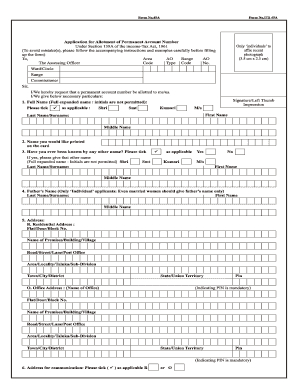

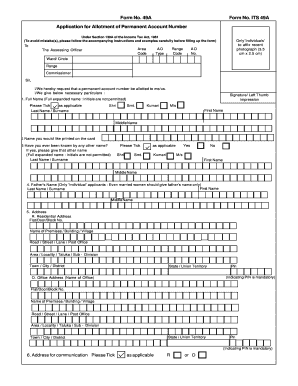

Form 49a

What is Form 49a?

Form 49a is a form issued by the Indian Government for the purpose of applying for a permanent account number (PAN). PAN is a unique alphanumeric identifier, required by individuals and entities for various financial transactions in India. It is essential for filing income tax returns, opening a bank account, or conducting any significant financial transaction.

What are the types of Form 49a?

There are two types of Form 49a:

Individual - This type is used by individuals who are Indian citizens or are eligible to become Indian citizens.

Non-Individual - This type is used by entities such as companies, firms, associations, or trusts.

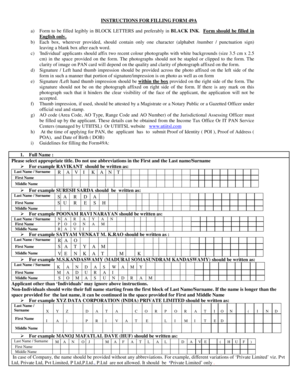

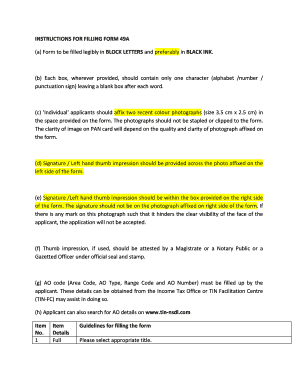

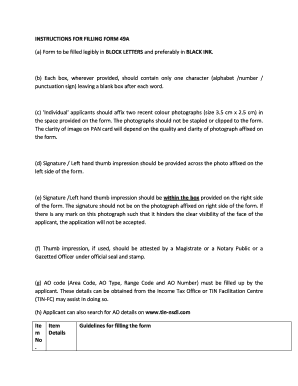

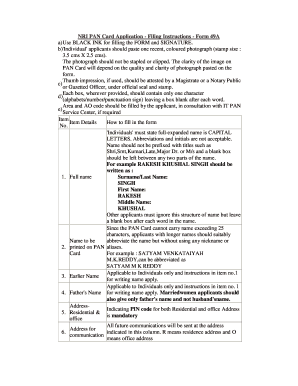

How to complete Form 49a

Completing Form 49a is a straightforward process. Here are the steps to follow:

01

Download Form 49a from the official website of the Indian Government or collect a physical copy from any PAN service center.

02

Fill in all the required details accurately, including personal information, contact details, and income details.

03

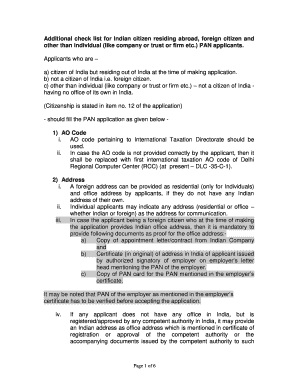

Attach the necessary documents as specified in the form instructions. This may include proof of identity, address, and date of birth.

04

Review the filled form for any errors or missing information.

05

Submit the completed form along with the supporting documents to the nearest PAN service center or send it by post to the address mentioned in the form instructions.

06

Upon verification, the PAN card will be issued and sent to the applicant's address.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Form 49a

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How can I download PAN application form?

Individuals can download PAN Form online from the PAN UTIITSL website. After downloading and filling all the required details in PAN, the PAN Form has to be submitted to the NSDL office with the required self-attested documents.

What is the meaning of 49A?

Form 49A is the application form for the allotment of Permanent Account Number for Indian residents. Any individual who is a resident of India and wishes to apply for PAN should compulsorily fill the form 49A as it is the application form.

How can I select my PAN card area code?

How to Find the AO Code for PAN Card? Visit NSDL's PAN Portal to search the AO Code by clicking here. Select the city of your residence. A list of AO codes in your city will be displayed. Select the appropriate AO code as per the details mentioned and click on the submit button.

How do students choose AO code?

For students, there is no AO code.

Can we download PAN card form online?

a) This facility is available for PAN holders whose latest application was processed through NSDL e-Gov. b) For the PAN applications submitted to NSDL e-Gov where PAN is alloted or changes are confirmed by ITD within last 30 days, e-PAN card can be downloaded free of cost three times.

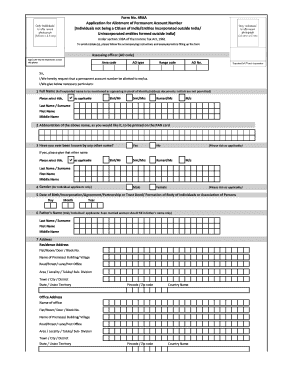

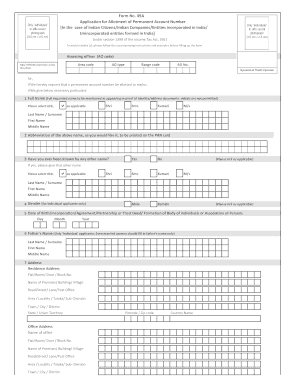

What is the Form 49A?

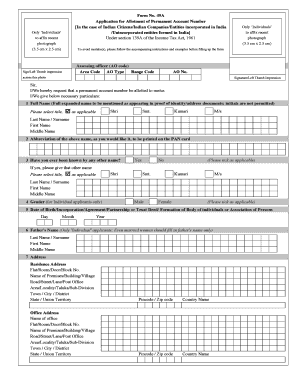

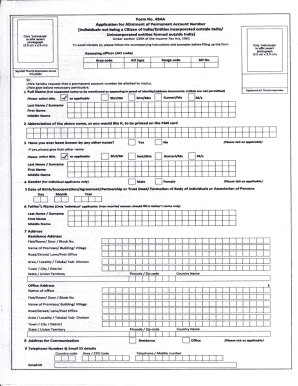

49A. Application for Allotment of Permanent Account Number. [In the case of Indian Citizens/Indian Companies/Entities incorporated in India/ Unincorporated entities formed in India]

Related templates