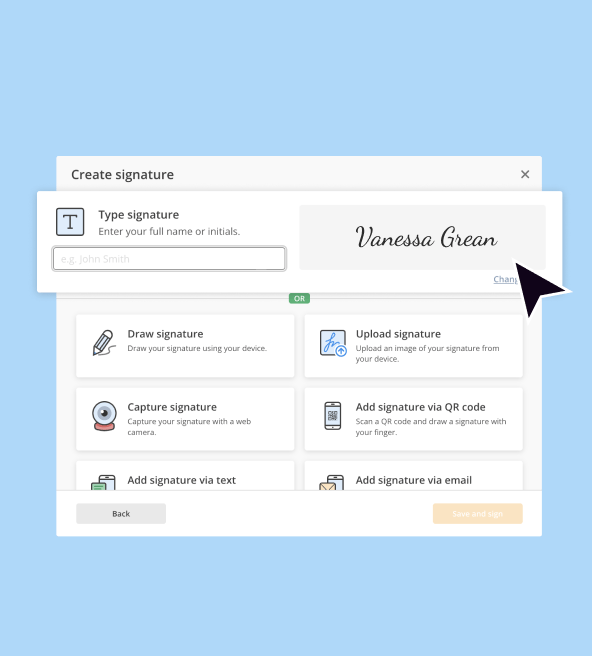

How to edit IRS 709

How to fill out IRS 709

About IRS previous version

What is IRS 709?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

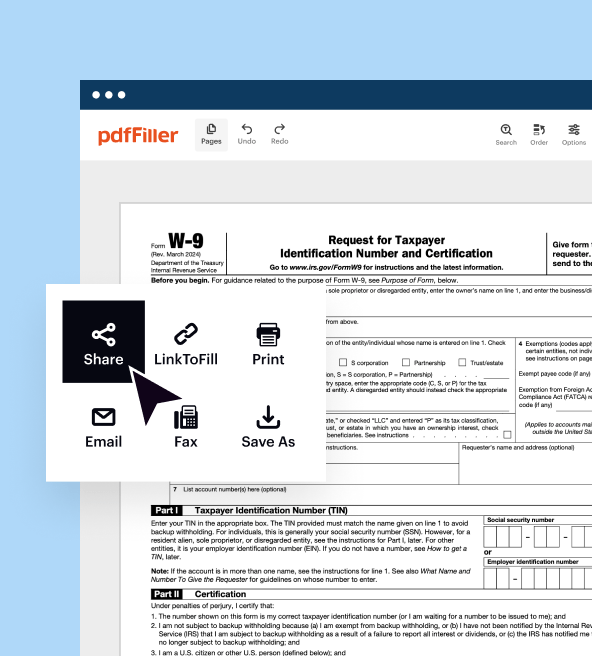

Where do I send the form?

FAQ about IRS 709

What should I do if I made a mistake on my IRS 709 after filing?

If you realize that you made an error on your IRS 709 form, you can submit a Form 709-A to amend it. Be sure to clearly explain the mistake and include any relevant documentation. Retain a copy of the amended form for your records, as it's essential for tracking your filing history.

How can I verify the status of my IRS 709 submission?

To verify the receipt and processing status of your IRS 709, you can use the IRS online tool for checking the status of your submitted forms. Additionally, keep track of any confirmation emails or notices that may have been sent to you after submission.

What should I do if my IRS 709 e-filing gets rejected?

In the event of an e-filing rejection for your IRS 709, review the common rejection codes provided by the IRS to understand the reason. Address the specific issues noted in the rejection message and re-file promptly to avoid any further complications.

Are there specific legal considerations when filing IRS 709 on behalf of someone else?

When filing the IRS 709 on behalf of another individual, ensure you have proper authorization, such as a Power of Attorney. Be aware of the specific responsibilities and liabilities you assume when handling someone else's tax submissions.

What common errors should I avoid when completing my IRS 709 form?

Common mistakes on the IRS 709 include incorrect social security numbers and misreporting gift amounts. Double-check all entries for accuracy and ensure that all required fields are completed before submission to minimize the chances of delays or rejections.

See what our users say