Pa State Withholding Form

What is pa state withholding form?

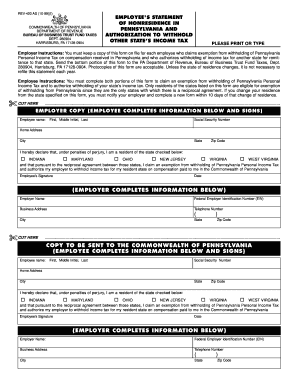

The PA State Withholding Form is a document used by employers in the state of Pennsylvania to withhold income taxes from their employees' wages. This form ensures that the appropriate amount of state income tax is withheld from employees' paychecks, which will be remitted to the Pennsylvania Department of Revenue.

What are the types of pa state withholding form?

There are several types of PA State Withholding Forms, each designed for a specific purpose. These forms include:

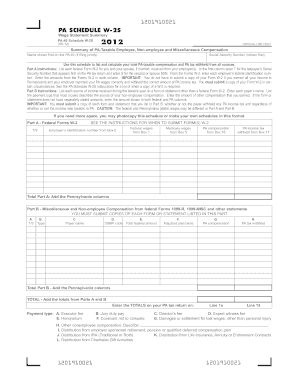

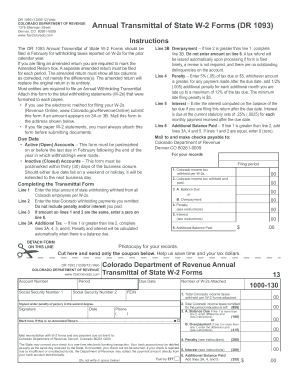

PA W-2 Form - This form is used by employers to report employees' wages and the amount of state income tax withheld throughout the year.

PA W-3 Form - Employers use this form to summarize the information from all the PA W-2 forms they have filed.

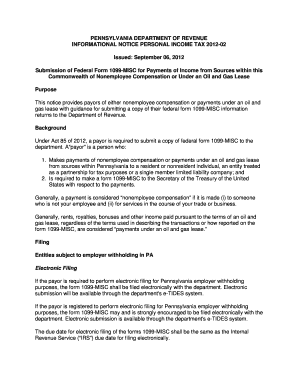

PA-UE Form - This form is used to report unemployment compensation paid to employees and the amount of state income tax withheld from those payments.

How to complete pa state withholding form?

Completing the PA State Withholding Form is a straightforward process. Here are the steps to follow:

01

Obtain the official PA State Withholding Form from the Pennsylvania Department of Revenue website or from your employer.

02

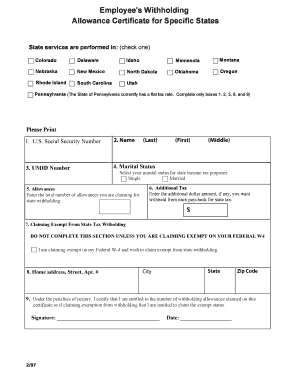

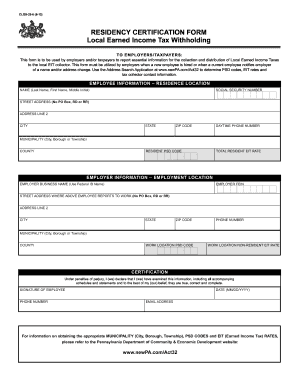

Provide your personal information, such as your name, social security number, and contact details.

03

Fill in your employer's information, including their name, address, and employer identification number.

04

Indicate your filing status and the number of exemptions you are claiming.

05

Calculate your taxable wages and determine the appropriate amount to withhold based on the PA withholding tax tables.

06

Sign and date the form, certifying that the information provided is accurate and complete.

07

Submit the completed form to your employer, who will then withhold the specified amount from your wages and remit it to the Pennsylvania Department of Revenue.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the withholding rate for PA?

Current Tax Rates TaxRatePA Sales, Use and Hotel Occupancy Tax6 percentLocal Sales Tax1 percent for Allegheny County 2 percent for PhiladelphiaCigarette Tax$2.60 per pack of 20 cigarettes/little cigars ($0.13 per stick)Malt Beverage TaxSee Malt Beverage Tax Rate Table31 more rows

How should I set my withholding?

Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.

What is the PA withholding tax rate for 2022?

Visit mypath.pa.gov to file your return. Pennsylvania personal income tax is levied at the rate of 3.07 percent against taxable income of resident and nonresident individuals, estates, trusts, partnerships, S corporations, business trusts and limited liability companies not federally taxed as corporations.

Do I claim 0 or 1 on my w4 2022?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

Do I claim 0 or 1 on my w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

What is the PA withholding tax for 2022?

The Pennsylvania individual income tax withholding rate remains at 3.07% for 2022.

Related templates