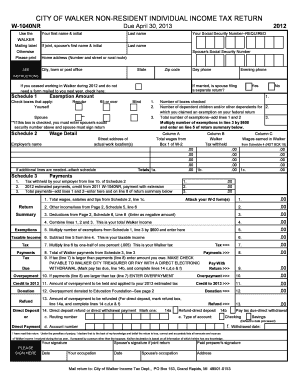

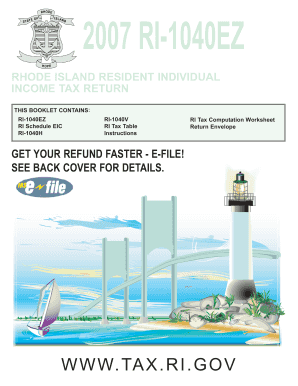

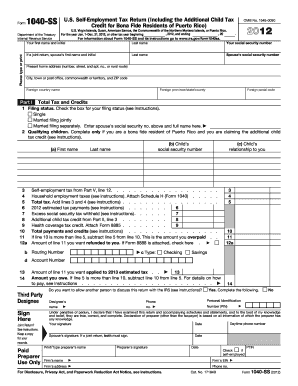

1040ez 2012 Instructions

What is 1040ez 2012 instructions?

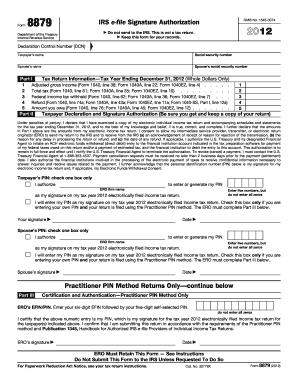

1040ez 2012 instructions refer to the guidelines provided by the Internal Revenue Service (IRS) for filling out the Form 1040EZ, a simplified version of the individual income tax return form. It is designed for taxpayers who have a straightforward tax situation and do not have many itemized deductions or complex financial transactions.

What are the types of 1040ez 2012 instructions?

The types of 1040ez 2012 instructions may vary based on the specific requirements of each taxpayer. However, the general types of instructions include:

How to complete 1040ez 2012 instructions

Completing 1040ez 2012 instructions is a simple process. Just follow these steps:

When completing 1040ez 2012 instructions, it's important to have a reliable tool like pdfFiller. pdfFiller empowers users to create, edit, and share documents online, including the Form 1040EZ. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done efficiently and accurately.