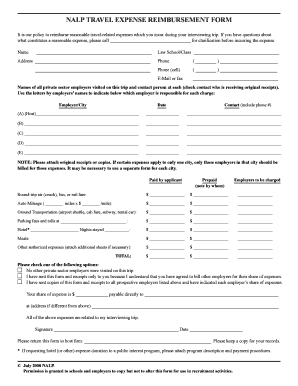

Expense Reimbursement Form

What is Expense Reimbursement Form?

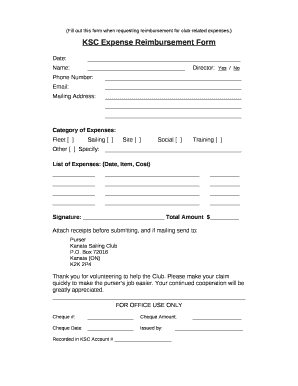

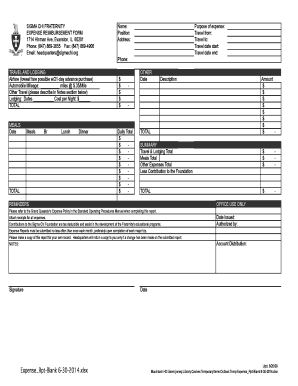

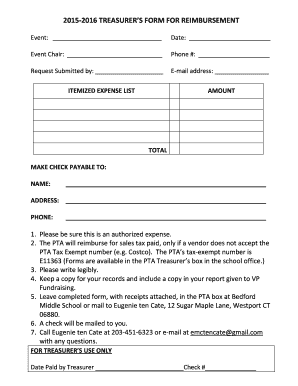

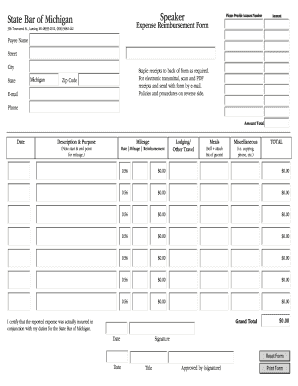

An Expense Reimbursement Form is a document used by individuals or businesses to request reimbursement for expenses incurred during business-related activities. It is a formal way to record and submit expenses for reimbursement purposes.

What are the types of Expense Reimbursement Form?

There are various types of Expense Reimbursement Forms available, depending on the organization or company's specific requirements. Some common types include:

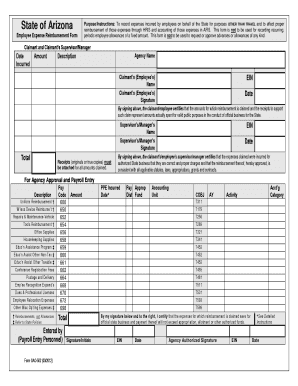

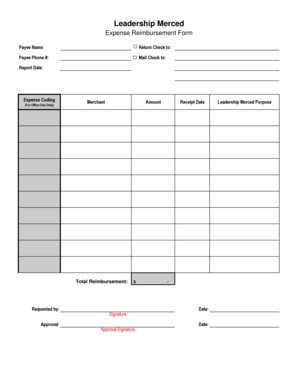

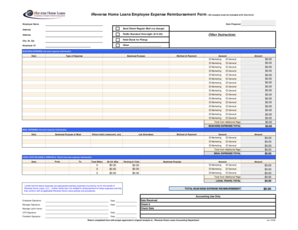

Employee Expense Reimbursement Form

Travel Expense Reimbursement Form

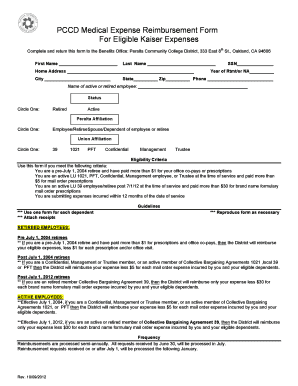

Medical Expense Reimbursement Form

Business Expense Reimbursement Form

How to complete Expense Reimbursement Form

Completing an Expense Reimbursement Form is a relatively simple process. Here are the steps to follow:

01

Gather all relevant receipts and supporting documents for the expenses incurred.

02

Download or obtain a blank Expense Reimbursement Form.

03

Fill in your personal information, such as name, employee ID, and contact details.

04

Provide a detailed description of each expense, including the date, purpose, and amount.

05

Attach the relevant receipts or supporting documents to validate each expense.

06

Calculate the total amount to be reimbursed.

07

Submit the completed form along with the supporting documents to the appropriate department or authority for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Expense Reimbursement Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write an application for reimbursement of money?

I am writing this letter to request you for reimbursement of the ________ (travel/ meal/ uniform/ any other) that was spent by me on __/__/____ (date) for the __________ (mention details) amounting __________ (mention amount). Therefore, I request you to kindly reimburse the mentioned amount.

What is an example of reimbursement?

Some common examples of reimbursements are reimbursements of business expenses like travel or food expenses, reimbursements made by insurance companies to the insured person for their medical bills, or reimbursements made to a person who makes a purchase on behalf of a third party.

How do I reimburse myself for business expenses?

0:16 1:30 How To Reimburse Yourself for Business Expenses - YouTube YouTube Start of suggested clip End of suggested clip You need to create an expense reimbursement. Report a one-page. Word document where you'll outlineMoreYou need to create an expense reimbursement. Report a one-page. Word document where you'll outline the expense. The reason for the expense the dollar value of the expense.

How do I write a reimbursement request?

Steps Give an explanation for requesting the refund or reimbursement. Request the refund or reimbursement. If you have enclosed receipts or other documents for reimbursement, tell the reader about them. Explain how or when you want to receive the refund or reimbursement and thank the reader.

How do I fill out an expense form?

How to create an expense report Determine what expenses you want to include in your report. List the expenses that meet your criteria, including the details listed above. Total the expenses included in your report. Add notes about expenses incurred or total paid.

How do you report expense reimbursement?

If your employer uses a nonaccountable plan, the IRS considers reimbursements, allowances, or advances as income. In this case, your employer would report your expense payments as income on your W-2. You can deduct your expenses from your taxes by using a Form 2106 or Form 2106-EZ.

Related templates