Treaty Based Returns Position Disclosure

What's included in the Treaty Based Returns Position Disclosure forms package

Did you know that it's possible to process your documents and forms in groups? From now on, any legal, tax, or other documents that you need to fill out are easily accessible within a bundle.

Open the Treaty Based Returns Position Disclosure package contents and select one of the documents to get started. pdfFiller is equipped with a fully-featured online text editing tool, which makes the process of editing documents online simple for all users. It features tools you can use to personalize the layout of document and make it look professional. Select a specific option from the panel to insert new fillable fields, add or delete text, add image, signature, etc.

The form bundles provided by pdfFiller, such as the Treaty Based Returns Position Disclosure forms package, allow you to reduce the amount of time it takes to submit an application, complete a tax form, sign a contract, and more. Special template bundles like the one listed above will come in use when you need to file various documents for a particular occasion, as quickly as possible. Don't go another day to find your submissions rejected due to improper formatting - get the Treaty Based Returns Position Disclosure package, fill out with the required information, put a digital signature and send out, all within a single platform.

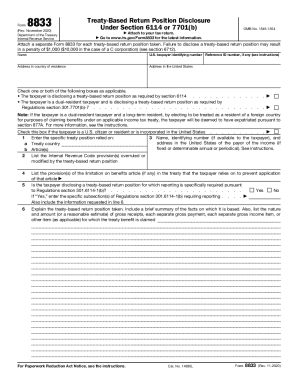

What Is Form 8833? Form 8833, “Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b),” is used by taxpayers to make a treaty-based return position disclosure as required by Section 6114, or such dual-resident taxpayers whose treaty-based return position disclosure is required under Reg. 301.7701(b)-7.

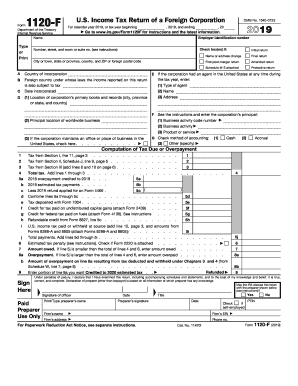

Form 1040NR is a version of the IRS income tax return that nonresident aliens may have to file if they engaged in business in the United States during the tax year or otherwise earned income from U.S. sources throughout the year.

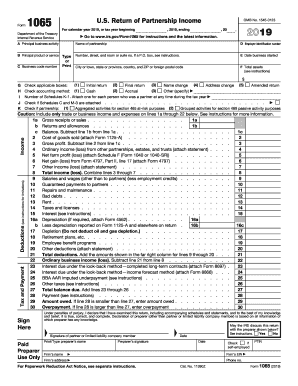

Form 1065: U.S. Return of Partnership Income is a tax document issued by the Internal Revenue Service (IRS) used to declare the profits, losses, deductions, and credits of a business partnership. 1 In addition to Form 1065, partnerships must also submit Schedule K-1, a document prepared for each partner.

IRS Form 1041 is an income tax return filed by a decedent's estate or living trust after their death. It's similar to a return that an individual or business would file. It reports income, capital gains, deductions, and losses, but it's subject to somewhat different rules than those that apply to living individuals.

Treaty Based Returns Position Disclosure FAQs