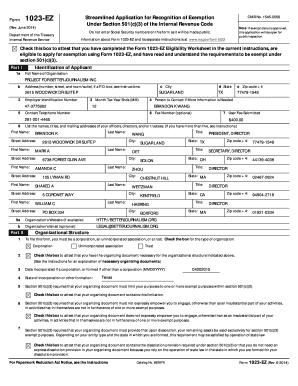

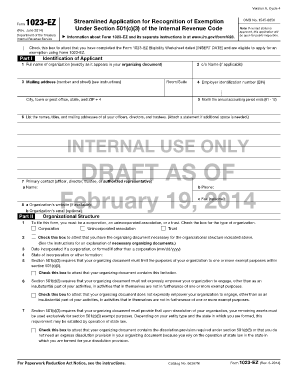

Form 1023-ez Eligibility Worksheet

What is form 1023-ez eligibility worksheet?

The form 1023-ez eligibility worksheet is a document that organizations must complete to determine if they meet the requirements for filing the simplified version of Form 1023, which is used to apply for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This worksheet helps organizations assess their eligibility based on various criteria.

What are the types of form 1023-ez eligibility worksheet?

There are different types of form 1023-ez eligibility worksheet based on the type of organization applying for tax-exempt status. The IRS provides separate worksheets for different types of applicants, such as churches, schools, hospitals, and other types of nonprofit organizations. Each worksheet is tailored to the specific requirements and qualifications for each type of organization.

How to complete form 1023-ez eligibility worksheet

Completing the form 1023-ez eligibility worksheet is an important step in the application process for tax-exempt status. To complete the worksheet, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.