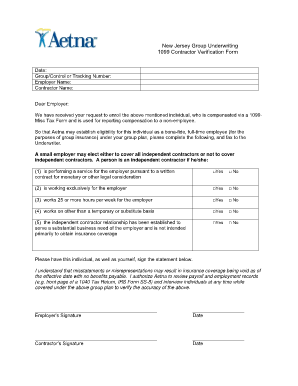

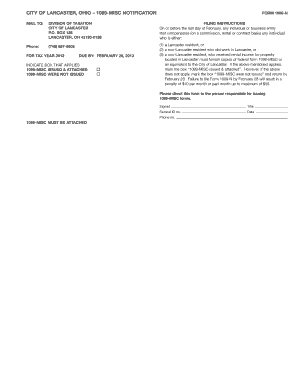

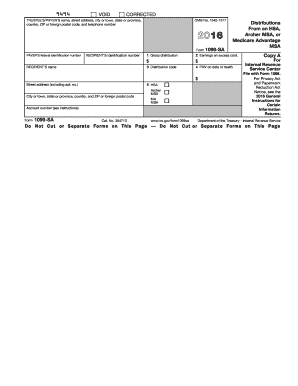

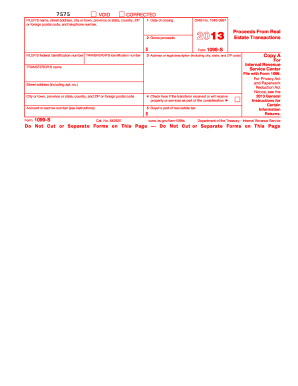

2016 Form 1099-misc

What is 2016 form 1099-misc?

The 2016 form 1099-misc is an information return form that is used to report income earned by individuals who are not employees, but rather freelancers, independent contractors, or other self-employed individuals. It is used by businesses to report payments made to these individuals throughout the year. The form provides details on various types of income, such as rent, royalties, prizes, awards, and healthcare payments. By filing this form, both the payer and the recipient ensure compliance with tax regulations and the accurate reporting of income.

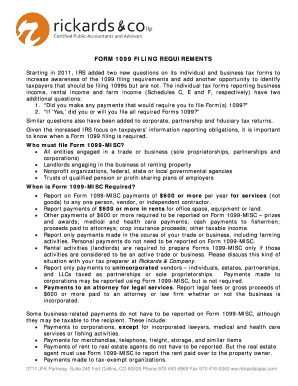

What are the types of 2016 form 1099-misc?

The types of income reported on the 2016 form 1099-misc include:

How to complete 2016 form 1099-misc

Completing the 2016 form 1099-misc is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.