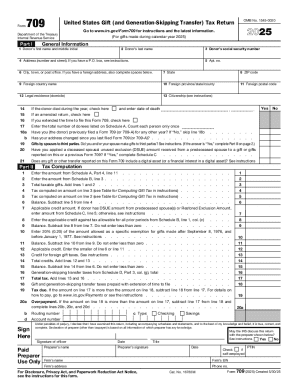

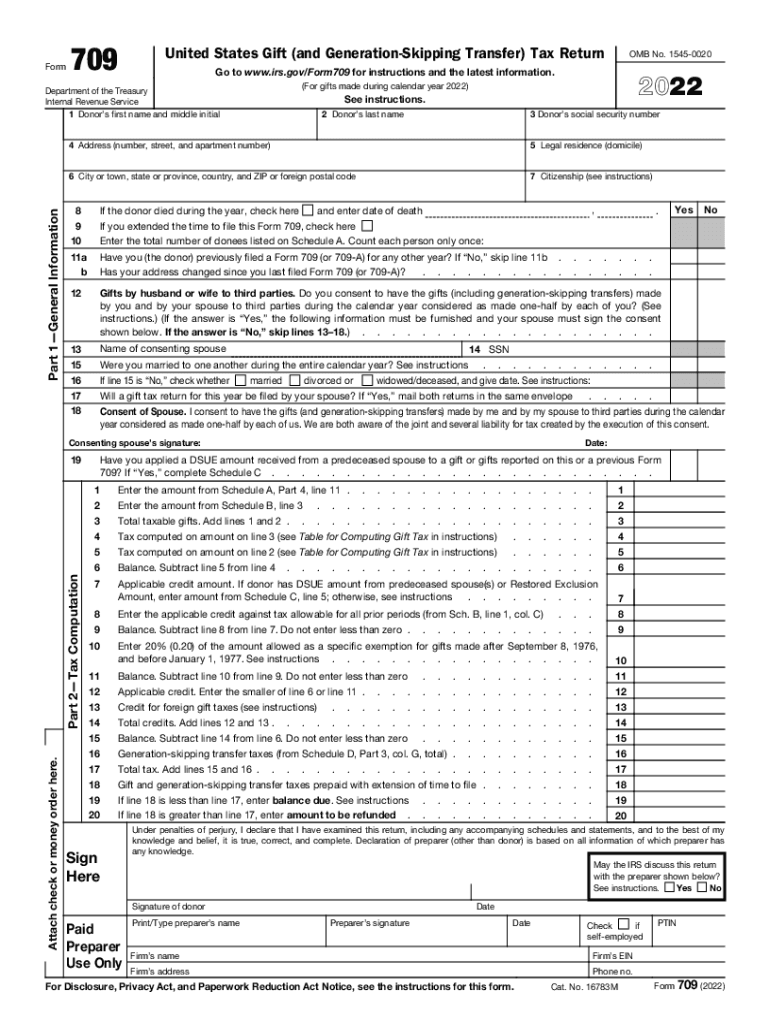

IRS 709 2022 free printable template

Instructions and Help about IRS 709

How to edit IRS 709

How to fill out IRS 709

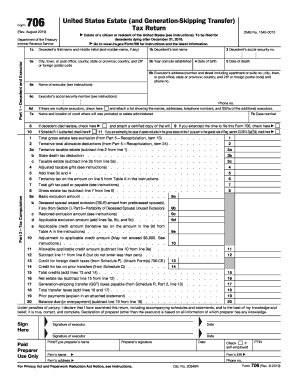

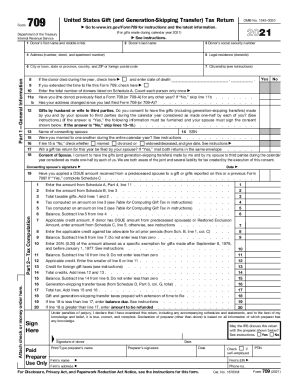

About IRS previous version

What is IRS 709?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 709

What should I do if I need to correct an error on my submitted IRS 709?

If you discover an error after submitting IRS 709, you can file an amended return using the same form. Ensure you clearly indicate the corrections made and label the return as 'Amended' to distinguish it from the original submission. It’s essential to retain copies of all submitted forms and any correspondence for your records.

How can I verify the status of my IRS 709 submission?

To check the status of your IRS 709, you can visit the IRS website and use their online tracking tools, or contact the IRS directly by phone. Keep handy your Social Security number and other identifying information to facilitate your inquiry. It’s crucial to follow up promptly to resolve any potential issues with your filing.

What common errors should I be aware of when filing IRS 709?

Common errors when filing IRS 709 include incorrect taxpayer identification numbers, missing signatories, and improperly reported gifts. To avoid these pitfalls, double-check all information for accuracy and ensure that all necessary fields are filled out completely. A thorough review before submission can help prevent delays or rejections.

Are e-signatures acceptable for filing IRS 709?

E-signatures are not universally accepted for IRS 709 at this time. Be sure to check the latest IRS guidelines and ensure compliance with their electronic submission rules. If e-signatures are not permitted, printed signatures are required to validate the submission of the form.

What should I do if my IRS 709 submission is rejected?

If your IRS 709 is rejected, the IRS will notify you with an explanation of the rejection reason. Take prompt action by addressing the specific issue mentioned and resubmitting the corrected form. If applicable, inquire about any potential service fees associated with the resubmission process.

See what our users say