Form 1023 Interactive - Page 2

What is Form 1023 Interactive?

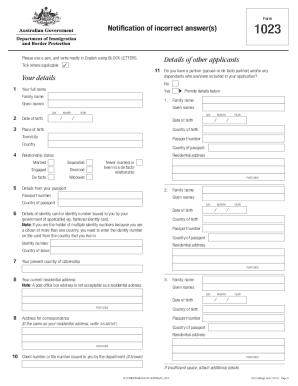

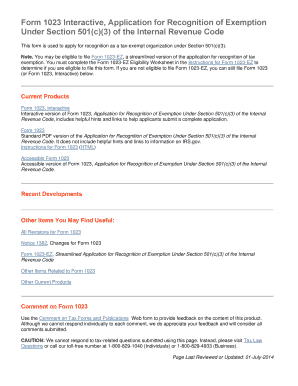

Form 1023 Interactive is a user-friendly online tool provided by pdfFiller that simplifies the process of completing Form 1023, the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. With Form 1023 Interactive, users can easily fill out and submit the application without the need for complex paperwork or manual calculations.

What are the types of Form 1023 Interactive?

Form 1023 Interactive offers two types of forms:

How to complete Form 1023 Interactive

Completing Form 1023 Interactive is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. Whether it's completing Form 1023 or any other document, pdfFiller provides a seamless and efficient experience.