NY DTF ST-120 2011 free printable template

Show details

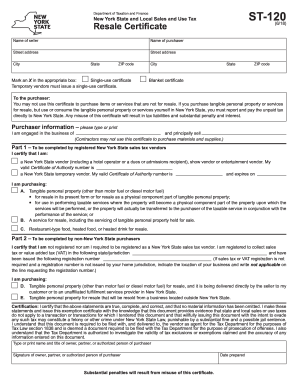

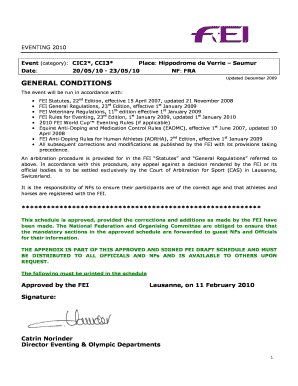

New York State Department of Taxation and Finance New York State and Local Sales and Use Tax Resale Certificate Name of seller Street address City State ZIP code ST-120 (1/11) Name of purchaser Street

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your st 120 2011 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 120 2011 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 120 2011 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit st 120 2011 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

NY DTF ST-120 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out st 120 2011 form

01

To fill out the st 120 2011 form, you will need to gather all the necessary information and documents required for the form. This may include details about your business, such as name, address, and employer identification number (EIN).

02

The form requires you to provide information about your sales and use tax activities. You will need to accurately report your taxable sales, exempt sales, and any other relevant transactions during the reporting period.

03

The st 120 2011 form also requires you to calculate the amount of sales tax due for the reporting period. This is usually done by multiplying the taxable sales by the applicable sales tax rate.

04

It is important to ensure that all the information provided on the form is accurate and properly filled out. Any mistakes or omissions could lead to potential errors or delays in processing your tax obligations.

05

Once you have completed filling out the st 120 2011 form, make sure to review it thoroughly before submitting it. Double-check all the details and calculations to ensure accuracy.

Who needs st 120 2011 form:

01

Businesses that are registered to collect and remit sales and use taxes in the state where the st 120 2011 form is applicable will need to fill out this form. It is a requirement for reporting their taxable sales and submitting the corresponding sales tax amount due to the state tax authorities.

02

Retailers, wholesalers, and other types of businesses involved in selling tangible personal property or providing taxable services may be required to use this form for sales tax reporting purposes.

03

Businesses that operate in multiple states may need to fill out the st 120 2011 form if they have sales tax obligations in the specific state where this form is applicable.

In summary, filling out the st 120 2011 form involves gathering all the necessary information, accurately reporting sales and calculating sales tax due, ensuring accuracy in the form, and reviewing before submission. Businesses that are registered to collect sales tax or have sales tax obligations in the specific state will need to fill out this form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is st 120 form?

The st 120 form is a tax form used to report sales and use tax in the state of New York.

Who is required to file st 120 form?

Businesses and individuals who make taxable sales or purchases in New York are required to file the st 120 form.

How to fill out st 120 form?

To fill out the st 120 form, you need to provide information about your business, including your sales and purchases, and calculate the amount of tax owed. The form can be filled out manually or electronically.

What is the purpose of st 120 form?

The purpose of the st 120 form is to report sales and use tax to the state of New York.

What information must be reported on st 120 form?

The st 120 form requires reporting of sales and purchases made in New York, including the amount of taxable sales, exempt sales, and the amount of tax due.

When is the deadline to file st 120 form in 2023?

The deadline to file the st 120 form in 2023 is typically on the 20th day of the month following the end of the reporting period. However, it is recommended to double-check with the New York State Department of Taxation and Finance for any specific deadline changes or extensions.

What is the penalty for the late filing of st 120 form?

The penalty for the late filing of the st 120 form in New York is generally a percentage of the tax due, based on the number of days the form is delinquent. It is advisable to consult the New York State Department of Taxation and Finance for the specific penalty rates and guidelines.

How do I complete st 120 2011 form online?

pdfFiller has made filling out and eSigning st 120 2011 form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the st 120 2011 form in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your st 120 2011 form in minutes.

How can I edit st 120 2011 form on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing st 120 2011 form.

Fill out your st 120 2011 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.