What is a Collection Letter Template?

A Collection Letter Template is a pre-designed document that businesses use to communicate with customers who have unpaid debts. It serves as a formal notice requesting payment and outlines the consequences of non-payment. Collection Letter Templates are essential for maintaining healthy financial relationships and ensuring timely payments.

What are the types of Collection Letter Template?

There are several types of Collection Letter Templates, each serving a specific purpose in the debt recovery process. The most common types include:

Initial Reminder Letter: This is the first letter in the collection process, reminding the customer of their outstanding payment.

Past Due Reminder Letter: Sent when the payment is overdue, this letter emphasizes the urgency of payment and potential penalties.

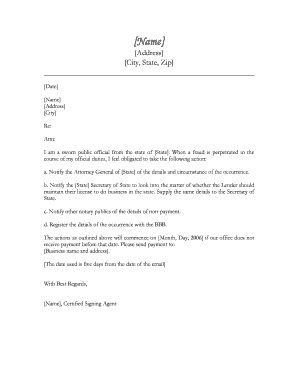

Final Notice Letter: This is the last attempt to remind the customer of the unpaid debt before taking legal action.

Cease and Desist Letter: Used when the customer disputes or disagrees with the debt, requesting them to stop contacting the debtor.

Legal Action Letter: This letter informs the customer of the initiation of legal action if the debt remains unresolved.

How to complete a Collection Letter Template

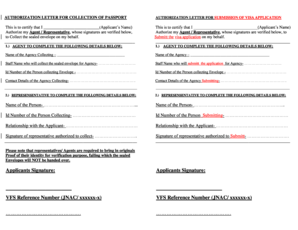

Completing a Collection Letter Template is a straightforward process. Follow these steps to effectively use a Collection Letter Template:

01

Personalize the letter: Address the recipient by name and include relevant details, such as their outstanding balance and payment due date.

02

Clearly state the purpose: Clearly explain that the letter is a collection notice regarding the unpaid debt to avoid confusion.

03

Provide payment details: Include the payment methods accepted and provide clear instructions on how to make the payment.

04

Mention consequences: Clearly state the consequences of non-payment, such as late fees, credit score impact, or legal action.

05

Keep it professional: Maintain a professional and respectful tone throughout the letter, keeping emotions aside.

06

Proofread and send: Before sending the letter, proofread it for any errors or inconsistencies. Make sure to keep a record of all communication for future reference.

In order to easily create, edit, and share Collection Letter Templates online, pdfFiller provides a user-friendly platform. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for swiftly handling all your document needs.