Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

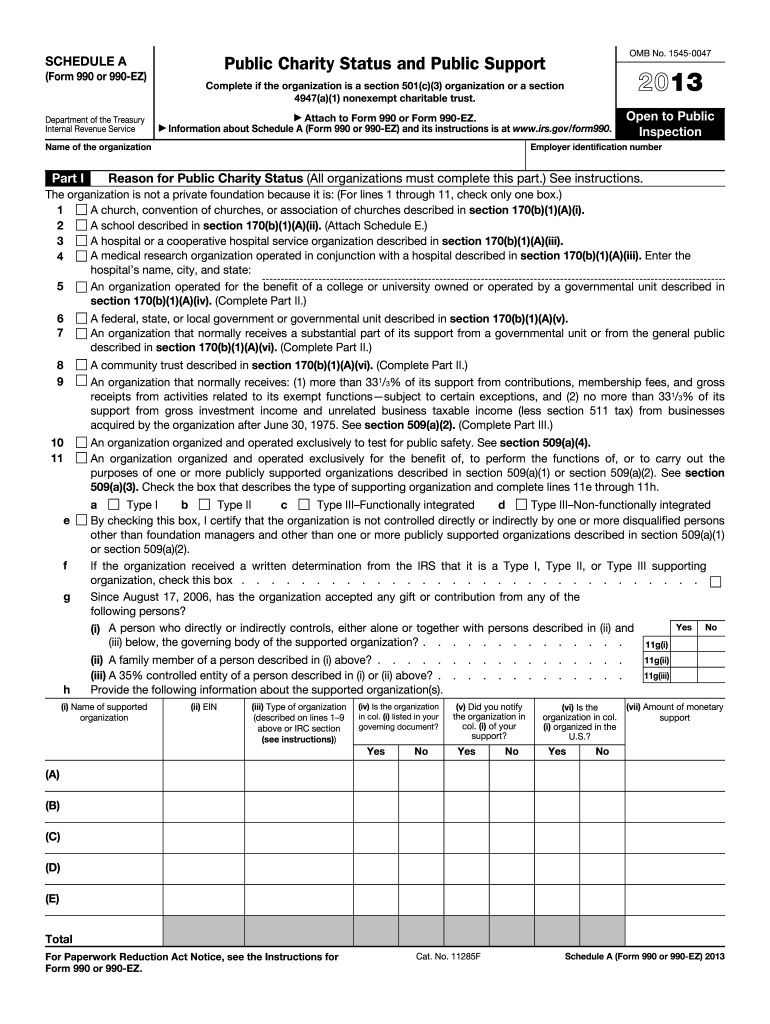

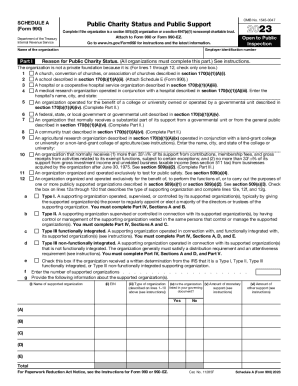

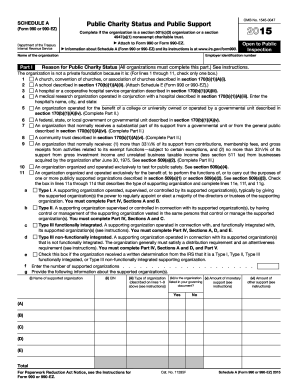

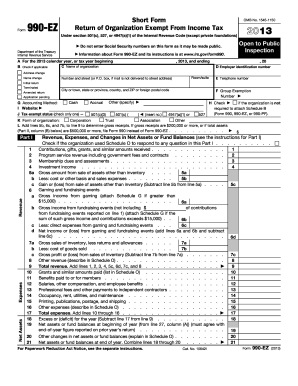

The 990-EZ form is a shorter version of the Internal Revenue Service (IRS) Form 990, which is used by tax-exempt organizations to report their financial information. The 990-EZ is specifically designed for organizations with gross receipts less than $200,000 and total assets less than $500,000. It requires less detailed financial information compared to the full Form 990, but still offers transparency into an organization's revenue, expenses, assets, and activities.

Who is required to file 990 ez form?

Nonprofit organizations with gross receipts less than $200,000 and total assets less than $500,000 are required to file Form 990-EZ with the Internal Revenue Service (IRS).

How to fill out 990 ez form?

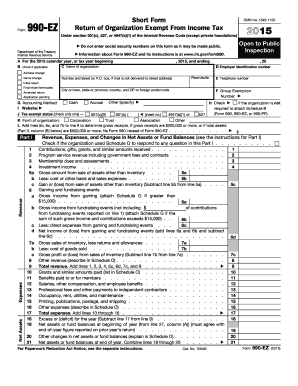

Filling out a Form 990-EZ, also known as the Short Form Return of Organization Exempt from Income Tax, requires attention to detail and accurate information about your organization's finances. Here is a step-by-step guide to help you fill out the form properly:

1. Gather necessary documents: Collect all relevant financial statements, receipts, bank statements, and other supporting documents needed to complete the form.

2. Provide basic information: Enter your organization's name, address, Employer Identification Number (EIN), and the tax year you are filing for at the top of the form.

3. Complete Part I - Revenue, Expenses, and Changes in Net Assets or Fund Balances:

- Lines 1-14: Report your organization's revenue and expenses across various categories. Fill in the appropriate amounts based on your financial statements.

- Lines 15-22: Indicate any changes in your net assets or fund balances during the tax year, such as contributions, distributions, or losses.

4. Complete Part II - Balance Sheets:

- Lines 23-30: Provide the opening and closing balances for each category mentioned in the form, including cash, investments, accounts payable, and more. Use your financial statements to determine these amounts accurately.

5. Complete Part III - Statement of Program Service Accomplishments:

- Lines 31-34: Describe the mission or purpose of your organization and provide a brief narrative on the significant activities and achievements during the tax year.

6. Complete Schedule O (Supplemental Information):

- Use this schedule to disclose additional details about your organization's activities, compensation of key employees, or any other required explanations.

7. Review and sign the form:

- Double-check all the information you have entered for accuracy and ensure you have attached all necessary schedules and documents.

- The form must be signed by an authorized individual, such as the president, vice president, treasurer, or other responsible officer of the organization.

8. Submit the form:

- Retain a copy of the completed form and supporting documents for your records.

- Mail the form to the appropriate IRS address or file electronically using the IRS e-file system, if eligible.

Remember, it's advisable to consult a tax professional or seek assistance from the IRS if you have any doubts or questions while filling out the Form 990-EZ.

What is the purpose of 990 ez form?

The purpose of Form 990-EZ is to provide the Internal Revenue Service (IRS) with financial information about tax-exempt organizations that have gross receipts below a certain threshold, which currently stands at $200,000 or total assets less than $500,000. This form is used by smaller tax-exempt organizations to report their annual information, including income, expenses, assets, and activities. The data collected on Form 990-EZ is used to ensure compliance with tax laws and to provide transparency and accountability for these organizations to the public.

What information must be reported on 990 ez form?

The 990-EZ form, also known as the Short Form Return of Organization Exempt from Income Tax, is a simplified version of the longer 990 form that certain tax-exempt organizations need to file with the Internal Revenue Service (IRS). The specific information that must be reported on the 990-EZ form includes:

1. Identification of the organization: This includes details such as the name, address, employer identification number (EIN), and the fiscal year-end of the organization.

2. Organizational structure: Information about the type of organization (e.g., corporation, trust, association) and details about the formation, dissolution, and changes in the structure of the organization.

3. Officers, directors, and key employees: The names, titles, and compensation of the organization's officers, directors, and the highest compensated employees are reported here.

4. Program service accomplishments: A description of the organization's mission, major program activities, and specific accomplishments during the year.

5. Revenue and expenses: Detailed reporting of the organization's revenue, including types of income (e.g., contributions, program service revenue, investment revenue), and expenses, such as salaries, grants, fundraising costs, and various other operational expenses.

6. Balance sheet: Reporting of assets, liabilities, and net assets (the organization's financial position) at the beginning and end of the tax year.

7. Supplemental financial information: Certain types of organizations may need to report additional financial information, such as revenue from specific government grants or contracts, statements pertaining to fundraising events, and non-cash contributions.

8. Public support: If applicable, reporting of the organization's public support to determine whether it qualifies as a publicly supported organization.

9. Compliance with tax-exempt requirements: Verification that the organization satisfies the relevant tax-exempt requirements and doesn't engage in prohibited activities.

It's important to note that the specific requirements may vary based on the organization's size, annual gross receipts, and other factors. Nonprofit organizations should consult the official IRS instructions and seek professional assistance to ensure accurate completion of the 990-EZ form.

When is the deadline to file 990 ez form in 2023?

The deadline to file Form 990-EZ in 2023 would be the 15th day of the fifth month following the close of the organization's fiscal year-end. Typically, if the fiscal year-end is December 31st, the deadline to file Form 990-EZ would be May 15th, 2023. However, it's always advisable to consult the official IRS website or a tax professional for specific and up-to-date information regarding deadlines and requirements.

What is the penalty for the late filing of 990 ez form?

The penalty for late filing of Form 990-EZ is calculated on a per-day basis, starting from the due date of the return. As of 2021, the penalty is $20 per day, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is smaller. Additionally, if the organization has gross receipts of over $1 million, the penalty increases to $100 per day, up to a maximum of $50,000. It's important to note that if an organization has a reasonable cause for the delay and provides a proper explanation, the IRS may waive the penalty.

How do I make edits in 2013 990 ez form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing 2013 990 ez form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out the 2013 990 ez form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 2013 990 ez form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete 2013 990 ez form on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 2013 990 ez form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.