CO DoR DR 1093 2017 free printable template

Show details

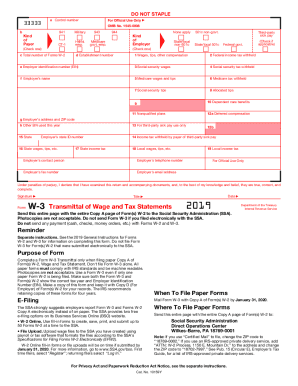

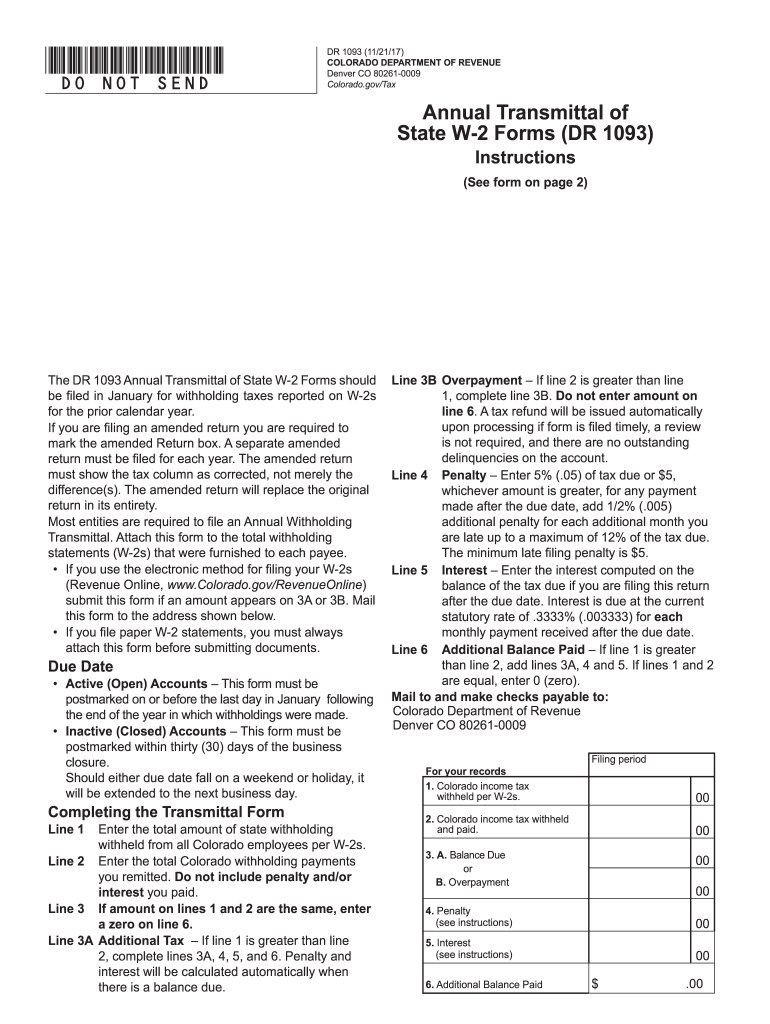

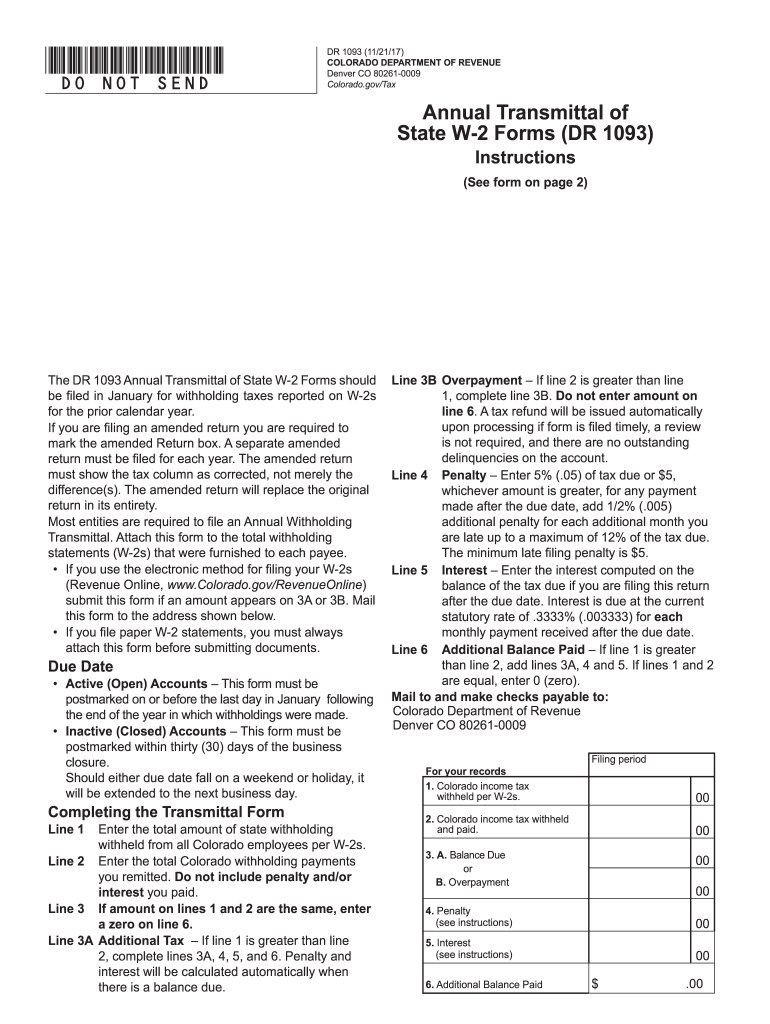

DO NOT SEND DR 1093 11/21/17 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0009 Colorado. gov/Tax Annual Transmittal of State W-2 Forms DR 1093 Instructions See form on page 2 The DR 1093 Annual Transmittal of State W-2 Forms should be filed in January for withholding taxes reported on W-2s for the prior calendar year. If you are filing an amended return you are required to mark the amended Return box. A separate amended return must be filed for each year. The amended return must show the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DoR DR 1093

Edit your CO DoR DR 1093 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DoR DR 1093 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CO DoR DR 1093 online

To use the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CO DoR DR 1093. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DoR DR 1093 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DoR DR 1093

How to fill out CO DoR DR 1093

01

Obtain a copy of the CO DoR DR 1093 form from the official website or office.

02

Read the instructions at the top of the form carefully before beginning.

03

Fill in the applicant's name and address in the designated fields.

04

Provide the necessary identification information, such as the driver's license number or social security number.

05

Indicate the reason for the request clearly and concisely in the specified section.

06

Attach any required documents or evidence supporting the request.

07

Review the filled form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form to the relevant department either via mail or in-person.

Who needs CO DoR DR 1093?

01

Individuals who need to request a copy of their driving record.

02

Employers requiring driving records for employment verification.

03

Insurance companies assessing risk factors for policyholders.

04

Legal entities involved in traffic-related cases.

Fill

form

: Try Risk Free

People Also Ask about

What is a Colorado DR 1093?

Filing Information Employers filing annual wage withholding statements (W-2s) electronically should not also send paper statements to the Department. In addition, the employer filing electronically only needs to complete the Annual Transmittal of State W-2 Form (DR 1093) if paying additional tax or requesting a refund.

What is dr 4709 colorado department of revenue?

The department collects most types of taxes and issues state identification cards and driver licenses and also enforces Colorado laws regarding gaming, liquor, tobacco, racing, auto dealers, and marijuana.

Where do I mail my Colorado extension?

Filing extensions are granted automatically, only return this form if you need to make an additional payment of tax. Return the DR 0158-I with check or money order payable to the “Colorado Department of Revenue”. Mail payments to Colorado Department of Revenue, Denver, Colorado 80261-0008.

How much is Colorado withholding tax?

Coloradans' income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital status.

How do I submit tax withholding?

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

Where do I mail my DR 1093 Colorado?

Mail your Form W2s along with Form DR-1093 to the following address. Colorado Department of Revenue, Denver, CO 80261-0009. Denver, CO 80217-0087.

What is the 2% withholding tax in Colorado?

Colorado 2% Withholding (DR 1083) This law affects non-Colorado residents or those parties moving out-of-state and not purchasing another primary residence. The amount, if withheld, shall be the lesser of 2% of the sales price of the property or the net proceeds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the CO DoR DR 1093 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your CO DoR DR 1093 and you'll be done in minutes.

Can I create an eSignature for the CO DoR DR 1093 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your CO DoR DR 1093 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit CO DoR DR 1093 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing CO DoR DR 1093, you need to install and log in to the app.

What is CO DoR DR 1093?

CO DoR DR 1093 is a form used in Colorado for the purpose of reporting specific financial transactions and information as required by the state's Department of Revenue.

Who is required to file CO DoR DR 1093?

Individuals and businesses engaged in certain financial transactions or activities as specified by the Colorado Department of Revenue are required to file CO DoR DR 1093.

How to fill out CO DoR DR 1093?

To fill out CO DoR DR 1093, gather all necessary financial data, enter the required information accurately in each section of the form, and ensure all calculations are correct before submission.

What is the purpose of CO DoR DR 1093?

The purpose of CO DoR DR 1093 is to provide the state with details on certain financial activities to ensure compliance with state tax laws and regulations.

What information must be reported on CO DoR DR 1093?

The information that must be reported on CO DoR DR 1093 includes details of the financial transaction, identifying information for involved parties, and any relevant financial figures as required by the form.

Fill out your CO DoR DR 1093 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DoR DR 1093 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.