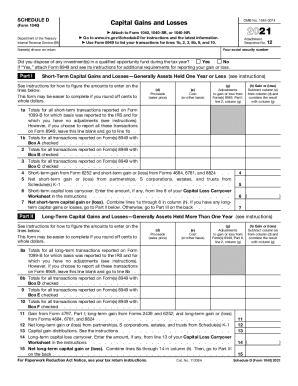

When can you use Schedule D instead of 8949?

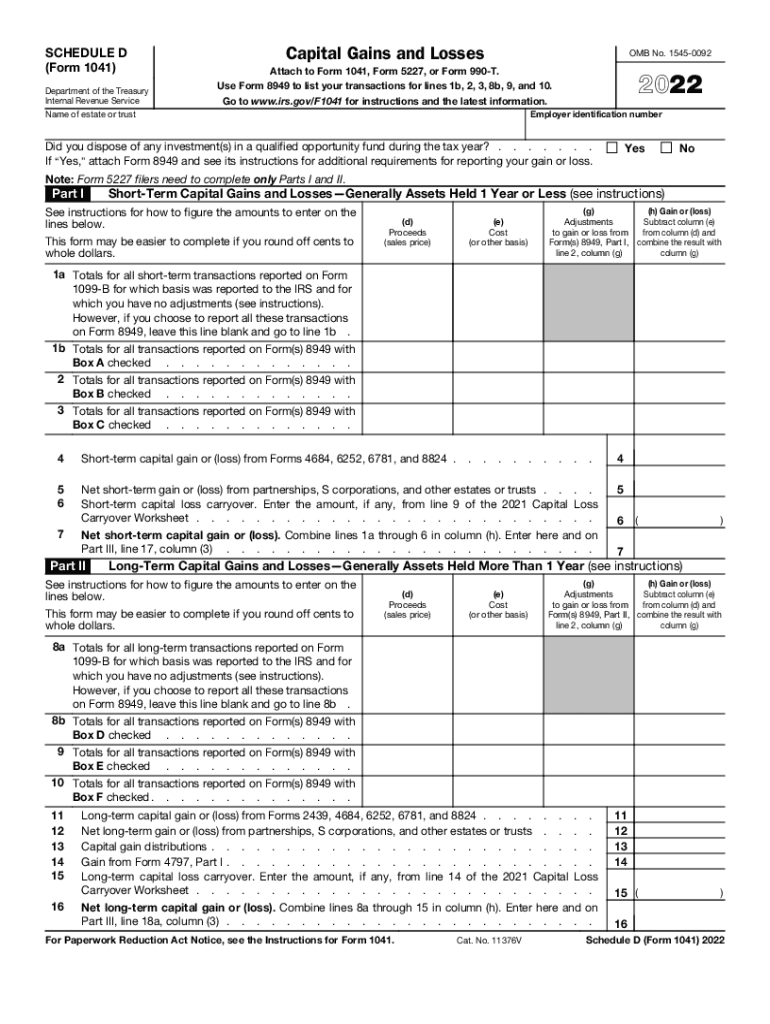

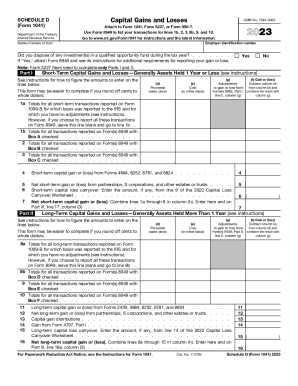

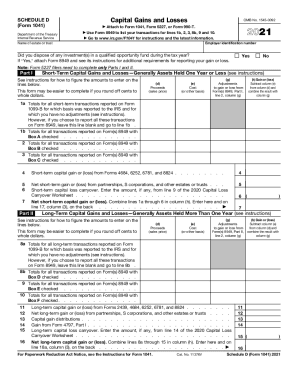

Use Schedule D for the following purposes. To figure the overall gain (or loss) from transactions reported on Form 8949. To report a gain from Form 6252 or Part I of Form 4797. To report a gain (or loss) from Form 4684, 6781, or 8824.

How do I know if Schedule D is required?

You'll have to file a Schedule D form if you realized any capital gains or losses from your investments in taxable accounts. That is, if you sold an asset in a taxable account, you'll need to file. Investments include stocks, ETFs, mutual funds, bonds, options, real estate, futures, cryptocurrency and more.

How do I know if I need to file form 8949?

Anyone who has received one or more Forms 1099-B, Forms 1099-S, or IRS-allowed substitutions should file a Form 8949. You may not need to file Form 8949 if the basis for all of your transactions was reported to the IRS, and if you don't need to make any adjustments to those figures.

Is Schedule D required if form 8949 is Used?

Schedule D of Form 1040 is used to report most capital gain (or loss) transactions. But before you can enter your net gain or loss on Schedule D, you have to complete Form 8949.

Who Needs to File Schedule D: Capital Gains and Losses? In general, taxpayers who have short-term capital gains, short-term capital losses, long-term capital gains, or long-term capital losses must report this information on Schedule D, an IRS form that accompanies form 1040.

Is form 8949 the same as Schedule D?

Use Form 8949 to reconcile amounts that were reported to you and the IRS on Form 1099-B or 1099-S (or substitute statement) with the amounts you report on your return. The subtotals from this form will then be carried over to Schedule D (Form 1040), where gain or loss will be calculated in aggregate.

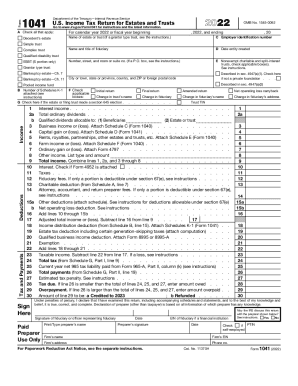

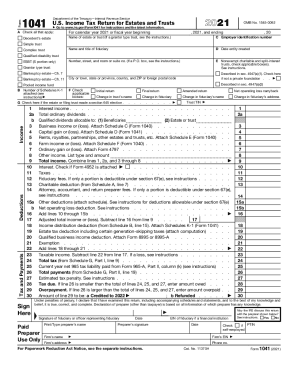

What is an IRS Schedule D?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

Who is exempt from filing Schedule D?

If distributions, line 13, are your only investment items to report, you don't have to fill out Schedule D; they go directly on your 1040 or 1040A return. You also can escape Schedule D if your only capital gain is from the sale of your residence.

Do I need Schedule D or 8949?

Any year that you have to report a capital asset transaction, you'll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Form 8949 requires the details of each capital asset transaction.

You'll have to file a Schedule D form if you realized any capital gains or losses from your investments in taxable accounts. That is, if you sold an asset in a taxable account, you'll need to file. Investments include stocks, ETFs, mutual funds, bonds, options, real estate, futures, cryptocurrency and more.

Can Schedule D be completed without form 8949?

Any year that you have to report a capital asset transaction, you'll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Form 8949 requires the details of each capital asset transaction.

What is the difference between Schedule D and form 8949?

Schedule D is for reporting both long-term (held over one year) and short-term (held for a year or less) gains. It's common to file Form 8949 with Schedule D. Form 8949 is a worksheet for all of the various assets that were sold. Form 8949 is titled Sales and Other Dispositions of Capital Assets.

What is a Schedule D and is it required?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

Who has to file a Schedule D?

Who Needs to File Schedule D: Capital Gains and Losses? In general, taxpayers who have short-term capital gains, short-term capital losses, long-term capital gains, or long-term capital losses must report this information on Schedule D, an IRS form that accompanies form 1040.

Who is required to file a Schedule D?

Who Needs to File Schedule D: Capital Gains and Losses? In general, taxpayers who have short-term capital gains, short-term capital losses, long-term capital gains, or long-term capital losses must report this information on Schedule D, an IRS form that accompanies form 1040.

Anyone who sells or exchanges a capital asset such as stock, land, or artwork must complete Form 8949. Both short-term and long-term transactions must be documented on the form.