Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

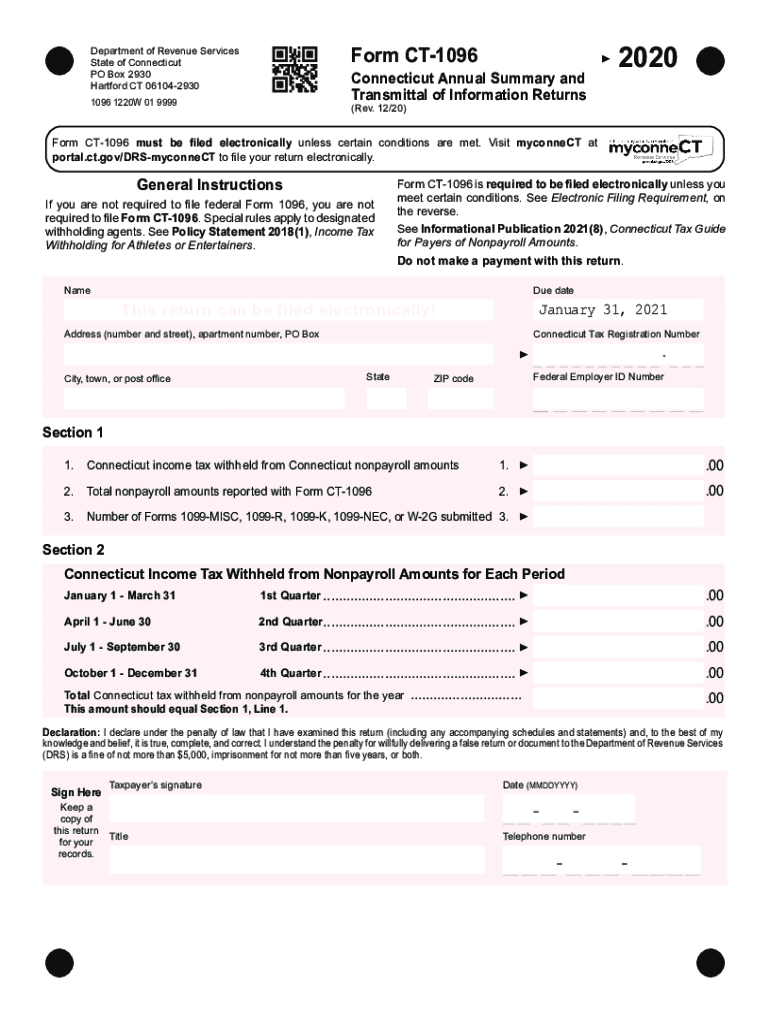

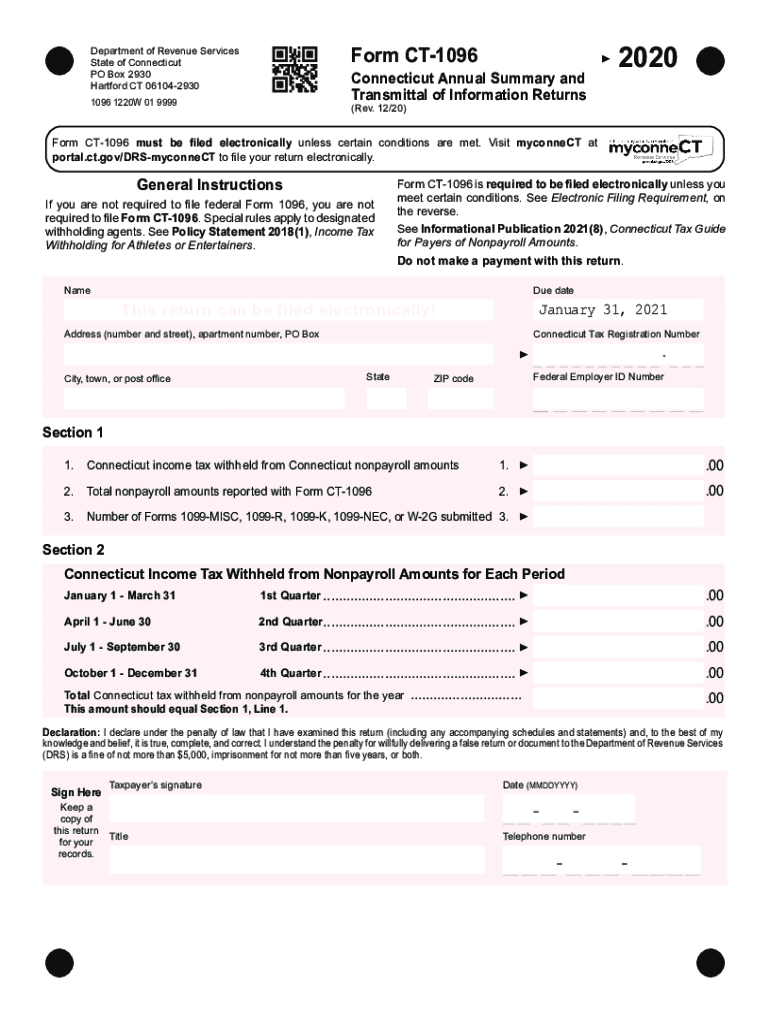

The CT-1096 form is a transmittal form used for the filing of Connecticut Annual Summary and Transmittal of State Income and Information Returns. It is used to transmit copies of various tax forms, such as CT-1099, CT-1096, W-2G, W-2, and others, to the Connecticut Department of Revenue Services. This form summarizes the total number of forms transmitted, along with the total amount of income reported on those forms.

Who is required to file ct 1096 form?

Form CT-1096 is required to be filed by employers who are filing Forms CT-W3, Employer's Annual Reconciliation Wage, and CT-1096, Connecticut Annual Summary and Transmittal of Information Returns, to report Connecticut income tax withheld from non-payroll payments.

How to fill out ct 1096 form?

To fill out the CT 1096 form, follow these steps:

1. Obtain the form: You can download the CT 1096 form from the Connecticut Department of Revenue Services (DRS) website or obtain a copy from your employer or tax advisor.

2. Provide your information: Fill in your name, address, city, state, ZIP code, and Connecticut Tax Registration Number in Section A.

3. Provide recipient/payee information: In Section B, you need to fill in the name, address, and federal identification number (or Social Security Number) of each recipient/payee you made payments to.

4. Enter the total amounts paid: In Section C, you need to enter the total amounts paid to each recipient/payee in the respective boxes. Make sure to include all applicable payments such as salaries, wages, rents, royalties, and other types of income.

5. Calculate the totals: In Section D, calculate and enter the total payments made to all recipients/payees during the tax year.

6. Withholdings: If you withheld Connecticut income tax from any payments, enter the total amount withheld in Section E.

7. Certification and signature: Review the information provided and sign and date the form in Section F. Make a copy of the completed form for your records.

8. Submit the form: Send the original copy of the CT 1096 form to the Connecticut Department of Revenue Services at the address mentioned in the form instructions. Retain a copy for your records.

It is important to note that the instructions for the CT 1096 form may vary depending on the tax year and any updates made by the Connecticut Department of Revenue Services. Therefore, it is recommended to carefully review the official instructions provided with the form before filling it out. If you are unsure or need further assistance, consider consulting a tax professional or contacting the Connecticut Department of Revenue Services directly.

What is the purpose of ct 1096 form?

The purpose of Form CT-1096, also known as Connecticut Annual Summary and Transmittal of Information Returns, is to report the summaries of all information returns (such as Forms W-2, 1099, and CT-1099R) that were filed with the Connecticut Department of Revenue Services (DRS) during the tax year. This form is required for businesses and employers who have submitted information returns to the DRS on behalf of their employees or independent contractors. The form ensures that the DRS has accurate and complete summary information for the filed returns.

What information must be reported on ct 1096 form?

The CT-1096 form, also known as the Connecticut Annual Summary and Transmittal of Information Returns, is used to report information related to certain forms (such as W-2, W-2G, 1099 series, etc.) that were filed with Connecticut State agencies.

The following information must be reported on the CT-1096 form:

1. Name, address, and federal employer identification number (FEIN) of the payer (the entity or business submitting the form).

2. Total number of forms filed (number of forms included in the transmittal).

3. Total amount of Connecticut state income tax withheld, if applicable.

4. Total Connecticut income, if applicable.

5. Total Connecticut income tax withheld, if applicable.

6. Total amount of state wages, pensions, and annuities, if applicable.

7. Total number and amount of state lottery winnings, if applicable.

8. Any other specific information required to properly report and reconcile income tax withholding.

It's important to note that the CT-1096 form is a transmittal form, meaning it is used to send the summarized information for all the related forms filed with the state. The actual forms that contain the detailed information (such as W-2s, 1099s, etc.) do not need to be attached to the CT-1096, but should be kept for record-keeping purposes.

What is the penalty for the late filing of ct 1096 form?

The penalty for the late filing of the CT 1096 form, which is the Connecticut Annual Summary and Transmittal of Information Returns form for certain real estate transactions, is determined by the Connecticut Department of Revenue Services (DRS). As of September 2021, the penalty for late filing is $50 per form, with a maximum penalty of $1,000 per calendar year. However, it is always advisable to check with the DRS or consult a tax professional for the most accurate and up-to-date information regarding penalties.

How can I modify ct 1096 form without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including connecticut income r form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I execute ct 1096 online?

Filling out and eSigning form ct misc is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit form 1096 drs form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign ct misc federal form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.