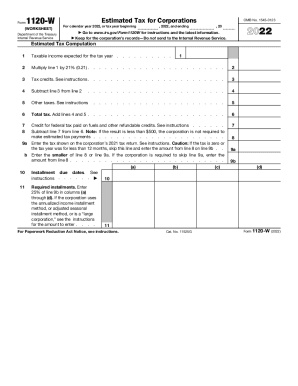

IRS 1120-W 2020 free printable template

Instructions and Help about IRS 1120-W

How to edit IRS 1120-W

How to fill out IRS 1120-W

About IRS 1120-W 2020 previous version

What is IRS 1120-W?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

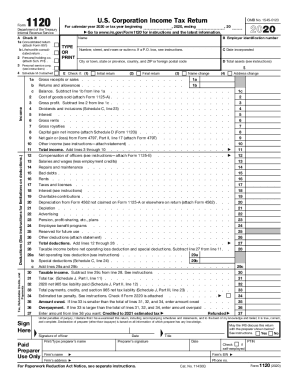

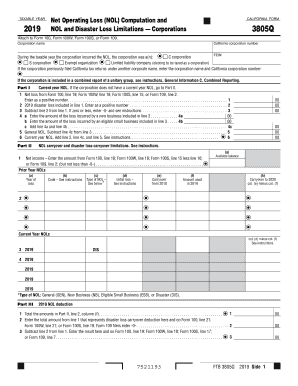

Is the form accompanied by other forms?

FAQ about IRS 1120-W

What should I do if I made a mistake on my IRS 1120-W after submission?

If you realize there is an error on your submitted IRS 1120-W, you can file an amended return. Make sure to correct the errors in the new form and indicate that it is an amendment. It's crucial to submit this as soon as possible to avoid potential penalties.

How can I verify the status of my IRS 1120-W after filing?

To track the status of your IRS 1120-W, you can check through the IRS online portal or call their customer service. Keep in mind that it might take some time before your submission is reflected in the system due to processing times.

What should I do if I receive a notice from the IRS regarding my IRS 1120-W?

If you receive a notice from the IRS concerning your IRS 1120-W, read the notice carefully and follow the instructions provided. It's essential to respond timely with the appropriate documentation to address the concerns raised.

Are there common errors that filers make when submitting the IRS 1120-W?

Yes, many filers commonly forget to review their information for accuracy, leading to mismatches. Additionally, not keeping thorough records can result in errors or omissions, which may complicate the review process.

What are the technical requirements for e-filing the IRS 1120-W?

E-filing the IRS 1120-W requires compatible software that supports e-filing protocols recommended by the IRS. Ensure your internet browser is up to date, and check for any specific guidelines that your e-file software may require.

See what our users say