Corporate Guarantee Form

What is Corporate Guarantee Form?

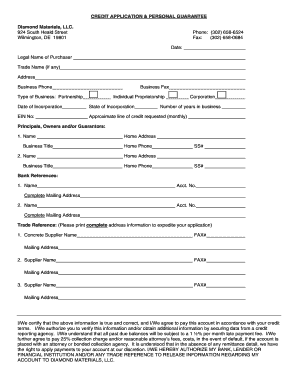

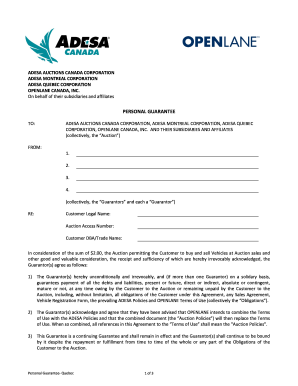

A Corporate Guarantee Form is a legally binding document where one company agrees to take responsibility for the debt or obligations of another company. It acts as a form of security for lenders or other parties involved in business transactions.

What are the types of Corporate Guarantee Form?

There are several types of Corporate Guarantee Forms, including:

Performance Guarantee Form

Financial Guarantee Form

Payment Guarantee Form

Bid Guarantee Form

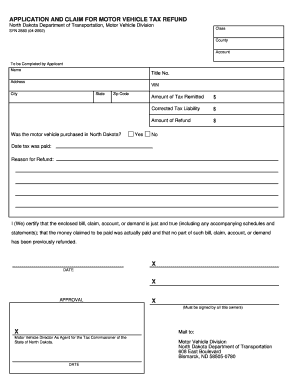

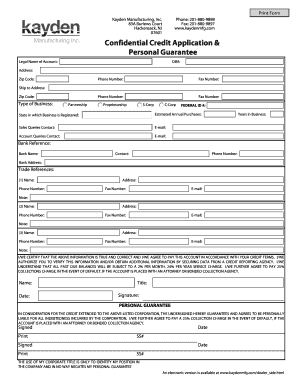

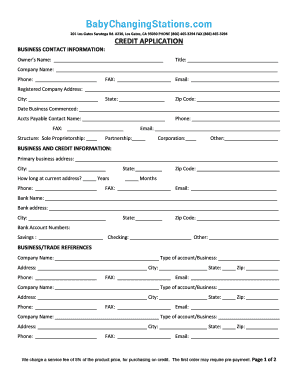

How to complete Corporate Guarantee Form

To complete a Corporate Guarantee Form, follow these steps:

01

Fill in the names and details of the companies involved.

02

Outline the terms and conditions of the guarantee clearly.

03

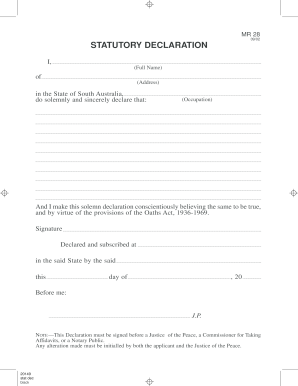

Sign and date the form to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Corporate Guarantee Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can a company be guarantor?

A personal guarantor is a person agreeing to take over the loan payment or other obligations for the debtor, as outlined in the agreement. A corporation that agrees to take on these obligations is a corporate guarantor.

What are the two types of guarantee?

Contracts of guarantees may be classified into two types: Specific guarantee and continuing guarantee. When a guarantee is given in respect of a single debt or specific transaction and is to come to an end when the guaranteed debt is paid or the promise is duly performed, it is called a specific or simple guarantee.

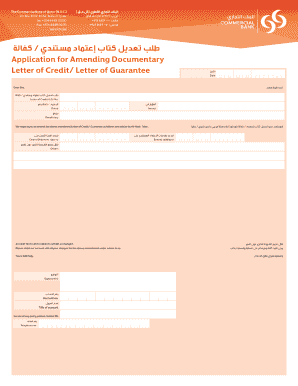

How many types of bank guarantees are there?

There are two key types of bank guarantees—a financial bank guarantee and a performance guarantee. Financial bank guarantees are for debts owed, while performance-based guarantees are for obligations laid out in a contract, such as particular tasks.

What is a guarantee corporation?

A guarantee company is a type of corporation designed to protect members from liability. Guarantee companies often form when non-profit organizations wish to attain corporate status.

What are the types of guarantees?

Types of Guarantees Bid/Tender Guarantee. Issued in support of an exporter's bid to supply goods or services and, if successful, ensures compensation in the event that the contract is not signed. Performance Guarantee. Advance Payment Guarantee. Warranty Guarantee. Retention Guarantee.

How do you write a guarantee letter?

Dear Sir/Madam: This letter will serve as your notification that (Bank Name) will irrevocably honor and guarantee payment of any check(s) written by our customer (Customer's Name) up to the amount of (Amount Guaranteed) and drawn on account number (Customer's Account Number). No stop payments will be issued.