Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

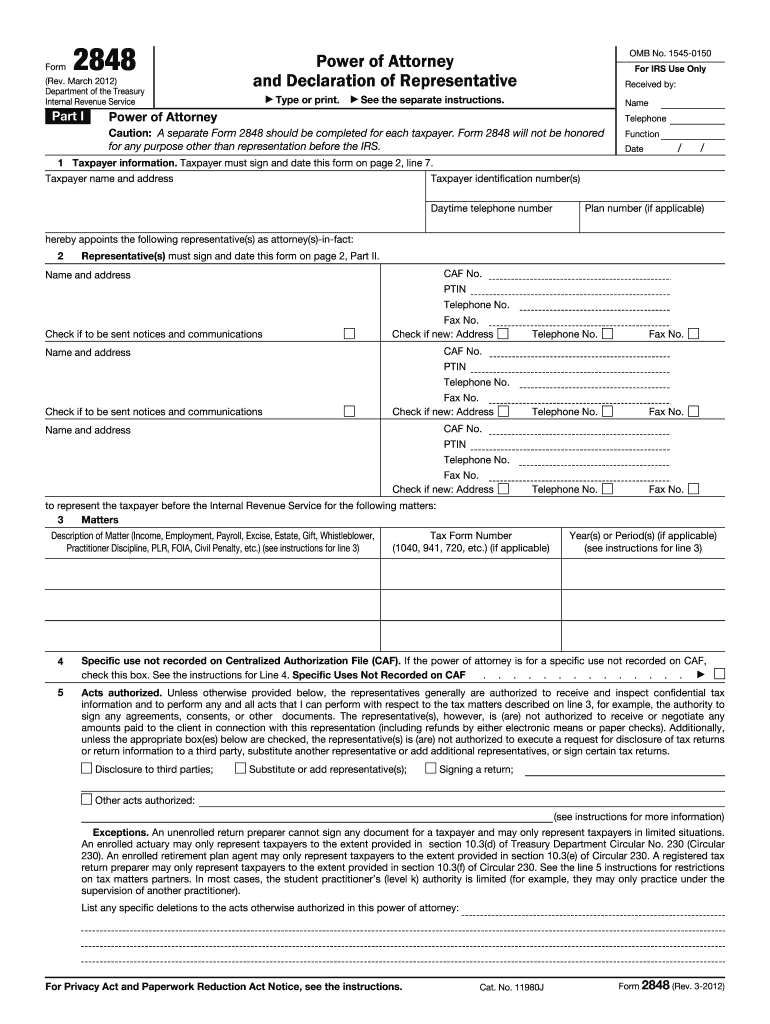

Form 2848, also known as the Power of Attorney and Declaration of Representative, is a document used by taxpayers to authorize an individual or organization to represent them before the Internal Revenue Service (IRS). This form grants the authorized representative the legal right to act on behalf of the taxpayer in tax matters such as tax returns, refunds, and audits. It includes information about both the taxpayer and the representative, and specifies the tax periods and types of taxes for which representation is authorized.

Who is required to file 2848 form?

Form 2848, also known as Power of Attorney and Declaration of Representative, is filed by individuals or entities who want to authorize someone else to represent them before the Internal Revenue Service (IRS). Generally, this form is filed by taxpayers who want to grant power of attorney to an individual, such as a tax professional, to handle their tax matters on their behalf.

How to fill out 2848 form?

To fill out Form 2848, Power of Attorney and Declaration of Representative, follow these steps:

1. Obtain the form: Visit the IRS website (www.irs.gov) and search for "Form 2848" or go directly to the page "https://www.irs.gov/forms-pubs/about-form-2848" to download the form.

2. Ensure eligibility: Confirm that you are authorized to represent the taxpayer. This includes tax professionals, attorneys, certified public accountants, enrolled agents, and individuals who have been given power of attorney (POA) by the taxpayer.

3. Taxpayer information: Fill in the taxpayer's personal information. This includes their name, address, Social Security Number (SSN) or Employer Identification Number (EIN), and primary taxpayer phone number.

4. Representation details: Specify if the power of attorney is being granted for a specific matter or for all tax purposes. Indicate the tax form number(s) related to the power of attorney.

5. Representative information: Provide your own personal information as the representative. This includes your name, address, phone number, and Centralized Authorization File (CAF) numbers, if applicable.

6. Specific tax matters: If the power of attorney is for specific tax matters, identify those matters (such as tax year, form number, and description).

7. Exceptions and restrictions: If there are any limitations or specific acts that you are not authorized to perform, state them on the form.

8. Signature: Both the taxpayer and the representative must sign and date the Form 2848.

9. Submit the form: Send the completed and signed Form 2848 to the appropriate IRS address, as specified on the form instructions.

10. Retention: Keep a copy of the filled form for your records and provide a copy to the taxpayer.

Note: It is recommended to review the detailed instructions provided with Form 2848 to ensure accuracy and compliance with the IRS requirements. Additionally, if you have any doubts or complex situations, it is advisable to consult a tax professional or IRS representative for guidance.

What is the purpose of 2848 form?

Form 2848, also known as the Power of Attorney and Declaration of Representative, is a document used by individuals or entities to authorize another person (referred to as a representative or agent) to act on their behalf in tax matters before the Internal Revenue Service (IRS) in the United States.

This form is typically used to grant authority to the representative for tasks such as filing tax returns, signing documents on behalf of the taxpayer, providing information to the IRS, and communicating with the IRS regarding tax issues, audits, or appeals. It allows the representative to represent the taxpayer with the IRS and to handle various tax matters efficiently.

What information must be reported on 2848 form?

The 2848 form, also known as the Power of Attorney and Declaration of Representative form, is used to authorize a person or organization to act on behalf of a taxpayer in matters related to their tax affairs. When completing the form, the following information must be reported:

1. Taxpayer Information:

- Taxpayer's name, address, and Social Security Number (SSN) or Employer Identification Number (EIN).

- Taxpayer's daytime telephone number.

- Taxpayer's representative's name, address, SSN/EIN, and phone number.

2. Tax Matters:

- Type of tax (e.g., income tax, employment tax, estate tax) for which representation is being authorized.

- Tax periods or years involved.

- Description of the specific matters the representative is authorized to act upon (e.g., prepare and sign tax returns, receive and inspect confidential tax information, represent the taxpayer in audits or appeals).

3. Signature and Declaration:

- The taxpayer's signature and date.

- If the taxpayer is physically unable to sign the form, the representative should provide additional information to explain why they are signing on behalf of the taxpayer.

It is important to ensure accuracy and completeness when filling out the form to avoid any issues or delays in granting the authorization. The form can be submitted to the Internal Revenue Service (IRS) via mail or fax.

When is the deadline to file 2848 form in 2023?

The deadline to file Form 2848 in 2023 will depend on the specific circumstances and the purpose for filing the form. Form 2848, also known as the Power of Attorney and Declaration of Representative, is used to authorize someone to act on your behalf for tax matters with the Internal Revenue Service (IRS).

If you are appointing a representative to handle your federal tax matters, the form generally needs to be submitted before the representative can take any action on your behalf. In this case, it is recommended to file Form 2848 as soon as possible to ensure your representative has the necessary authority.

However, if you are seeking to file Form 2848 in relation to a specific tax return or tax issue, the deadline will depend on the specific due date of that particular return or issue. For example, if you need representation for a federal income tax return for the tax year 2022, the due date will generally be April 15, 2023 (unless extended). Therefore, it is advisable to submit Form 2848 before that deadline to ensure your representative can act on your behalf.

It's always a good idea to consult with a tax professional or the IRS to determine the specific deadline and requirements for filing Form 2848 based on your individual circumstances.

What is the penalty for the late filing of 2848 form?

The penalty for the late filing of Form 2848, also known as the Power of Attorney and Declaration of Representative form, is not specified within the form's instructions or the Internal Revenue Code. However, the Internal Revenue Service (IRS) may still impose penalties for failing to file the form on time, especially if it leads to delays in resolving tax issues or representing the taxpayer before the IRS. These penalties may vary based on the specific circumstances and may be assessed on a case-by-case basis. It is recommended to consult the IRS or a tax professional for the most accurate and up-to-date information regarding penalties for late filing of Form 2848.

Can I create an electronic signature for the 2848 form 2012 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 2848 form 2012 in minutes.

How do I edit 2848 form 2012 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing 2848 form 2012 right away.

Can I edit 2848 form 2012 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share 2848 form 2012 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.