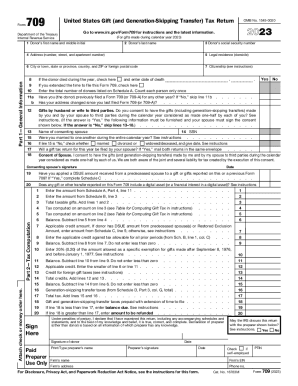

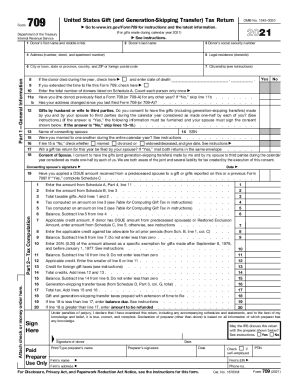

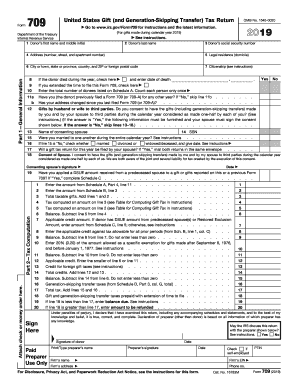

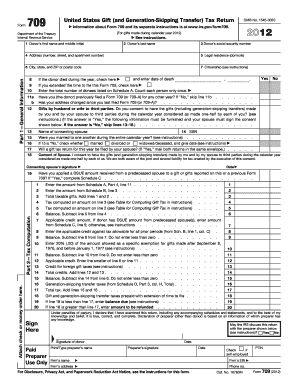

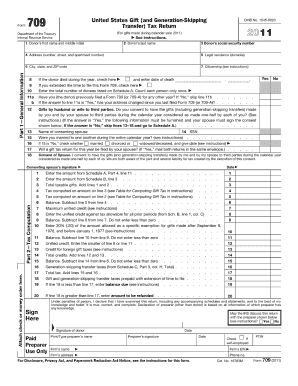

What is the IRS Form 709?

IRS Form 709 calculates gift taxes and reports this amount to the Internal Revenue Service since some gifts, donations, or transfers are subject to taxation. The record also calculates taxes on generation-skipping transfers (GSTs). The taxpayer who gave the gift must pay the tax on it. The gift receiver may also be required to pay taxations on it.

Who should file Form 709 2013?

Submit IRS Form 709 in the following situations:

- If the individual gave a gift valued greater than $15,000 to someone (other than their spouse) during the tax year

- If the individual gave gifts as future interests in any dollar amount (even if they do not exceed $15,000).

- If the individual is a part of a trust, estate, partnership, or corporation that gave gifts.

Keep in mind the person responsible for paying taxes is a donor. Nevertheless, if a donor does not pay the tax, the donee may have to pay it.

Please note that gifts made to political organizations, educational institutions, and medical institutions are not subject to gift taxes.

What information should be provided in IRS Form 709?

The filer must add the information about the donor and fill out all the attached schedules. Follow the instructions in the document to compute the amount of taxes due.

How do I fill out Form 709 in 2014?

The template is pretty long. In addition to the one-page record, filers should fill out the attached Schedules (A-D). Follow the guidelines below to accelerate the filling process with pdfFiller:

- Open the template in the online filler – click Get Form.

- Provide the required general information in Part 1.

- Indicate taxable gifts, taxes, and credits in Part 2.

- Review the page to determine what Schedules to attach.

- Fill out the required Schedules.

- Double-check the document.

- Click Done at the bottom of the template or in the top-right corner.

- Insert the data of the file preparation.

- Get the record in your preferred way: save it to your device, print it out, transfer it to the cloud, or send it by email.

Is Form 709 accompanied by other forms?

Typically this document is sent with a taxpayer’s annual individual tax return. The donor should also attach other supporting documents if required.

When is Form 709 due?

File the record between the 1st of January and the 15th of April of the year after the gift was made.

Where do I send the document after its completion?

Forward the completed and signed record to the Department of the Treasury Internal Revenue Service Center Cincinnati, OH 45999.