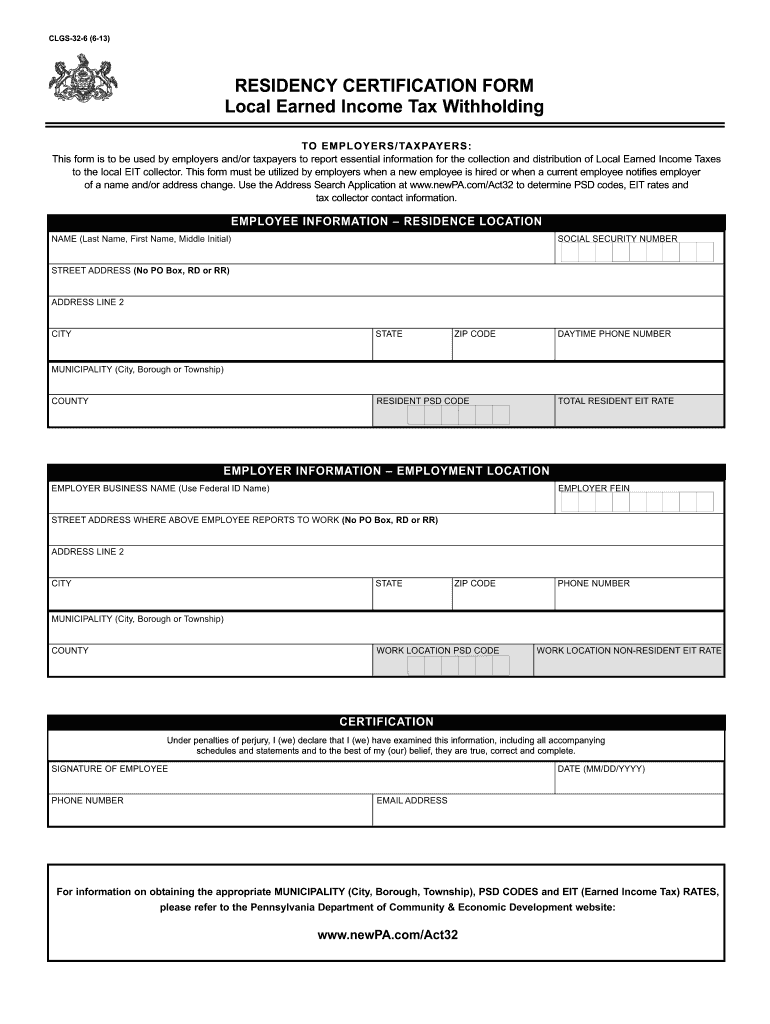

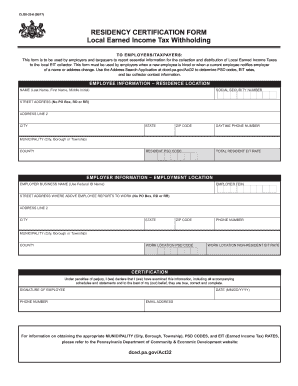

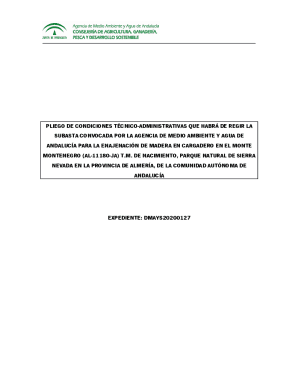

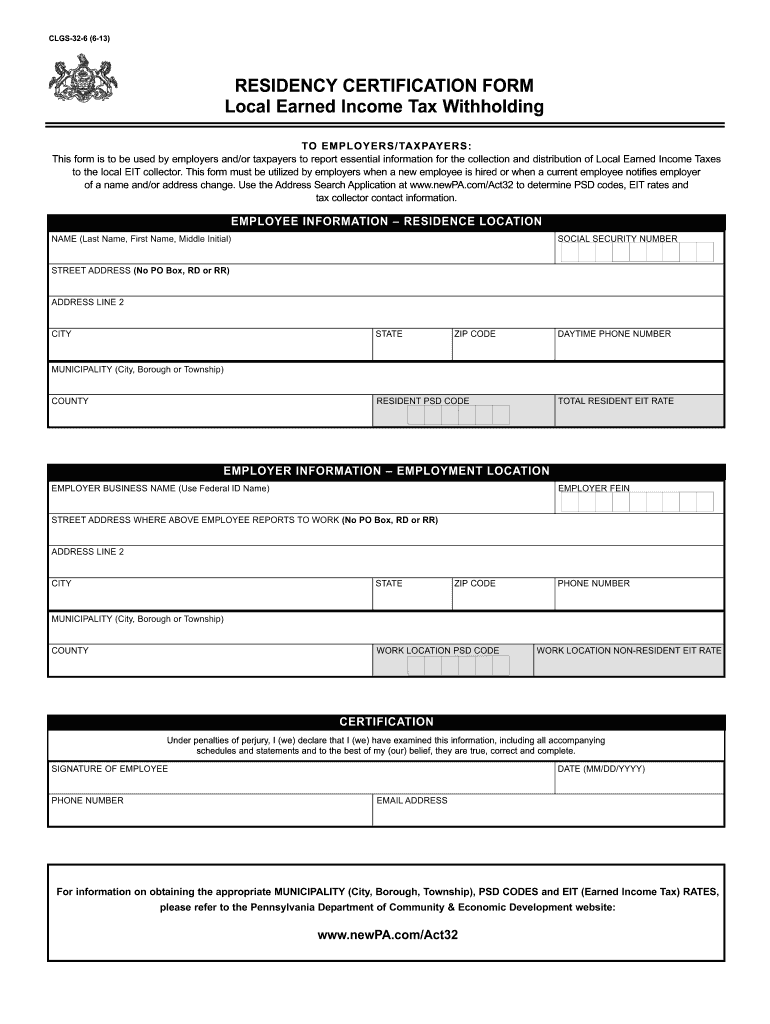

PA DCED CLGS-32-6 2013 free printable template

Get, Create, Make and Sign

Editing clgs 32 6 online

PA DCED CLGS-32-6 Form Versions

Video instructions and help with filling out and completing clgs 32 6

Instructions and Help about pa certificate of residence form

Hi I'm Teresa and I work for the Internal Revenue Service are you an individual corporation or other entity that needs verification of your US residency for tax purposes if so here are some tips to help you fill out form 8802 which is the US residency certification application if your application is approved the IRS will send you a certification letter that you can use to claim benefits under a tax treaty with a foreign country such as reduced withholding on income you receive from that country this letter can also help you if you are claiming exemption from a value-added tax imposed by a foreign country, but before we get started you may want to know when to apply for certification in general you should mail or fax your application at least 45 days before you need certification requests for future years may not be postmarked or faxed earlier than December 1st of the current year there's a non-refundable user fee of $85 which you can pay by check or money order or electronically this fee is charged for each form 8802 regardless of the number of certifications requested if you're submitting a foreign claim form it must be accompanied by form 8802 and the user fee there are no exceptions please contact us to determine which forms we will certify now let's get started with filling out form a VA Oh — just above the beginning of the numbered sections enter your name and taxpayer identification number also known as a 10 this is the name and ten of the individual corporation or other entity requiring certification the identification number can be a social security number or employer identification number to certify us residency the IRS must match the name and ten on the residency application to the name and tint previously verified on a US tax return filed for the year certification is being requested we can also do this through other documents you provide us such as a tax determination letter Articles of Incorporation etc if your name has changed since the most recent filing of the form 8802 with the IRS you should submit a new form 8802 for each individual or entity using the new name in addition you must submit documentation of the name change such as a trust agreement corporate charter or marriage license with the form for more information on how to update us with your new name contact our customer service numbers businesses should call 808 two nine four nine three that's eight hundred eight to nine four nine three individuals should call one eight hundred eight to nine 1040 that's one eight hundred eight to nine one zero four zero remember if the certification request is for a husband and wife and if each will need a separate certification check the box labeled four separate certification now let's go to line five it asks if you were required to file a tax form for the tax periods for which the certification will be based if you did the answer is yes and just check the box for the form that was filed if the answer is no then look at table one in...

Fill pa tax residency form : Try Risk Free

People Also Ask about clgs 32 6

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your clgs 32 6 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.