Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

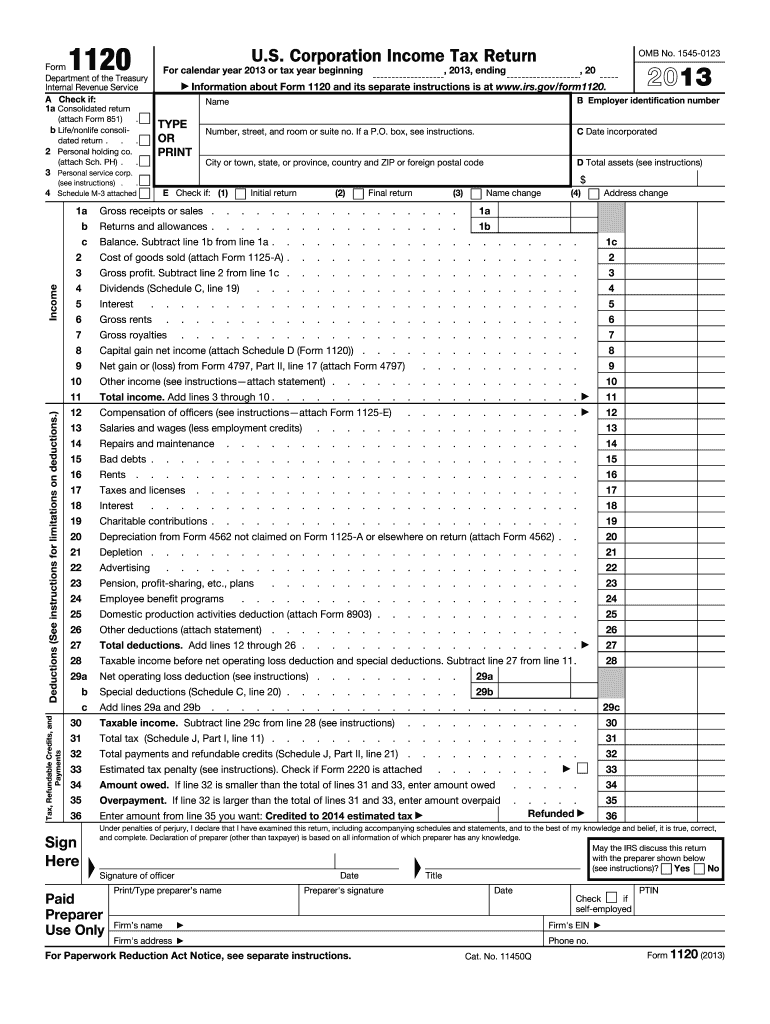

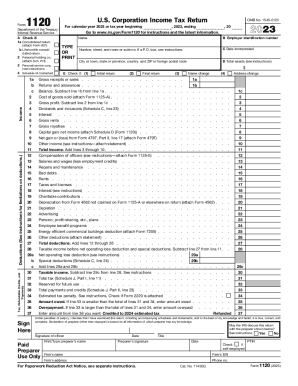

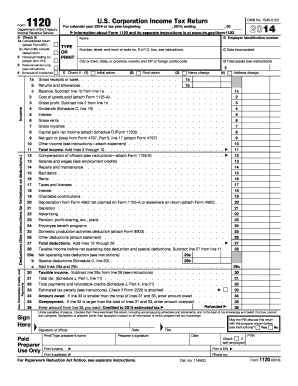

Form 1120 is a U.S. corporate income tax return form. It is used by C corporations, which are separate legal entities that are taxed separately from their owners. The form is used to report the corporation's income, deductions, gains, losses, credits, and other information for the purpose of calculating and paying federal income taxes.

Who is required to file form 1120?

Form 1120 must be filed by a U.S. corporation or other entity that is subject to corporate income tax. This includes domestic corporations, certain foreign corporations engaged in a U.S. trade or business, and certain tax-exempt organizations.

How to fill out form 1120?

Filling out a form 1120 (U.S. Corporation Income Tax Return) can be a complex process, and it is recommended to seek the assistance of a tax professional to ensure accuracy and comply with tax regulations. However, here is a general guide on how to fill out form 1120:

1. Gather necessary information: Collect all the necessary financial records, including income statements, balance sheets, and any other required documents such as depreciation schedules, deductions, and capital gains/losses information.

2. Provide general information: Enter the corporation's name, address, Employer Identification Number (EIN), fiscal year, and business activity code on the top of the form.

3. Complete Schedule A: This schedule requires the corporation to report its income, deductions, and tax liability. It includes sections such as gross receipts, cost of goods sold, and business expenses. Calculate the totals and transfer them to the respective fields on the form 1120.

4. Complete Schedule B: This schedule is used to reconcile the corporation's taxable income reported in Schedule A with the taxable income reported on the corporation's financial statements. Fill in the necessary details, such as differences in depreciation, interest expenses, charitable contributions, and net operating loss.

5. Complete Schedule D: If the corporation had any capital gains or losses during the tax year, they must be reported on Schedule D.

6. Complete Schedule G: This schedule is used to report any tax credits or payments made throughout the year, such as estimated taxes, prior-year overpayments, and refundable credits.

7. Complete Schedule M-1: This schedule reconciles the corporation's book income with its taxable income by reporting any differences or adjustments made between financial statement net income and taxable income.

8. Complete any additional schedules or forms as required: Certain corporations with unique circumstances may need to complete additional schedules or forms, such as Schedule K, Schedule L, or Form 4626 (Alternative Minimum Tax).

9. Complete the signature section: Ensure that the form is signed and dated by the authorized person.

10. Submit the form: Make a copy of the completed form 1120 for records and mail it to the appropriate IRS address mentioned in the instructions or file it electronically if applicable.

Remember, this is a general guide, and it is strongly recommended to consult a tax professional or refer to the official IRS forms and instructions for the most accurate guidance on how to fill out form 1120.

What is the purpose of form 1120?

Form 1120 is a tax return form used by corporations in the United States to report their income, deductions, and tax liabilities. The purpose of Form 1120 is to determine the corporation's tax liability and report it to the Internal Revenue Service (IRS). It includes information on the corporation's income, expenses, assets, liabilities, and shareholder information. The form must be filed annually by corporations to fulfill their tax obligations.

What information must be reported on form 1120?

Form 1120 is used to report the income, deductions, gains, losses, and other information of a corporation for a specific tax year. The following information must be reported on Form 1120:

1. Business Information:

- Name and address of the corporation

- Employer Identification Number (EIN)

- Date of incorporation

- Principal business activity

2. Income:

- Gross receipts or sales from business operations

- Cost of goods sold

- Gross profit

- Other income sources, such as interest, dividends, or rental income

3. Deductions:

- Cost of goods sold

- Business expenses, including wages, rent, utilities, insurance, advertising, and professional fees

- Depreciation and amortization expenses

- Bad debts

- Taxes paid or accrued (excluding income taxes)

- Charitable contributions

- Net operating loss deduction

- Other deductions related to the corporation's business operations

4. Credits:

- General business credits, such as the research and development credit, investment credit, or energy-related credits

- Foreign tax credits

- Credit for small employer pension plan startup costs

- Any other credits the corporation may qualify for

5. Tax and Payments:

- Calculation of regular corporate income tax based on taxable income

- Estimated tax payments made throughout the year

- Overpayment of previous year's taxes or any refund due

6. Other Information:

- List of shareholders or partners (with their ownership percentages) if applicable

- Detailed information about any foreign activities, including controlled foreign corporations, foreign disregarded entities, or foreign partnerships

- Disclosure of any potential tax avoidance transactions or reportable transactions

These are the main categories of information that must be reported on Form 1120. However, it is important to review the specific instructions provided by the Internal Revenue Service (IRS) each year to ensure compliance with any changes or additional reporting requirements.

When is the deadline to file form 1120 in 2023?

The deadline to file Form 1120 for the tax year 2023 is March 15, 2024. However, if the corporation has a fiscal year ending on a date other than December 31, the filing deadline may vary.

What is the penalty for the late filing of form 1120?

The penalty for late filing of Form 1120, which is the U.S. Corporation Income Tax Return, can vary depending on the size of the corporation.

For corporations with annual gross receipts of more than $1 million, the penalty is generally $195 for each month or part of a month that the return is late, up to a maximum penalty of 12 months.

For corporations with annual gross receipts of $1 million or less, the penalty is generally $205 for each month or part of a month that the return is late, up to a maximum penalty of 12 months.

However, if the corporation fails to file the return within 60 days of the due date (including extensions), the minimum penalty is the lesser of $435 or 100% of the unpaid tax.

It is worth noting that the penalty applies to the net amount due, which is the tax owed after subtracting any payments and credits. Additionally, reasonable cause exceptions or extensions may be granted in certain circumstances, but these are subject to IRS approval.

How can I get form 1120 2013?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the form 1120 2013 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit form 1120 2013 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your form 1120 2013 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit form 1120 2013 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your form 1120 2013, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.