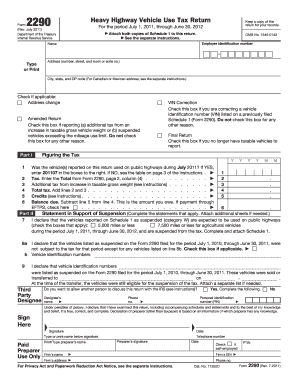

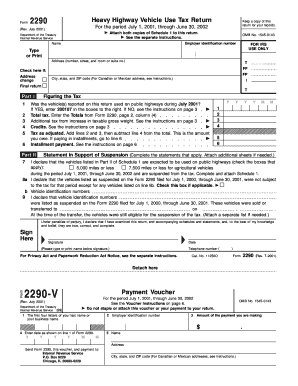

Form 2290 Tax Computation Table

What is form 2290 tax computation table?

Form 2290 tax computation table is a tool used by taxpayers to calculate the amount of tax owed on heavy vehicles. The table provides rates based on the weight of the vehicle and the number of miles it will be driven. By using this table, taxpayers can determine their tax liability accurately and ensure compliance with tax laws.

What are the types of form 2290 tax computation table?

There are two main types of form 2290 tax computation tables: the regular tax computation table and the agricultural tax computation table. The regular tax computation table is used for vehicles that are not used primarily for agricultural purposes. On the other hand, the agricultural tax computation table is used for vehicles that are mainly used for farming or agricultural activities. It is important for taxpayers to use the correct table based on the purpose of their vehicle to calculate the accurate tax amount.

How to complete form 2290 tax computation table

Completing form 2290 tax computation table is a straightforward process. Here are the steps to follow:

By following these steps, taxpayers can accurately complete form 2290 tax computation table and fulfill their tax obligations. It's important to note that pdfFiller empowers users to create, edit, and share documents online, including form 2290. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done efficiently.