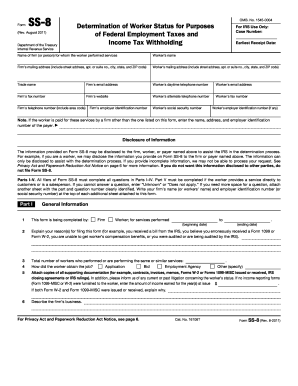

SS-8 Form

What is SS-8 Form?

The SS-8 Form, also known as the Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, is a document used by the Internal Revenue Service (IRS) to determine whether a worker should be classified as an employee or an independent contractor for tax purposes. It is essential for employers and workers to understand the criteria and requirements set forth in the form to ensure proper classification.

What are the types of SS-8 Form?

There are two types of SS-8 Form:

How to complete SS-8 Form

Completing the SS-8 Form requires careful attention to detail. Here is a step-by-step guide to help you through the process:

Remember, if you have any doubts or need assistance in completing the SS-8 Form, it is advisable to seek professional advice. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.