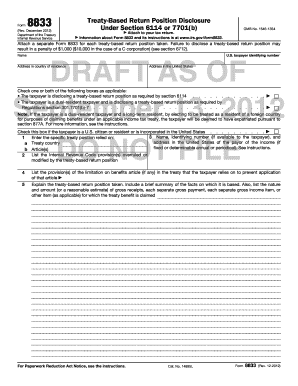

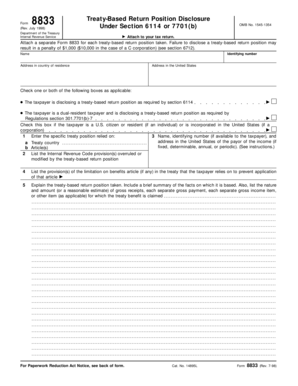

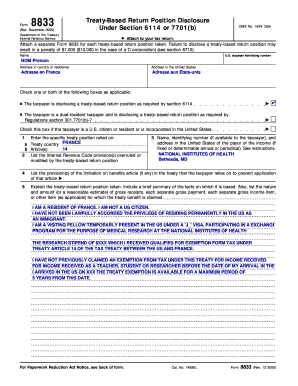

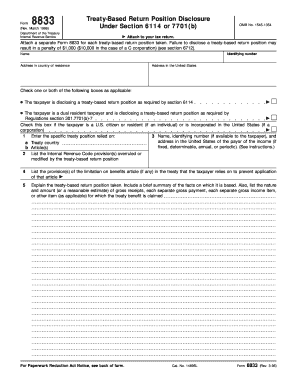

8833 Form

What is 8833 form?

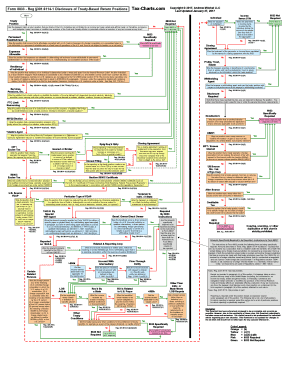

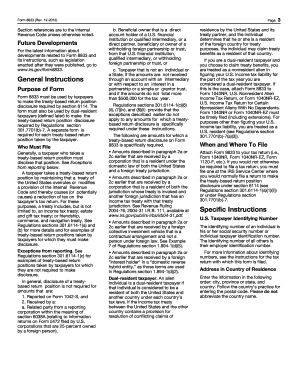

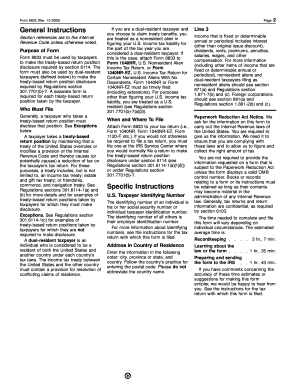

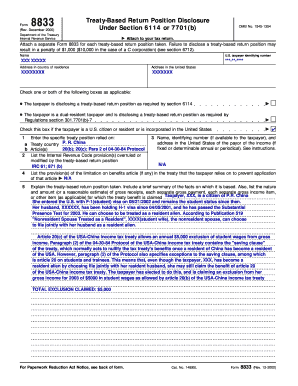

The 8833 form, also known as the Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b), is a form used by taxpayers to disclose their treaty-based return positions to the Internal Revenue Service (IRS). This form is required when a taxpayer wants to claim benefits under a tax treaty between the United States and another country. By completing the 8833 form, taxpayers can ensure proper compliance with the IRS regulations regarding treaty benefits.

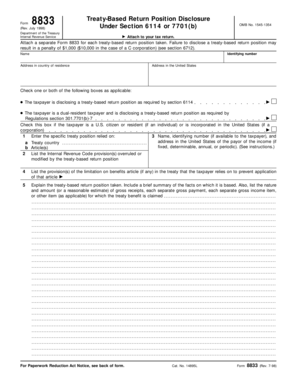

What are the types of 8833 form?

There are two types of 8833 forms: the Regular Method and the Simplified Method. The Regular Method, as the name suggests, is the standard way of reporting treaty-based return positions. Taxpayers must provide detailed explanations and attach supporting documents to justify their entitlement to treaty benefits. On the other hand, the Simplified Method allows taxpayers to provide a concise explanation of their treaty-based return positions without the need for detailed documentation. This method is only applicable if the total amount of adjustments and treaty-based positions doesn't exceed certain thresholds set by the IRS.

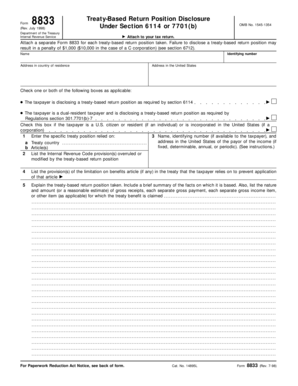

How to complete 8833 form

Completing the 8833 form correctly is crucial to ensure accurate disclosure of treaty-based return positions. Here is a step-by-step guide to help you complete the form smoothly:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.