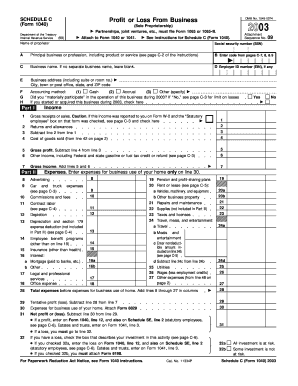

2012 Schedule C - Page 2

What is 2012 schedule c?

2012 Schedule C is a form used by sole proprietors to report their income and expenses from a business or profession. It is filed as part of the individual's personal tax return. Schedule C helps determine the net profit or loss of the business, which is then included in the individual's total income.

What are the types of 2012 schedule c?

There are several types of businesses that can use the 2012 Schedule C form to report their income and expenses. Some of the common types include:

How to complete 2012 schedule c

Completing the 2012 Schedule C form is a straightforward process. Here are the steps to follow:

It's important to ensure the accuracy and completeness of the information provided on the 2012 Schedule C form. By using pdfFiller, users can conveniently create, edit, and share their Schedule C online. With unlimited fillable templates and powerful editing tools, pdfFiller makes it easy for individuals to get their documents done efficiently.