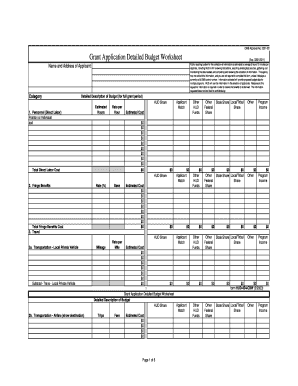

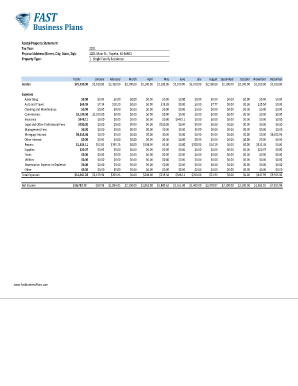

What is Family Budget Template?

A Family Budget Template is a pre-designed spreadsheet or document that helps individuals or families track their income, expenses, and savings. It provides a structured format to organize financial information and make informed decisions about budgeting and spending. With a Family Budget Template, users can easily monitor their cash flow, identify areas of overspending or potential savings, and plan for future financial goals.

What are the types of Family Budget Template?

There are different types of Family Budget Templates available to cater to various financial needs and preferences. Some common types include:

Monthly Budget Template: This type of template focuses on tracking income and expenses on a monthly basis.

Annual Budget Template: This template allows users to plan and monitor their finances for the entire year.

Weekly Budget Template: Ideal for those who prefer to track their finances on a weekly basis, this template provides a shorter timeframe for budgeting and expense tracking.

Bi-Weekly Budget Template: Similar to the weekly template, this allows users to budget and track expenses every two weeks.

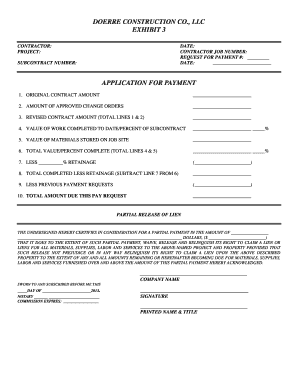

Expenses-Only Budget Template: This template is designed specifically for tracking and managing expenses rather than overall budgeting.

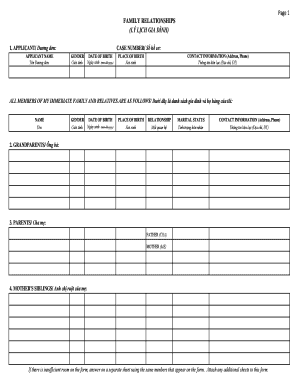

How to complete Family Budget Template

Completing a Family Budget Template is a straightforward process that involves the following steps:

01

Gather financial information: Start by collecting all the necessary financial documents, such as bank statements, pay stubs, bills, and receipts.

02

Determine income sources: Identify all sources of income, including wages, salaries, investments, and any other form of income.

03

Record expenses: Categorize and record all expenses, such as bills, groceries, transportation, entertainment, and miscellaneous expenses.

04

Calculate savings: Deduct total expenses from total income to calculate the savings amount.

05

Review and adjust: Regularly review the budget template to ensure accuracy and make any necessary adjustments to align with financial goals.

pdfFiller empowers users to create, edit, and share documents online with ease. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that allows users to get their documents done efficiently and conveniently.