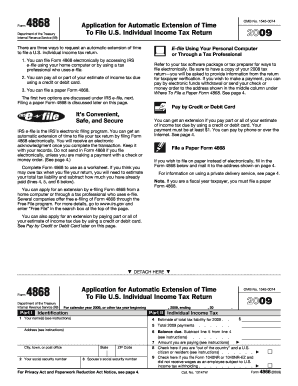

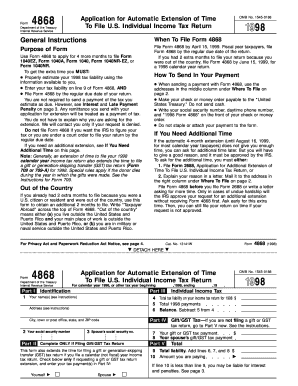

What is form 4868 extension time?

Form 4868 extension time refers to the length of time granted to taxpayers to file their income tax return after the original due date. This form, officially known as Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, allows individuals to request an extension of up to 6 months.

What are the types of form 4868 extension time?

There are two types of form 4868 extension time:

Automatic Extension: This is the most common type of extension where filers request additional time to file their tax returns without providing any reason. With this extension, individuals are granted an automatic 6-month extension period.

Reasonable Cause Extension: In certain cases, taxpayers may be eligible for a reasonable cause extension if they are unable to file their tax return on time due to specific circumstances, such as natural disasters or serious illnesses. This type of extension requires taxpayers to provide a valid reason for the delay.

How to complete form 4868 extension time

Completing form 4868 extension time is a straightforward process. Here are the steps to follow:

01

Provide your personal information, including your name, address, and Social Security Number.

02

Enter your estimated tax liability for the year.

03

Calculate the total payments you have already made for the year, including any withholdings or estimated tax payments.

04

Determine the balance due or overpayment amount based on your estimated tax liability and total payments made.

05

Choose the type of extension you are requesting (automatic extension or reasonable cause extension) and provide any necessary explanations or supporting documents.

06

Sign and date the form.

07

Submit the form electronically or mail it to the appropriate IRS address.

In order to simplify and streamline the process of completing form 4868 extension time, users can take advantage of pdfFiller. pdfFiller empowers users to create, edit, and share documents online, including form 4868. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that users need to efficiently complete their tax extensions.