Express Truck Tax

What is express truck tax?

Express truck tax is a tax imposed on trucks used for transportation purposes. This tax is levied by the government to generate revenue and regulate the trucking industry. It is important for truck owners and operators to understand and comply with express truck tax regulations to avoid penalties and ensure smooth operations.

What are the types of express truck tax?

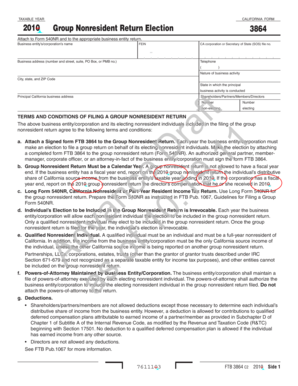

There are two main types of express truck tax: 1. Heavy Vehicle Use Tax (HVUT): This is an annual tax imposed on trucks with a gross weight of 55,000 pounds or more. The HVUT tax is based on the weight of the vehicle and is paid to the Internal Revenue Service (IRS) using Form 2290. 2. International Fuel Tax Agreement (IFTA) Fuel Tax: This tax is applicable to trucks operating in multiple jurisdictions. It simplifies the reporting and payment of fuel taxes by allowing truck owners to pay taxes based on the total distance traveled in each jurisdiction.

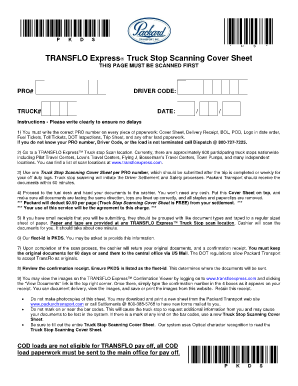

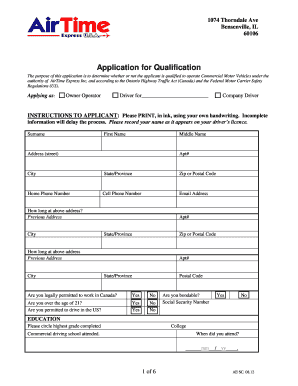

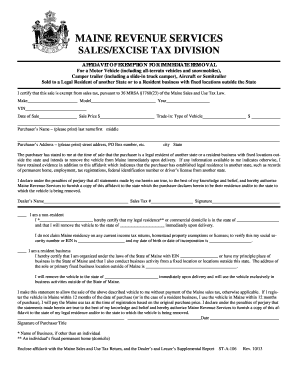

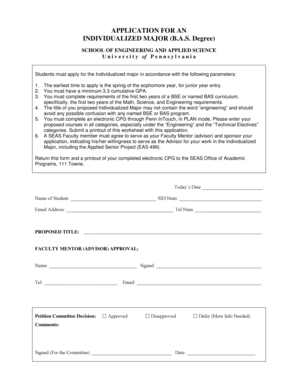

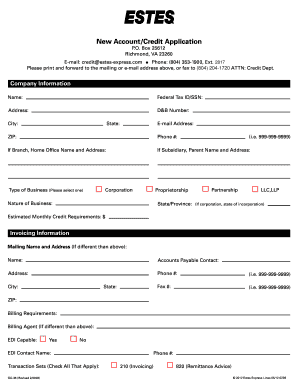

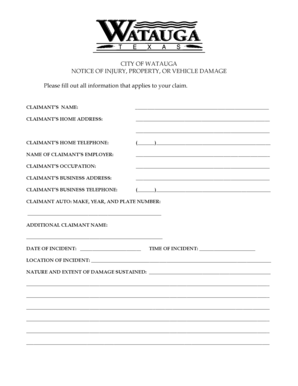

How to complete express truck tax

Completing express truck tax requires the following steps: 1. Gather necessary documents: Collect all relevant information, including vehicle details, mileage records, and fuel usage data. 2. Determine the applicable tax form: Depending on the type of express truck tax, select the appropriate tax form. 3. Fill out the tax form: Provide accurate information and ensure all required fields are completed. 4. Calculate the tax amount: Use the provided instructions to calculate the tax based on vehicle weight or distance traveled. 5. Submit the tax form and payment: File the completed tax form with the relevant tax authority and make the payment using the accepted payment methods. Keep copies of the filed tax form and payment confirmation for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.